by Calculated Risk on 8/06/2009 03:50:00 PM

Thursday, August 06, 2009

Residential Investment Components in Q2

More from the supplemental GDP tables released yesterday ...

Residential investment (RI), according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Back in Q4 2008 - for the first time ever - investment in home improvements exceeded investment in new single family structures. This has continued through Q2 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

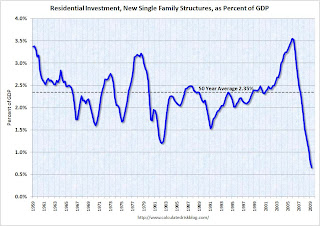

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $153.3 billion Seasonally Adjusted Annual Rate (SAAR) in Q2, significantly above investment in single family structures of $92.8 billion (SAAR).

Let's take a closer look at these two key components of RI: As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

Currently investment in single family structures is at 0.66% of GDP, significantly below the average of the last 50 years of 2.35% - and almost half of the previous record low in 1982 of 1.20%.

And on home improvement: The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.08% of GDP, well off the high of 1.31% in Q4 2005 - but just back to the average of the last 50 years of 1.07%.

This would seem to suggest there remains downside risk to home improvement spending. Home Depot and Lowes announce results in the middle of August, and this might be something to watch.

NOTE: Home improvement is a rough estimate by the BEA - and could be lower. Also, there could be changes in spending patterns leading to a higher percentage of GDP on home improvement.