by Calculated Risk on 7/21/2010 07:39:00 PM

Wednesday, July 21, 2010

Excess Capacity and Housing

Fed Chairman Ben Bernanke was asked today why he thought companies with significant cash weren't investing. His answer was that most companies currently have excess capacity.

Bernanke was also asked about small companies having trouble getting financing, and he pointed out that small companies reported their number one problem is "lack of customers", not difficulties in obtaining financing.

This excess capacity or lack of demand - and therefore lack of new investment - is a key reason why the recovery is sluggish.

One of the few sectors seeing new investment is the semiconductor equipment manufacturers - Intel, Taiwan Semiconductor and others are making new investments in equipment to meet increased demand - and Applied Material, LAM Research, KLA-Tencor, Cymer and others are all seeing a boom in business. I've spoken with companies in the semiconductor equipment sector, and they are hiring like crazy (probably all of these companies are). But this is a small part of the economy ...

Most other sectors, from autos to commercial real estate, and especially residential real estate have too much capacity. Away from equipment and software, investment is still very weak.

As we've discussed many times, usually residential investment is the key investment sector for the economy in the early stages of a recovery. But not this time because of the oversupply of existing housing units.

There is some good news:

However the bad news is:

Eventually this excess supply will be absorbed, and new residential investment will increase - but that will not happen until the excess inventory is reduced significantly.

1Analysis: Housing Units added to stock in 2010

Yesterday the Census Bureau reported housing starts fell in June to a 549 thousand seasonally adjusted annual rate. As I noted yesterday, this is good news for the housing market longer term (because of the excess housing units), but bad news for the economy and employment short term.

The table below is based on the data through June, and shows an estimate of the number of housing units that will be added to the stock in 2010 (based on completions from the Census Bureau).

Housing units include single family homes (included as 1 to 4 units), apartments (5+ units), and mobile homes. Demolitions are subtracted from the stock (note: demolitions are the hardest to estimate).

| (in thousands) | 2009 | First Half 2010 | 2010 Estimate |

|---|---|---|---|

| 1 to 4 units | 534.6 | 243.8 | 500 |

| 5+ units | 259.8 | 86.8 | 150 |

| Mobile Homes1 | 53 | 26 | 55 |

| Sub-Total | 848.4 | 356.6 | 705 |

| Demolitions2 | 200 | 100 | 200 |

| Added to Stock | 648.4 | 256.6 | 505 |

1 Actual through May 2010, June estimated.

2 estimated.

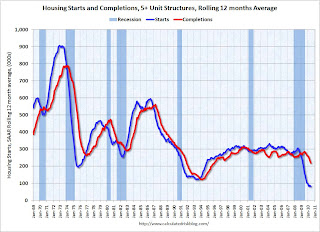

Notice that the number of "5+ units" completed in 2010 is about to collapse. This is already in the works as shown in the following diagram:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The blue line is for multifamily starts and the red line is for multifamily completions. All the multifamily units that will be delivered in 2010 have already been started since, according to the Census Bureau, it takes on average over 1 year to complete these projects.

Since multifamily starts collapsed in 2009, completions will collapse in 2010.

In June 2010, builders started 8,200 apartment units (NSA), and completed 18,200 units. This level of starts has been steady all year, and completions should drop sharply in the next few months. As an aside, this suggests that construction employment will decline further over the next few months.

Similar logic applies to single family units, although these only take around 7 months to complete. Most of the housing units that will be completed this year have already been started. Builders completed 243,800 units (1 to 4 units) in the first half of 2010. Based on starts, builders will probably complete about the same number of units in the 2nd half of the year.

The manufactured homes data is from the Census Bureau through May (and demolitions are estimated).