by Calculated Risk on 8/29/2009 10:11:00 AM

Saturday, August 29, 2009

Failed Banks and the Deposit Insurance Fund

As a companion to the August 28 Problem Bank List (unofficial), below is a list of failed banks since Jan 2007.

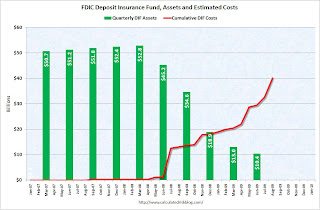

The FDIC released the Q2 Quarterly Banking Profile this week. The report showed that the Deposit Insurance Fund (DIF) balance had fallen to $10.4 billion or 0.22% of insured deposits. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows the cumulative estimated losses to the FDIC Deposit Insurance Fund (DIF) and the quarterly assets of the DIF (as reported by the FDIC). Note that the FDIC takes reserves against future losses in the DIF, and collects fees and special assessments - so you can't just subtract estimated losses from assets to determine the assets remaining in the DIF.

The cumulative estimated losses for the DIF are now over $40 billion.

In this Dick Bove interview with CNNMoney, the interviewer Poppy Harlow said:

"When we look at that list though - we don't get the names from the FDIC obviously - only about 13% of the bank on that list actually end up failing".The 13% number is historically accurate, but that is over the entire cycle - and this down cycle will probably be worse than most. So during this down period, the percentage will probably be much higher. As far as the names of the banks on the "list", most of them are on the Unofficial Problem Bank list.

The FDIC closed three more banks on Friday, and that brings the total FDIC bank failures to 84 in 2009.

Failed Bank List

Deposits, assets and estimated losses are all in thousands of dollars.

Losses for failed banks in 2009 are the initial FDIC estimates. The percent losses are as a percent of assets.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

Click here for a full screen version.

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can click on the number and see "the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC