by Calculated Risk on 10/30/2008 09:32:00 PM

Thursday, October 30, 2008

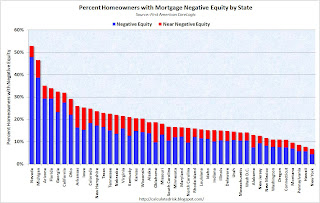

Report: Almost Half of Nevada Homeowners Underwater

The WSJ reports on a new report from First American CoreLogic that estimates 48% of homeowners with a mortgage in Nevada owe more than their homes are worth. The WSJ reports that First American CoreLogic estimates 18% of homeowners with a mortgage nationwide are underwater.

Using the Census Bureau 2007 estimate of 51.6 million households with mortgages, 18% would be 9.3 homeowners with negative equity. This is less than the recent estimate from Moody's Economy.com of 12 million households underwater. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the percent of homeowners with mortgages underwater by state (data from First American CoreLogic via the WSJ)

Note: there is no data for Maine, Mississippi, North Dakota, South Dakota, Vermont, West Virginia and Wyoming.

It's interesting that the two worst states are Nevada and Michigan - one a bubble state, the other devastated by a poor economy. That pattern continues - everyone expects the bubble states of Arizona, Florida and California to be near the top of the list, and Ohio too because of the weak economy - but what about Arkansas, Iowa and even Texas?

The housing problems are everywhere.