by Calculated Risk on 1/31/2005 10:41:00 PM

Monday, January 31, 2005

Misestimates in CBO's Projections

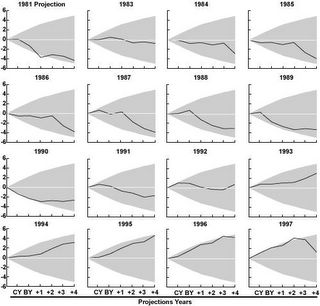

The following chart shows the accuracy of the CBO's projections from 1981 to 1997.

Misestimates in CBO's Projections Made from 1981 to 1997

Source: Congressional Budget Office. Notes: CY = current year; BY = budget year.

When the CBO makes an error (see '80s or 90's) they continue to make the same error for several years running. We are seeing the same phenomenon now. The CBO is consistently underestimating the tax revenues, specifically Corporate and Individual Income taxes. Social Security taxes (now 38% of all Federal revenue) have been reliable.

As an example, in Jan 2002 CBO projected a unified deficit of 21 Billion for fiscal 2002 (ends in Sept). The actual unified deficit was $158 Billion. The primary causes for this miss were Individual Income Taxes (short $89 Billion) and Corporate Income Taxes (short $31 Billion). This pattern is repeated for 2003 and 2004.

Just a reminder: On January 29, 2002, George W. Bush said in his State of the Union Address: "... our budget will run a deficit that will be small and short-term". He was sure wrong.

Mort Zuckerman on Social Security

by Calculated Risk on 1/31/2005 08:57:00 PM

Mort Zuckerman (US News & Report) writes: "A 'cure' worse than the cold"

Excerpt:

"[T]here is value in savings and self-reliance, in making private investment decisions, planning ahead, and increasing distance from the government. But there are other values in the very title of the program--Social Security. "Social" surely implies a contract to help manage poverty among the old and to know that our society provides a minimum income for all of our fellow citizens in their retirement years. And "security" means buffering the harshness and cruelty of the markets so that the well-being of the elderly is not dependent on shrewd stock picks and hot mutual funds that enrich some but fail the very people who need Social Security benefits the most.

Privatization thus gets things upside down. Social Security was not meant to re-create the free market; it was intended to insure against the vagaries and cruelties of the market and to permit Americans to count on the promise that the next generation will take care of them in their old age."

New Home Sales off in December

by Calculated Risk on 1/31/2005 10:44:00 AM

The Census Bureau's report today:

Sales of new one-family houses in December 2004 were at a seasonally adjusted annual rate of 1,098,000, according to estimates released jointly today by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development. This is 0.1 percent (±9.4%) above the revised November rate of 1,097,000, but is 2.0 percent (±10.6%) below the December 2003 estimate of 1,120,000.

The median sales price of new houses sold in December 2004 was $222,000; the average sales price was $276,600. The seasonally adjusted estimate of new houses for sale at the end of December was 432,000. This represents a supply of 4.8 months at the current sales rate.

In 2004, there were 1,183,000 houses sold compared with 1,086,000 houses sold during 2003, establishing a new record. This is an increase of 8.9 percent (±3.0%).

Thursday, January 27, 2005

4th Quarter Housing Vacancies and Homeownership

by Calculated Risk on 1/27/2005 04:01:00 PM

The 4th quarter report of Housing Vacancies and Homeownership is now available.

The housing inventory increased 1.325 million units in 2004. Interestingly, 1.763 million more units were occupied by owner; more units than the overall inventory increased.

The number of occupied rental units decreased slightly for the year and increased in the 4th quarter. This is the 2nd consecutive quarter of an increase in occupied rental units - a trend change from the last few years.

The Home Ownership rate is at a record 69.2%.

Monday, January 24, 2005

Global Warming Update

by Calculated Risk on 1/24/2005 09:29:00 PM

An international climate change task force has issued a new report that "global warming is approaching the point of no return, after which widespread drought, crop failure and rising sea levels will be irreversible."

"An ecological time bomb is ticking away," said Stephen Byers, who was co-chairman of the task force with U.S. Sen. Olympia Snowe, R-Maine. "World leaders need to recognize that climate change is the single most important long-term issue that the planet faces."

See also: Institute for Public Policy Research: G8-Plus Group needed to tackle climate change.

