by Calculated Risk on 3/30/2011 07:19:00 AM

Wednesday, March 30, 2011

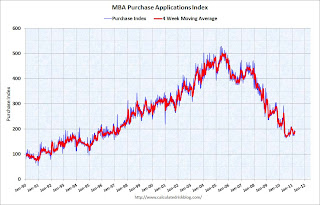

MBA: Mortgage Purchase Application activity decreases slightly

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 10.1 percent from the previous week. The seasonally adjusted Purchase Index decreased 1.7 percent from one week earlier.

...

"Treasury and mortgage rates increased towards the end of last week, as global markets calmed following the recent crises in Japan and the Middle East. Refinance volume predictably fell in response to these rate increases. As rates climb back to 5 percent, fewer homeowners have both the incentive and the ability to refinance," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Purchase volume remained roughly flat as we enter what is typically the peak homebuying season."

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.92 percent from 4.80 percent, with points decreasing to 0.83 from 0.96 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is still moving sideways suggesting fairly weak home sales "as we enter what is typically the peak homebuying season". Note: There is a large percentage of cash buyers too.