by Calculated Risk on 6/12/2008 12:07:00 PM

Thursday, June 12, 2008

OCC: Bank Underwriting Standards Tighten

The Office of the Comptroller of the Currency (OCC) released their annual survey of underwriting standards today. Here is the Survey of Credit Underwriting Practices 2008

This is similar to the Federal Reserve Senior Financial Officer Survey except this survey is annual and is based on examiner assessments of the institutions underwriting practices, as opposed to the opinions of financial officers:

The 2008 survey included examiner assessments of credit underwriting standards at the 62 largest national banks. This population covers loans totaling $3.7 trillion as of December 2007, approximately 83 percent of total loans in the national banking system.As expected, the survey showed significantly tightening in most areas (except agricultural loans).

The Office of the Comptroller of the Currency released today its 14th annual Survey of Credit Underwriting Practices and reported that commercial and retail underwriting standards tightened after four consecutive years of eased underwriting standards.A key area of concern for 2008 is Commercial Real Estate:

...

Examiner assessments found that risk in both the commercial and retail portfolios increased over the past year and they expect portfolio risk to continue to increase over the coming year.

The most prevalent tightening occurred in CRE loans, leveraged loans, and counterparty credit exposure to hedge funds.

...

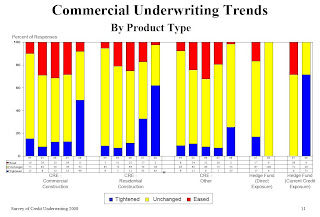

CRE products include commercial construction, residential construction, and other CRE loans. These products are offered by virtually all of the surveyed banks. Net tightening, which measures the difference between the percentage of banks tightening and those easing, was greatest in residential construction, followed by commercial construction. The following [graph] provide the breakdown by each real estate type.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph is from the OCC. The blue bar shows the percent of banks tightening lending standards for each category by year.

Note that residential construction has been tightening for two years, but commercial construction just saw a significant jump in tightening.

Examiners most often cited the following as reasons for strengthening of CRE underwriting standards:Although CRE concentrations are a concern at these larger national banks (with assets greater than $3 billion), most of the bank failures will probably be at smaller banks with even higher CRE concentrations. Update: The highest concentration of CRE loans are for institutions in the $1 billion to $10 billion range (so there is some overlap).weakening economy, specifically the downturn in residential real estate markets. Declines in market values/prices as a result of oversupply or slow-moving inventory. Existing credit concentrations, both by type of product and by location. Use of non-traditional terms and excessive investor speculation.

CRE remains a primary concern among examiners given the rapid growth of these exposures and banks’ significant concentrations relative to their capital. These concerns are compounded by elevated concerns over market conditions in select areas.