Buffett on the Market

by Calculated Risk on 1/24/2005 04:29:00 PM

In Friday's Boston Herald, "Billionaire Buffett has a bear-y bad feeling" reports that Warren Buffett is very worried. A few quotes:

``We are force-feeding dollars on the rest of the world at the rate of close to a couple billion dollars a day,'' he said in an interview on cable channel CNBC. ``That's going to weigh on the dollar . . . unless we have a major change in trade policies, I don't see how the dollar avoids going down.''

But, he added, ``I don't know if it's going to be this month, next month or next year.''

...

He doesn't like the stock market: ``I'm having a hard time finding things to buy,'' he said. He doesn't like commodities, such as steel, copper or coffee: ``We haven't been buying commodities.'' And he doesn't like bonds: ``I think you're going to see more inflation,'' he said.

Buffett is now sitting on $43 Billion in cash, an incredible amount considering (BRK-A:) Berkshire Hathaway's market cap is $138 Billion. To put that in prospective, MicroSoft's special dividend was considered amazing and that was $32 Billion.

Tuesday, January 18, 2005

A Desolation called Peace

by Calculated Risk on 1/18/2005 04:37:00 PM

Atque ubi colitudinum faciunt pacem apellant.

"They create a desolation and call it a peace."

Calgacus quoted in Tacitus' Agricola (98 A.D.)

Cover Story in The American Conservative:

A Time for Leaving

by William R. Polk

The Independent on Sunday U.K.

Not Even Saddam Could Achieve the Divisions This Election Will Bring

By Robert Fisk

IRAQ, the new Afghanistan

by Mark Follman, Salon.com

The Tsunami of Iraq

Dahr Jamail's Iraq Dispatches, 15 January 2005

Destroying Babylon

Dahr Jamail's Iraq Dispatches, 16 January 2005

NYTimes on Social Security: A Question of Numbers

by Calculated Risk on 1/18/2005 01:52:00 AM

This article by Roger Lowenstein is excellent.

A Question of Numbers

By ROGER LOWENSTEIN

Published: January 16, 2005

EXCERPT (my emphasis added):

The campaign to privatize has not only been about ideology; it has also focused on Social Security's supposed insolvency. Moore's book calls Social Security a ''Titanic . . . headed toward the iceberg'' and a program ''on the verge of collapse.'' A stream of other conservatives have bombarded the public, over years and decades, with prophecies of trillion-dollar liabilities and with metaphors intended to frighten -- ''train wreck,'' ''bankruptcy,'' ''cancer'' and so forth. Recently, a White House political deputy wrote a strategy note in which he said that Social Security is ''on an unsustainable course. That reality needs to be seared into the public consciousness.''

The campaign is potentially self-fulfilling: persuade enough people that Social Security is going bankrupt, and it will lose public support. Then Congress will be forced to act. And thanks to such unceasing alarums, many, and perhaps most, people today think the program is in serious financial trouble.

But is it? After Bush's re-election, I carefully read the 225-page annual report of the Social Security trustees. I also talked to actuaries and economists, inside and outside the agency, who are expert in the peculiar science of long-term Social Security forecasting. The actuarial view is that the system is probably in need of a small adjustment of the sort that Congress has approved in the past. But there is a strong argument, which the agency acknowledges as a possibility, that the system is solvent as is.

Although prudence argues for making a fix sooner rather than later, the program is not in crisis, nor is its potential shortfall irresolvable. Ideology aside, the scale of the fixes would not require Social Security to abandon the role that was conceived for it in 1935, and that it still performs today -- as an insurance fail-safe for the aged and others and as a complement to people's private market savings.

Thursday, January 13, 2005

Jobs, Jobs, Jobs

by Calculated Risk on 1/13/2005 09:29:00 PM

An interesting post on macroblog started me thinking about something my father once told me: “The American economy floats on oil”. Now macroblog has suggested a possible link between our sluggish job creation and the recent spike in energy prices. He offers this theory as an alternative explanation to EPI’s view that sluggish job creation is the result of poor public policy; specifically Bush’s tax cuts.

While I think about issues like causation and timing, I would like to make a minor contribution by asking: What exactly is Sluggish Job Creation?

