by Calculated Risk on 6/27/2022 08:16:00 AM

Monday, June 27, 2022

Five High Frequency Indicators for the Economy

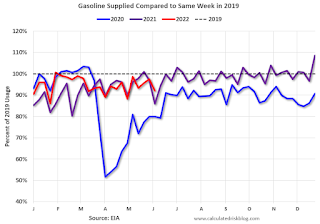

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

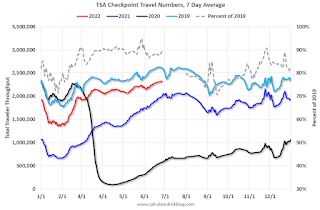

The TSA is providing daily travel numbers.

This data is as of June 26th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 10.8% from the same day in 2019 (89.2% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $241 million last week, down about 6% from the median for the week.

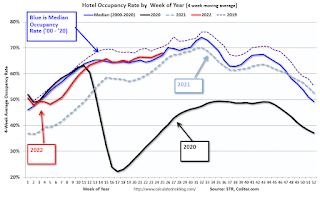

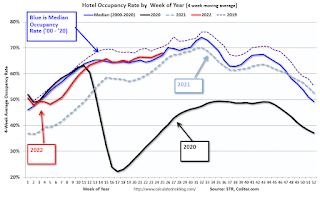

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through June 18th. The occupancy rate was down 4.8% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of June 10th, gasoline supplied was down 7.9% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

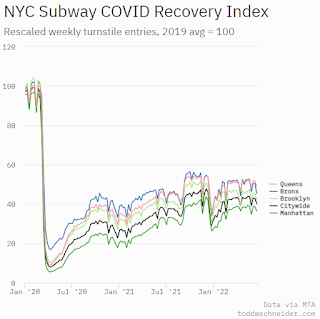

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, June 24th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, June 26, 2022

Monday: Durable Goods, Pending Home Sales, Dallas Fed Mfg

by Calculated Risk on 6/26/2022 06:56:00 PM

Weekend:

• Schedule for Week of June 26, 2022

Monday:

• At 8:30 AM ET, Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.1% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for May. The consensus is for a 2.0% decrease in the index.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for June.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 12, and DOW futures are down 102 (fair value).

Oil prices were down over the last week with WTI futures at $107.62 per barrel and Brent at $113.12 per barrel. A year ago, WTI was at $73 and Brent was at $76 - so WTI oil prices are up 45% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.88 per gallon. A year ago prices were at $3.09 per gallon, so gasoline prices are up $1.79 per gallon year-over-year.

Hotels: Occupancy Rate Down 4.8% Compared to Same Week in 2019

by Calculated Risk on 6/26/2022 08:12:00 AM

U.S. hotel revenue per available room (RevPAR) reached an all-time weekly high on a nominal basis and a pandemic-era high on an inflation-adjusted basis, according to STR‘s latest data through June 18.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

June 12-18, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 71.8% (-4.8%)

• Average daily rate (ADR): $155.02 (+14.9%)

• evenue per available room (RevPAR): $111.29 (+9.4%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Saturday, June 25, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 6/25/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• May New Home Sales Increase, Over 5 Months of Inventory Under Construction

• New Home Sales and Cancellations

• Final Look at Local Housing Markets in May

• NAR: Existing-Home Sales Decreased to 5.41 million SAAR in May

• Housing Completions will Increase Sharply in 2022

• 3rd Look at Local Housing Markets in May

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of June 26, 2022

by Calculated Risk on 6/25/2022 08:11:00 AM

The key reports this week are the third estimate of Q1 GDP, and Personal Income and Outlays for May.

Other key reports include the June ISM Manufacturing survey, June Vehicle Sales, and April Case-Shiller house prices.

For manufacturing, the June Richmond and Dallas Fed manufacturing surveys will be released.

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.1% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for May. The consensus is for a 2.0% decrease in the index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for June.

9:00 AM: S&P/Case-Shiller House Price Index for April.

9:00 AM: S&P/Case-Shiller House Price Index for April.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 21.0% year-over-year increase in the Comp 20 index for April.

9:00 AM: FHFA House Price Index for April 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 1st quarter 2022 (Third estimate). The consensus is that real GDP decreased 1.5% annualized in Q1, unchanged from the second estimate of a 1.5% decrease.

Early: Census Bureau to Release Vintage 2021 Population Estimates

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand up from 229 thousand last week.

8:30 AM ET: Personal Income and Outlays, May 2022. The consensus is for a 0.5% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.4%. PCE prices are expected to be up 6.2% YoY, and core PCE prices up 4.7% YoY.

9:45 AM: Chicago Purchasing Managers Index for June.

10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 55.0, down from 56.1 in May.

10:00 AM: Construction Spending for May. The consensus is for a 0.4% increase in construction spending.

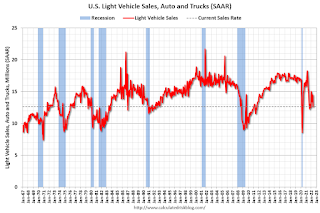

Late in the day: Light vehicle sales for June.

Late in the day: Light vehicle sales for June.The consensus is for light vehicle sales to be 13.6 million SAAR in June, up from 12.7 million in May (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

Wards Auto is forecasting sales of 13.3 million SAAR in June.

