by Calculated Risk on 2/09/2011 07:33:00 AM

Wednesday, February 09, 2011

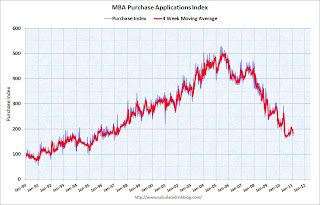

MBA: Mortgage Applications Decrease as Rates Jump

The MBA reports: Mortgage Applications Decrease as Rates Jump in Latest MBA Weekly Survey

The Refinance Index decreased 7.7 percent from the previous week. The seasonally adjusted Purchase Index decreased 1.4 percent from one week earlier.

...

"Mortgage rates increased last week as many incoming economic indicators continue to show stronger growth than had been anticipated. Refinance volume continues to be low, as fewer homeowners with equity have any incentive to refinance," said Michael Fratantoni, MBA’s Vice President of Research and Economics. "We are at the beginning of the spring buying season, but purchase volume remains weak on a seasonally adjusted basis."

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.13 percent from 4.81 percent, with points decreasing to 0.84 from 1.02 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest contract 30-year rate recorded in the survey since the week ending April 9, 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index suggests weak home sales through the first few months of 2011. That is quite an increase in mortgage rates!