by Calculated Risk on 2/06/2023 07:10:00 PM

Monday, February 06, 2023

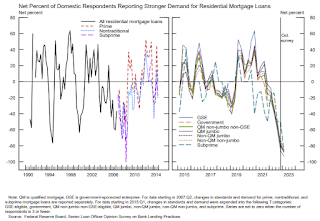

Fed Survey: Banks reported Tighter Standards, Weaker Demand for Residential Real Estate and HELOCs

From the Federal Reserve: The January 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices

The January 2023 Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the fourth quarter of 2022.

Regarding loans to businesses, survey respondents on balance reported tighter standards and weaker demand for commercial and industrial (C&I) loans to large, middle-market, and small firms over the fourth quarter.2 Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

For loans to households, banks reported that lending standards tightened or remained basically unchanged across all categories of residential real estate (RRE) loans and demand for these loans weakened. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Standards tightened and demand weakened, on balance, for credit card, auto, and other consumer loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate demand is from the Senior Loan Officer Survey Charts.

This shows that demand has declined sharply.

Heavy Truck Sales Up 6% Year-over-year

by Calculated Risk on 2/06/2023 01:12:00 PM

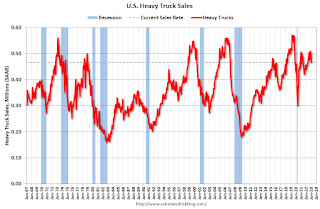

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the January 2023 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

Black Knight Mortgage Monitor: Home Prices Declined in December; Down 5.3% since June

by Calculated Risk on 2/06/2023 09:39:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: Home Prices Declined in December; Down 5.3% since June

A brief excerpt:

Here is a graph of the Black Knight HPI. The index is still up 5.0% year-over-year but declined for the sixth straight month in December and is now 5.3% off the peak in June.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• December’s 0.45% seasonally adjusted decline was roughly on par with the 0.48% average seen over the past 6 months, with an even sharper 0.89% decline on an unadjusted basis

• Nationally, home prices are now 5.3% off their summer peak (2.9% when accounting for typical seasonal patterns)

• December’s decline pushed the annual home price growth rate down to 5.0% -- now only 0.4% above its 30-year average – and the slowest home price growth rate since June 2020 in the early stages of the pandemic

• If the current rate of monthly declines persists, we would see the annual home price growth rate go negative within the next three months

Housing February 6th Weekly Update: Inventory Decreased 1.9% Week-over-week

by Calculated Risk on 2/06/2023 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, February 05, 2023

Sunday Night Futures

by Calculated Risk on 2/05/2023 06:15:00 PM

Weekend:

• Schedule for Week of February 5, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 13 and DOW futures are down 81 (fair value).

Oil prices were down over the last week with WTI futures at $73.39 per barrel and Brent at $79.94 per barrel. A year ago, WTI was at $92, and Brent was at $97 - so WTI oil prices are DOWN 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.43 per gallon. A year ago, prices were at $3.28 per gallon, so gasoline prices are up $0.15 per gallon year-over-year.

Hotels: Occupancy Rate Down 0.3% Compared to Same Week in 2019

by Calculated Risk on 2/05/2023 10:02:00 AM

U.S. hotel performance increased from the previous week, according to STR‘s latest data through Jan. 28.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Jan. 22-28, 2023 (percentage change from comparable week in 2019*):

• Occupancy: 56.3% (-0.3%)

• Average daily rate (ADR): $142.66 (+13.4%)

• Revenue per available room (RevPAR): $80.32 (+13.0%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019. Year-over-year comparisons will once again become standard after the first quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Saturday, February 04, 2023

Real Estate Newsletter Articles this Week: Case-Shiller: National House Price Index "Continued to Decline"

by Calculated Risk on 2/04/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index "Continued to Decline" to 7.7% year-over-year increase in November

• Rents Continue to Decline; "Apartment Market Loosens"

• Inflation Adjusted House Prices 3.6% Below Peak

• Lawler: Net Home Orders and Sales Cancellations of Large Publicly-Traded Home Builders

• Lawler: D.R. Horton (DHI) Net Order Price Declined "Roughly" 10% from Peak

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of February 5, 2023

by Calculated Risk on 2/04/2023 08:11:00 AM

This will be light week for economic data.

No major economic releases scheduled.

8:00 AM ET: Corelogic House Price index for December.

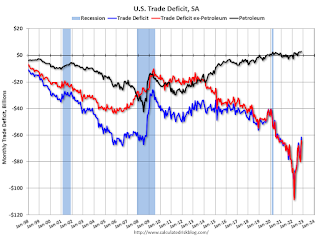

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $68.5 billion. The U.S. trade deficit was at $61.5 billion in November.

12:40 PM, Discussion Fed Chair Jerome Powell, Conversation with David Rubenstein, Chairman of the Economic Club of Washington, D.C. at the Economic Club of Washington, D.C.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 194 thousand initial claims, up from 183 thousand last week.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for February). The consensus is for a reading of 67.0.

Friday, February 03, 2023

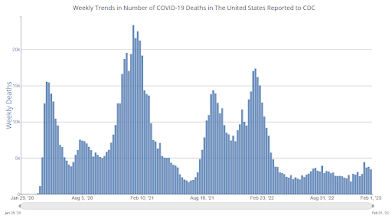

COVID Feb 3, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 2/03/2023 09:24:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 280,911 | 301,243 | ≤35,0001 | |

| Hospitalized2 | 25,603 | 29,306 | ≤3,0001 | |

| Deaths per Week2 | 3,452 | 3,792 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

AAR: January Rail Carloads Increased and Intermodal Decreased Year-over-year

by Calculated Risk on 2/03/2023 04:17:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

U.S. rail traffic started January 2023 with both discouraging and encouraging aspects.

On the encouraging side, total U.S. carloads rose 2.2% in January 2023. January 2022 was the worst January for total carloads in our records that begin in 1988. Still, growth is better than a decline.

...

On the discouraging side, January 2023 was the worst January for intermodal since 2013, with originations down 8.1% from last year. In recent months, major retailers have cut inventories; consumer spending — especially on goods — has contracted; and truck rates have fallen.

emphasis added

Click on graph for larger image.

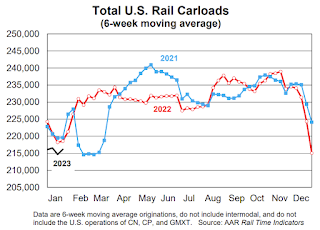

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2021, 2022 and 2022:

The good news is total U.S. carloads were up 2.2%, or 19,827 carloads, in January 2023 over January 2022. The bad news is January 2022 was the worst January for total carloads in our records that go back to 1988, so a 2.2% increase — while certainly better than some alternatives — is less impressive than it could be.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):U.S. railroads also originated 919,928 intermodal containers and trailers in January 2023, down 8.1%, or 81,443 units, from January 2022. Intermodal volume averaged 229,982 units per week in January 2023, the fewest for January since 2013. January 2023 was the first time since March 2017 that the number of originated carloads exceeded the number of originated intermodal units on U.S. railroads.