To be fair to Bush (admittedly hard for me), when he took office the economy was clearly overheated. All things being equal, we would expect the economy to add about 1.7 million jobs per year based on working age population growth. So we would expect on average about 6.8 million new jobs created over Bush’s first term. But all things are not equal.

In Jan 2001 there were 132.388 million Americans employed. Unemployment was 4.2% with a civilian labor force participation rate of 67.2%. In Dec 2004 there are 132.266 million Americans employed. Unemployment is 5.4% with a civilian labor force participation rate of 66.0%.

The BLS is the source for all statistics.

The average unemployment for the 10 year period before Bush took office was 5.6% so it is not unreasonable to expect the unemployment rate to rise during Bush’s first term from the historically low rate of 4.2%. But what is surprising is the significant drop in the civilian labor force participation rate – the average for the same 10 year period was 66.7%.

We would expect, with averages of 5.6% unemployment and 66.7% participation rate, approximately 1.2 million more jobs today. And that estimate is probably low since we are 3 years into a recovery (the recession ended in Nov 2001) and usually unemployment is falling (it is) and the participation rate is rising (it is not). For example, with 67% participation and 5% unemployment we are 2.6 million jobs short of expected employment. So job creation is disappointing (by 1.2 to 2.6 million jobs) and I guess that defines “sluggish”.

Wednesday, January 12, 2005

At last! Sunshine in California

by Calculated Risk on 1/12/2005 02:41:00 PM

A beautiful day in Yosemite!

Photo captured from this live cam.

Tuesday, January 11, 2005

Housing Prices: An asset bubble?

by Calculated Risk on 1/11/2005 11:18:00 PM

Here is a look at the period from Jan 1998 until Dec 2004. I chose this period since this is when it appears housing prices accelerated.

NOTE: I'm posting this now and will update the post when new data for 2004 becomes available. Over the first 9 months of 2004 housing prices increased 8.9% while Household income was stagnate. So any bubble at the end of '03 will be larger now.

1) Home prices increased 49% nationwide during the 6 year period.

SOURCE HPI: OFHEO

2) Although real household incomes have been stagnate, with inflation household incomes have increased 17% from ’98 to ’04.

SOURCE: Census Bureau

3) Mortgage rates (30 year fixed) declined from 6.99% in Jan 1998 to 5.88% in Jan 2004.

SOURCE: FreddieMac

The drop in interest rates would predict a 19% increase in potential debt to keep the buyer’s monthly payment the same. However taxes would have also increase based on the value of the home. Therefore, a simple model would have predicted a 15% increase in prices due to changes in interest rates and taxes, and 17% due to increases in household incomes (because of inflation). Taking the multiple, the model would have predicted an increase of 34.5%, instead of the 49% increase we have observed.

This would argue (if ’98 prices were reasonable) that home prices are approximately 14% overvalued due to speculation or easy terms (ARMs, 0% down, etc). If mortgage interest rates increase, or we have a recession (lower household income), home prices would be even more overvalued.

A similar analysis was performed by the FRBNY Economic Policy Review, Dec 2004 "Are Home Prices the Next Bubble?"

Their conclusion: "The marked upturn in home prices is largely attributable to strong market fundamentals: Home prices have essentially moved in line with increases in family income and declines in nominal mortgage interest rates."

More to come ...

Saturday, January 08, 2005

The General Fund Deficit

by Calculated Risk on 1/08/2005 12:20:00 AM

Dr. DeLong does an outstanding job with his post "Social Security Talking Points". He points out that any trouble with Social Security Retirement Insurance is small in comparison to other fiscal problems facing the United States. He writes:

Bigger fiscal problems include:

- The current $600 billion a year General Fund deficit.

- The long-run problems of finding financing for and controlling the growth of rapidly-rising Medicare and Medicaid spending.

- The need to make sure that the General Fund has the resources to meet its commitments without undue strain after 2020--when it will no longer be able to borrow from the Social Security Trust Fund.

The following site, The Public Debt Online (run by the US Treasury), is useful in checking the size of the General Fund Deficit. Our National Debt as of Jan 6, 2005 is:

$7,595,653,400,600.33 (that is almost $7.6 Trillion)

As of Jan 6, 2004, our National Debt was:

$6,991,488,657,454.93 (just under $7 Trillion).

So the General Fund has run a deficit of $604 Billion and change over the last 12 months. That is a crisis.