by Calculated Risk on 11/18/2009 01:56:00 PM

Wednesday, November 18, 2009

Quarterly Housing Starts and New Home Sales

The Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q3 2009.

Monthly housing starts (even single family starts) cannot be compared directly to new home sales, because the monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows that there were 93,000 single family starts, built for sale, in Q3 2009, and that is less than the 105,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders are selling more homes than they are starting.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because homebuilders were stuck with “unintentional spec homes” during the housing bust because of the high cancellation rates, but cancellation rates are now much closer to normal. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the two years starts have been below sales – and new home inventories have been falling. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

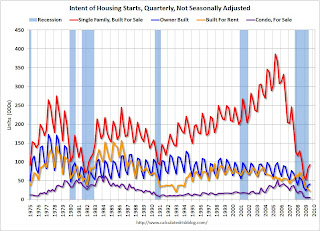

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts in Q3 tied the all time record low for Condos built for sale set in Q1 and Q2 of this year (5,000); the previous record was 8,000 set in Q1 1991 (data started in 1975).

Owner built units are above the record low set in Q1 (42,000 units compared to 24,000 units in Q1 2009), however the pickup in owner built starts was probably mostly seasonal (this is NSA data).

Units built for rent were near the record low (23,000 units in Q3 2009 compared to the all time record low of 21,000 units). With the vacancy rate at a record high, the demand for new rental units will stay low for some time.