by Calculated Risk on 8/19/2007 03:40:00 PM

Sunday, August 19, 2007

Housing: Looking Ahead

Right now it appears housing is about to take another significant downturn.

But someday housing will bottom.

And I'm starting to see the first signs - not of a bottom - but that it might be worth looking ahead to the bottom. Blasphemy to some, I'm sure.

Defining a Bottom

The first step in predicting a bottom is to define what we mean. I think a bottom for new construction is very different than a bottom for existing homes. For existing homes, the most important number is price. So the bottom for a particular location would be defined as when housing prices bottomed in that area. Historically, during housing busts, existing home prices fall slowly for 5 to 7 years - so I'd expect to start looking for the bottom in the bubble areas in the 2010 to 2012 time frame.

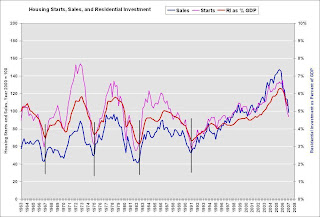

For new construction, we have several possible measures of a bottom. The following graph shows three of the most commonly used: Starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

NOTE: Sales and starts are normalized to 100 for year 2000. The purpose of this graph is to show the peaks and valleys of starts, sales, and RI. DO NOT use to compare sales to starts! Click on graph for larger image.

Click on graph for larger image.

The four previous bottoms, as defined by Residential Investment, are marked with a vertical line. In general the three indicators bottom together, although starts bottomed before investment in 1982.

Overall I think we can use Residential Investment (or RI as a percent of GDP) to define a bottom for housing investment (but not prices).

The very tentative positive signs. The first possible piece of good news is that the NAR reported inventory declined from the record in May to a 4.196 million units in June.

The first possible piece of good news is that the NAR reported inventory declined from the record in May to a 4.196 million units in June.

Total housing inventory fell 4.2 percent at the end of June to 4.20 million existing homes available for sale, which represents an 8.8-month supply at the current sales pace, the same as a downwardly revised 8.8-month supply in MayOther sources have reported that inventory levels have increased, and I do expect inventories to continue to rise somewhat through the summer. I also expect the months of supply (inventory / sales) to continue to rise as sales decline. And more bad news: the number of REOs (bank Real Estate Owned) will certainly increase dramatically in the coming year. That sounds grim, but the good news is we might be nearing the peak of existing home inventory in raw numbers - and that could be the first baby step towards a bottom.

Another piece of potential good news is that it appears the homeowner vacancy rate (from the Census Bureau) might have peaked.

Click on graph for larger image.

Click on graph for larger image.This graph shows the homeowner vacancy rate since 1956. A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, but it does appear the decline in Q2 was statistically significant.

The rental vacancy rate has been trending down for almost 3 years (with some noise). This was due to a decline in the total number of rental units in 2004, and more recently due to more households choosing renting over owning.

These vacancy rates are very high, but it does appear the rates have stopped climbing and - at least for rental vacancies - has started to decline. As starts decline (see Forecast: Housing Starts), inventory should stabilize and then decline, and the vacancy rates should slowly decline. More baby steps toward the eventual bottom.

Caution: the above signs are very tentative.

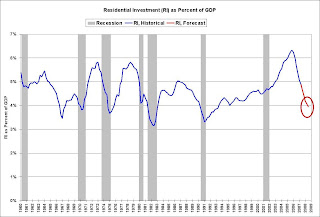

Residential Investment as a percent of GDP

The final graph shows historical RI as a percent of GDP (blue) and a rough forecast (red). My current view is that RI will bottom in 2008 (red circle).

Just as we watched housing as a leading indicator for the economy on the downside, we should also watch investment in housing as an indicator that the economy is bottoming and starting to recover. (I'll post my view on the overall economy this week).

Note: although I expect housing to bottom in '08 by these measures, I don't expect a quick rebound in housing investment.

To repeat: I expect housing to be crushed in the coming months. But it might be time to start looking ahead to the bottom in residential investment.