Friday, June 24, 2022

COVID June 24, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 6/24/2022 09:01:00 PM

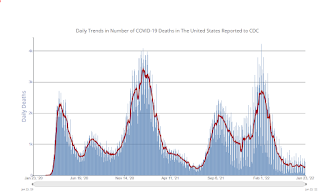

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 222.1 | --- | ≥2321 | |

| New Cases per Day3 | 97,548 | 102,042 | ≤5,0002 | |

| Hospitalized3🚩 | 24,950 | 24,513 | ≤3,0002 | |

| Deaths per Day3 | 283 | 291 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Q2 GDP Forecasts: Fairly Wide Range

by Calculated Risk on 6/24/2022 01:32:00 PM

From BofA:

We continue to track 1.5% qoq saar growth for 2Q, unchanged from last week. We continue to forecast 2.3% GDP growth for 2022 and expect growth to slow to 1.4% and 0.8% in 2023 and 2024, respectively as the lagged effects of tighter monetary policy and financial conditions cool the economy. [June 24 estimate]From Goldman:

emphasis added

Following today’s data, we boosted our Q2 GDP tracking estimate by 0.1pp to +2.9% (qoq ar) [June 24 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is 0.0 percent on June 16, unchanged from June 15 after rounding. [June 16 estimate]

May New Home Sales Increase, Over 5 Months of Inventory Under Construction

by Calculated Risk on 6/24/2022 11:23:00 AM

Today, in the Calculated Risk Real Estate Newsletter: May New Home Sales Increase, Over 5 Months of Inventory Under Construction

Brief excerpt:

The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.You can subscribe at https://calculatedrisk.substack.com/.

There are just over 0.68 months of completed supply (red line). This is about half the normal level.

The inventory of new homes under construction is at 5.0 months (blue line) - well above the normal level. This elevated level of homes under construction is due to supply chain constraints. This is close to the record set in 1980.

And a record 115 thousand homes have not been started - about 2.0 months of supply (grey line) - almost double the normal level. Homebuilders are probably waiting to start some homes until they have a firmer grasp on prices and demand.

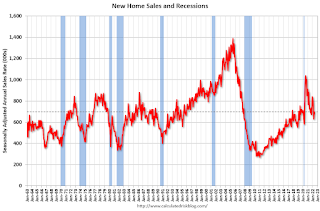

New Home Sales Increase to 696,000 Annual Rate in May

by Calculated Risk on 6/24/2022 10:09:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 696 thousand.

The previous three months were revised up, combined.

Sales of new single‐family houses in May 2022 were at a seasonally adjusted annual rate of 696,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 10.7 percent above the revised April rate of 629,000, but is 5.9 percent below the May 2021 estimate of 740,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are now at pre-pandemic levels.

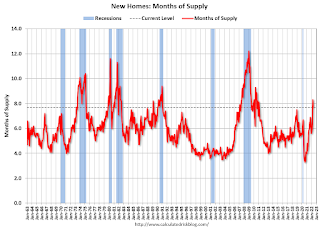

The second graph shows New Home Months of Supply.

The months of supply decreased in May to 7.7 months from 8.3 months in April.

The months of supply decreased in May to 7.7 months from 8.3 months in April. The all-time record high was 12.1 months of supply in January 2009. The all-time record low was 3.5 months, most recently in October 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of May was 444,000. This represents a supply of 7.7 months at the current sales rate."

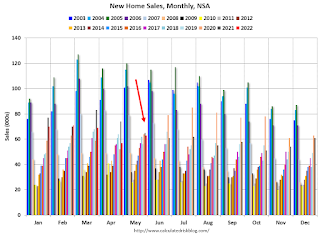

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2022 (red column), 63 thousand new homes were sold (NSA). Last year, 65 thousand homes were sold in May.

The all-time high for May was 120 thousand in 2005, and the all-time low for May was 26 thousand in 2010.

This was above expectations, and sales in the three previous months were revised up, combined. I'll have more later today.

Black Knight: "Past-Due Mortgages Fall to Third Consecutive Record Low in May"

by Calculated Risk on 6/24/2022 08:30:00 AM

From Black Knight: Black Knight’s First Look: Past-Due Mortgages Fall to Third Consecutive Record Low in May; Serious Delinquencies, Foreclosure Starts See Continued Improvement

• The national delinquency rate fell five basis points from April to 2.75% in May, continuing the downward trend in overall delinquencies of the prior two months and marking yet another new lowAccording to Black Knight's First Look report, the percent of loans delinquent decreased 1.9% in May compared to April and decreased 42% year-over-year.

• Following typical seasonal patterns, early-stage delinquencies – borrowers who have missed a single mortgage payment – edged marginally higher (+0.2%) month over month

• While serious delinquencies saw strong improvement, falling 7% from April, the population of such loans (those 90 or more days past due but not yet in foreclosure) remains 45% above pre-pandemic levels

• Despite elevated serious delinquency levels, foreclosure starts dropped 12% from April and continue to hold well below pre-pandemic levels while active foreclosures edged slightly higher

• Prepayment activity fell by 11.1% from the prior month and is now down 59.1% year over year on sharply higher interest rates

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.75% in May, down from 2.80% in April.

The percent of loans in the foreclosure process increased in May to 0.33%, from 0.32% in April. This is increasing from very low levels due to the foreclosure moratoriums.

The number of delinquent properties, but not in foreclosure, is down 1,050,000 properties year-over-year, and the number of properties in the foreclosure process is up 26,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| May 2022 | Apr 2022 | May 2021 | May 2020 | |

| Delinquent | 2.75% | 2.80% | 4.73% | 7.76% |

| In Foreclosure | 0.33% | 0.32% | 0.28% | 0.38% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,461,000 | 1,496,000 | 2,511,000 | 4,123,000 |

| Number of properties in foreclosure pre-sale inventory: | 174,000 | 173,000 | 148,000 | 200,000 |

| Total Properties | 1,635,000 | 1,669,000 | 2,659,000 | 4,323,000 |