by Calculated Risk on 10/03/2010 05:21:00 PM

Sunday, October 03, 2010

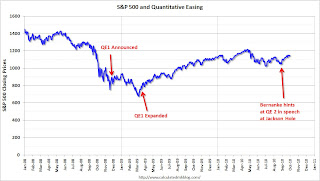

A QE1 Timeline

Note: Here is the weekly schedule for Oct 3rd, and the summary for last week.

QE2 will probably arrive on November 3rd. By request here is a look back at the QE1 announcements (phased in over a few months):

S&P 500: 851.81

The Federal Reserve announced

the purchase of the direct obligations of housing-related government-sponsored enterprises (GSEs)--Fannie Mae, Freddie Mac, and the Federal Home Loan Banks--and mortgage-backed securities (MBS) backed by Fannie Mae, Freddie Mac, and Ginnie Mae.

...

Purchases of up to $100 billion in GSE direct obligations under the program will be conducted with the Federal Reserve's primary dealers through a series of competitive auctions and will begin next week. Purchases of up to $500 billion in MBS will be conducted by asset managers selected via a competitive process with a goal of beginning these purchases before year-end. Purchases of both direct obligations and MBS are expected to take place over several quarters.

S&P 500: 913.18

As previously announced, over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant. The Committee is also evaluating the potential benefits of purchasing longer-term Treasury securities.

S&P 500: 874.09

The Federal Reserve continues to purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand the quantity of such purchases and the duration of the purchase program as conditions warrant. The Committee also is prepared to purchase longer-term Treasury securities if evolving circumstances indicate that such transactions would be particularly effective in improving conditions in private credit markets.

S&P 500: 794.35

To provide greater support to mortgage lending and housing markets, the Committee decided today to increase the size of the Federal Reserve’s balance sheet further by purchasing up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion this year, and to increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. Moreover, to help improve conditions in private credit markets, the Committee decided to purchase up to $300 billion of longer-term Treasury securities over the next six months.

Click on graph for larger image in new window.

Click on graph for larger image in new window.S&P 500: 1064.79

This is not investment advice!