by Calculated Risk on 5/04/2011 07:19:00 AM

Wednesday, May 04, 2011

MBA: Mortgage Purchase application activity increases slightly, Mortgage Rates lowest in 2011

The MBA reports: Latest MBA Weekly Survey Shows Increase in Mortgage Applications, Driven by Refinances

The Refinance Index increased 6.0 percent from the previous week. The seasonally adjusted Purchase Index increased 0.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased for the third consecutive week to 4.76 percent from 4.80 percent, with points decreasing to 0.76 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year fixed contract rate since December 3, 2010.

Click on graph for larger image in graph gallery.

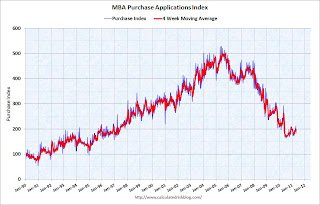

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

Refinance activity increased as mortgage rates fell to the lowest level since December 2010.

The four week average of purchase activity is at about 1997 levels, although this doesn't include the very high percentage of cash buyers. This suggests weak existing home sales through June (not counting cash buyers).