by Calculated Risk on 11/05/2008 08:15:00 PM

Wednesday, November 05, 2008

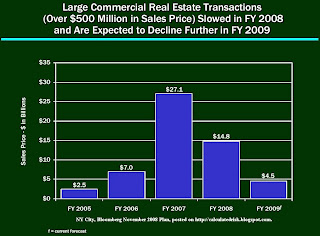

NY City Commercial Real Estate from Mayor Bloomberg Report

Mayor Bloomberg released a report on the NY City economy today. Here are a couple of graphs from the report on commercial real estate (CRE). There is much more in the report, especially on the impact of the financial crisis on NYC employment. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the actual and projected (by the NYC OMB) rents and office vacancy rate for NYC Class A buildings.

The vacancy rate is expected to rise from about 7.5% to 13%, and rents are expect to decline by 20% or more from the peak.

This decrease in rents will make many of the recent transactions that were based on overly optimistic pro forma income projections uneconomical. These loans typically included reserves to pay interest until rents increased (like a negatively amortizing option ARM), so these deals will blow up when the interest reserve is depleted - probably in the 2009-2010 period. The second graph shows the total dollar amounts for large commercial real estate transactions in NYC. This is expected to decline sharply next year, although if a number of projects get into trouble then I wouldn't be surprised to see a few more transaction (similar to all the foreclosure sales boosting existing home sales right now).

The second graph shows the total dollar amounts for large commercial real estate transactions in NYC. This is expected to decline sharply next year, although if a number of projects get into trouble then I wouldn't be surprised to see a few more transaction (similar to all the foreclosure sales boosting existing home sales right now).