by Calculated Risk on 12/07/2008 03:07:00 PM

Sunday, December 07, 2008

Thoughts on Oil

All year we have been discussing the potential for significant demand destruction with regards to oil - the weaker economy and higher prices leading to less consumption in the U.S. and elsewhere, the demand impact of the Chinese stockpiling oil before the Olympics (and subsequently reducing demand after the Olympics), other Asian countries reducing their subsidies - all leading to a significant decline in oil prices in the 2nd half of 2008.

Now that oil prices have fallen sharply to around $40 per barrel, here are some further thoughts ...

First, I think it will be interesting to see if U.S. vehicle miles driven increases with gasoline prices now below $2 per gallon. Or will households just save the difference? Click on graph for larger image in new window.

Click on graph for larger image in new window.

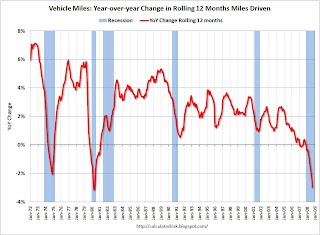

This graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven through September (from DOT). The number of U.S. vehicle miles driven has fallen off a cliff with high gasoline prices, rising unemployment and an overall weaker economy. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.0% YoY, and the decline in miles driven is worse than during the early '70s oil crisis - and about the same as the 1979-1980 declines. As the DOT noted, miles in September 2008 were 4.4% less than September 2007, so the YoY change in the rolling average will probably get worse. The second graph shows the weekly U.S. gasoline prices from the EIA through Dec 1st. This shows that gasoline prices really declined in October - but prices in September were still over $3.50 per gallon. So we will have to wait for the October and November vehicle mile reports to see the impact of sharply lower gasoline prices.

The second graph shows the weekly U.S. gasoline prices from the EIA through Dec 1st. This shows that gasoline prices really declined in October - but prices in September were still over $3.50 per gallon. So we will have to wait for the October and November vehicle mile reports to see the impact of sharply lower gasoline prices.

I expect vehicle miles to start increasing again - or at least stop declining. I think the impact of price declines on driving behavior will more than offset higher unemployment and the weaker economy. And gasoline prices are still falling in December!

How much will the decline in oil prices cushion the U.S. recession? That is another key question.

The following graph shows the monthly personal consumption expenditures (PCE through October) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly through November, December estimated at $41 per barrel). At current oil prices, it appears oil related PCE will fall to $250 to $300 billion SAAR, from close to $500 billion SAAR in July. This is a savings of over $15 billion per month compared to July. And that would be very helpful and definitely provide some cushion for consumers. This might show up as more savings, as opposed to other consumption, but rebuilding savings is probably a necessary step towards rebuilding household balance sheets.

At current oil prices, it appears oil related PCE will fall to $250 to $300 billion SAAR, from close to $500 billion SAAR in July. This is a savings of over $15 billion per month compared to July. And that would be very helpful and definitely provide some cushion for consumers. This might show up as more savings, as opposed to other consumption, but rebuilding savings is probably a necessary step towards rebuilding household balance sheets.

Data sources: PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117. Oil prices from EIA U.S. Spot Prices.

And this leads to the potential impact on oil producing countries and U.S. interest rates. Rachel Ziemba (filling in for Brad Setser) at RGE Monitor in March discussed how petrodollars are being spent by the GCC (Gulf Cooperation Council) countries in Petrodollars: How to Spend It. When I saw the following graph, my first thought was: What happens if oil prices fall? Rachel Ziemba writes:

Rachel Ziemba writes:

2007 was the first year that spending growth outstripped revenues [growth] in the GCC and many other oil exporters. 2008 budget plans imply even higher current (especially wages and subsidies) and capital expenditures. Even countries that have traditionally saved more (Kuwait) are ramping up spending especially on capital projects and in some cases transfers to the population or pension funds. ... With megaprojects in the works in a variety of sectors including energy and other infrastructure, capital spending will likely continue to rise.With oil prices at $40 per barrel, and government spending at $50 per barrel, the math doesn't work!

And once again I'd like to recommend (again) this paper from Dr. Krugman: The Energy Crisis Revisited

The fact that oil is an exhaustible resource means that not extracting it is a form of investment. And it is an investment that might look attractive to a national government when oil prices are high. If a country does not want to spend all of the massive flow of cash generated by a sudden price increase on consumption, it must do one of three things: engage in real investment at home, which is subject to diminishing returns; invest abroad; or "invest" by cutting oil extraction, and hence reducing supply.

Krugman: Figure 1.

Krugman: Figure 1.So there is a definite possibility that over some range higher oil prices will lead to lower output. And given highly inelastic demand, as Cremer et al showed, that means that you can have multiple equilibria. Figure 1 illustrates the point: given the backward-bending supply curve and a steep demand curve, there are stable equilibria at both the low price PL and the high price PH.And my comment from back in March:

So there is a possibility that what has looked like peak oil to some observers (something I believe is coming), was actually GCC countries investing by not extracting oil. If oil prices start to fall, and with rising expenditures (see first graph again), the GCC countries might increase production - causing prices to fall further.Now that oil prices are below the level needed to support government expenditure in the GCC, I think OPEC's talk of production cuts is mostly just talk.

And finally, I've been writing about how China might cut back on buying dollar denominated assets as they try to stimulate their domestic economy. However Dr. Brad Setser has argued several times that he views this is unlikely, and he recently highlighted this report from David Dollar and Louis Kuijs World Bank China Quarterly:

The last thing anyone needs to worry about is fall in Chinese demand for US treasuries.That is a good argument for China not cutting their purchases of U.S. assets, but what about oil producing countries? That has the same impact on demand for dollar denominated assets (just further down the chain).

...

The World Bank forecasts that China’s current account surplus will RISE not fall in 2009, going from an estimated $385 billion to $425 billion. How is that possible if real imports are forecast to grow faster than real exports? Easy – the terms of trade moved in China’s favor. The price of the raw materials China imports will fall faster than the value of China’s exports. China’s oil and iron bill will fall dramatically.

This touches on a number of related topics, and hopefully provides some food for thought on a Sunday. Best to all.