by Calculated Risk on 2/23/2010 10:48:00 AM

Tuesday, February 23, 2010

FDIC Q4 Banking Profile: 702 Problem Banks

The FDIC released the Q4 Quarterly Banking Profile today. The FDIC listed 702 banks with $403 billion in assets as “problem” banks in Q4, up from 552 banks with $346 billion in assets in Q3, and 252 and $159.4 billion in assets in Q4 2008.

Note: Not all problem banks will fail - and not all failures will be from the problem bank list - but this shows the problem is significant and still growing.

The Unofficial Problem Bank List shows 617 problem banks - and will continue to increase as more formal actions (or hints of pending actions) are released. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of FDIC insured "problem" banks since 1990.

The 702 problem banks reported at the end of Q4 is the highest since 1992.

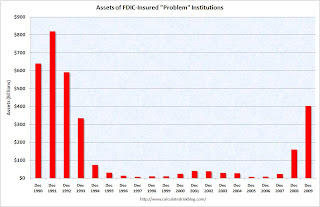

The second graph shows the assets of "problem" banks since 1990. The assets of problem banks are the highest since 1992.

The assets of problem banks are the highest since 1992.

On the Deposit Insurance Fund:

The Deposit Insurance Fund (DIF) decreased by $12.6 billion during the fourth quarter to a negative $20.9 billion (unaudited) primarily because of $17.8 billion in additional provisions for bank failures. ... For the year, the fund balance shrank by $38.1 billion, compared to a $35.1 billion decrease in 2008.

The DIF’s reserve ratio was negative 0.39 percent on December 31, 2009, down from negative 0.16 percent on September 30, 2009, and 0.36 percent a year ago. The December 31, 2009, reserve ratio is the lowest reserve ratio for a combined bank and thrift insurance fund on record.Note: This doesn't mean the FDIC DIF is out of money or bankrupt. The FDIC reserves against future losses, and they don't include the prepay of assessments in the DIF (although they have the cash). The FDIC has plenty of cash right now - although there will probably be hundreds of bank failures over the next couple of years, and the FDIC might have to borrow from the Treasury in the future.

Forty-five insured institutions with combined assets of $65.0 billion failed during the fourth quarter of 2009, at an estimated cost of $10.2 billion. For all of 2009, 140 FDIC-insured institutions with assets of $169.7 billion failed, at an estimated cost of $37.4 billion. This was the largest number of failures since 1990 when 168 institutions with combined assets of $16.9 billion failed (excluding thrifts resolved by the RTC).