by Calculated Risk on 8/06/2008 11:18:00 AM

Wednesday, August 06, 2008

Freddie Conference Call Notes

A few notes from the Freddie Mac conference call (hat tip Brian):

They are now expecting nation HPD (home price depreciation) of 18-20% vs prior assumption of 15% (using their national index). They think we are halfway through the price decline.

Severity assumptions in loan loss provision increased from 22% in Q1 (ending March) to 26% in Q2 (ending June).

Until their credit raising options clarify, they will approach growth of their mortgage portfolio cautiously. They acknowledged that the market realizes that it will be difficult for them to grow and that has probably contributed to increase in mortgage spreads. Their base case forecast is that their portfolio has no growth.

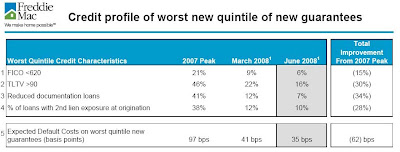

They have a chart of the credit profile of their guarantees at various points over the last year or so (chart 13 in the slide deck) that is worth a look. The worst quintile of loans (from a credit characteristics standpoint) from the 2007 peak had the following characteristics (they don’t say when the peak is, but my guess is that it would be late Q2 or early Q3):

Click on table for larger image in new window.

Click on table for larger image in new window.Their “expected default costs” on this bucket of guarantees is 97bp – it does not detail how that number is calculated, but I can’t imagine how it would be that low if its similar to a realized loss number on that portfolio (don’t know what if any PMI is on that group).