by Calculated Risk on 2/03/2010 12:15:00 PM

Wednesday, February 03, 2010

MBA: Mortgage Applications Increase to mid-December Levels

From earlier this morning ... the MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased of 21.0 percent on a seasonally adjusted basis from one week earlier. ...

"Mortgage application volume rebounded last week, returning the purchase and refinance indexes to levels from mid-December," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Rates continue to hover around 5 percent, quite low by historical standards, but are well above the record lows seen in 2009, and hence are not generating substantial refi volume. We expect that rates will rise over the next few months as the Federal Reserve winds down its MBS purchase program, and this will likely lead to a decline in refinance volume."

The Refinance Index increased 26.3 percent from the previous week and the seasonally adjusted Purchase Index increased 10.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.01 percent from 5.02 percent, with points increasing to 1.04 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

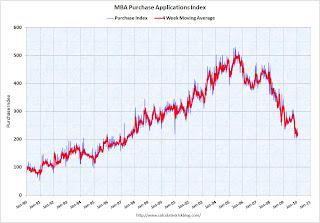

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average has declined sharply since October, and is at about the same level as November 1997. The increase this week was just a rebound from the decline last week.

The decline in mortgage applications since October appears significant, and even with the increase in refinance applications last week, it also appears the refinance boom is ending.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.Every time the 10 year yield drops sharply, refinance activity picks up. But notice what happened at the end of 1995. The Ten Year yield dropped, but the increase in refinance activity was muted. This was because mortgage rates didn't fall below the rates of a couple years earlier - and many people had already refinanced at those lower rates. The same thing will happen this year and next - there will only be a surge in refinance activity if rates fall below the rates of 2009.