by Calculated Risk on 12/14/2010 12:36:00 PM

Tuesday, December 14, 2010

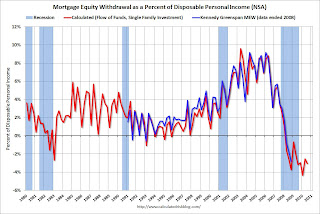

Q3 2010: Mortgage Equity Withdrawal

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008. My thanks to Jim Kennedy and the other Fed contributors for the previous MEW updates. For those interested in the last Kennedy data, here is a post, and the spreadsheet from the Fed is available here.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity (hence the name "MEW", but there is little MEW right now!), normal principal payments and debt cancellation.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q3 2010, the Net Equity Extraction was minus $86 billion, or a negative 3.0% of Disposable Personal Income (DPI). This is not seasonally adjusted.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q3, and this was probably mostly because of debt cancellation per foreclosure and short sales, and some from modifications, as opposed to homeowners paying down their mortgages. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be slightly negative.