by Calculated Risk on 4/11/2006 06:44:00 PM

Tuesday, April 11, 2006

Toll Bros CEO: Speculators Impacting Supply

Dow Jones reports: Toll Bros CEO: Housing Comparisons Difficult Over Last Year

Toll Brothers Inc. Chief Executive Robert Toll said comparisons in the housing market continue to be difficult over last year ...How Speculation impacts supply:

...

As demand declined, Toll said speculators left the market.

"What's more you get the speculator putting their product back on the market - so you've got a little excess supply," Toll said.

A recent report by the National Association of Realtors (NAR) reported that 39.9% of all homes nationwide bought in 2005 were purchased as second homes. NAR reported 12.2% were purchased as vacation homes and 27.7% for investments. This is clear evidence of speculation.

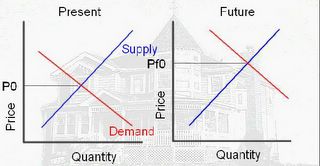

The following supply demand diagrams illustrate this type of speculation.

Click on diagram for larger image.

The above diagram shows the motive for the speculator. If he buys today, at price P0, he believes he can sell in the future at price Pf0 (price future zero), because of higher future demand. The speculation would return: Profit = Pf0-P0-storage costs (the storage costs are mortgage, property tax, maintenance, and other expenses minus any rents).

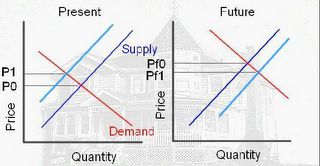

In this model, speculation is viewed as storage; it removes the asset from the supply. The following diagram shows the impact on price due to the speculation:

Since speculation removes the asset from the supply, the Present supply curve shifts to the left (light blue) and the price increases from P0 to P1. In the second diagram, when the speculator sells, the supply increases (shifts to the right). The future price will fall from PF0 to PF1. As long as (PF1 – storage costs) is greater than P1 the speculator makes a profit.

However, if the price does not rise, the speculator must either hold onto the asset or sell for a loss. If the speculator chooses to sell, this will add to the supply and put additional downward pressure on the price.

This is the type of speculation that Robert Toll is describing.

For more on speculation, especially leverage (using nontraditional mortgages), see my post on Angry Bear: Speculation is the Key. (Some of this post is a duplicate of that post).