by Calculated Risk on 5/12/2022 08:35:00 AM

Thursday, May 12, 2022

Weekly Initial Unemployment Claims Increase to 203,000

The DOL reported:

In the week ending May 7, the advance figure for seasonally adjusted initial claims was 203,000, an increase of 1,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 200,000 to 202,000. The 4-week moving average was 192,750, an increase of 4,250 from the previous week's revised average. The previous week's average was revised up by 500 from 188,000 to 188,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 192,750.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Wednesday, May 11, 2022

Thursday: PPI, Unemployment Claims

by Calculated Risk on 5/11/2022 08:50:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 210 thousand up from 200 thousand last week.

• At 8:30 AM, The Producer Price Index for April from the BLS. The consensus is for a 0.5% increase in PPI, and a 0.6% increase in core PPI.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 220.3 | --- | ≥2321 | |

| New Cases per Day3🚩 | 78,236 | 61,715 | ≤5,0002 | |

| Hospitalized3🚩 | 14,104 | 12,291 | ≤3,0002 | |

| Deaths per Day3 | 326 | 332 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

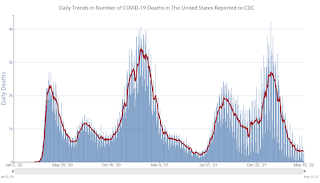

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

2nd Look at Local Housing Markets in April; Inventory increasing, No Surge in New Listings

by Calculated Risk on 5/11/2022 12:48:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in April

A brief excerpt:

Here is a summary of active listings for these housing markets in April. Note: Inventory usually increases seasonally in April, so some month-over-month (MoM) increase is not surprising.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Inventory was up 17.9% in April MoM from March, and up 4.9% year-over-year (YoY). Eight of 15 markets were up YoY.

Active inventory in these markets were down 19% YoY in February, and down 4.8% YoY in March, so this is a significant change from February and March. This is another step towards a more balanced market, but inventory levels are still very low.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle), North Texas (Dallas) and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3) Totals do not include Atlanta (included in state total).

Cleveland Fed: Median CPI increased 0.5% and Trimmed-mean CPI increased 0.4% in April

by Calculated Risk on 5/11/2022 11:18:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.5% in April. The 16% trimmed-mean Consumer Price Index increased 0.4% in April. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Used Cars" were down slightly annualized in April, and this will likely show further declines in coming months. Motor fuel was down 51% annualized in April after increasing sharply in March

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

BLS: CPI increased 0.3% in April; Core CPI increased 0.6%

by Calculated Risk on 5/11/2022 08:33:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in April on a seasonally adjusted basis after rising 1.2 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the >all items index increased 8.3 percent before seasonal adjustment.The consensus was for 0.2% increase in CPI (up 8.1% YoY), and a 0.4% increase in core CPI (up 6.1% YoY). Both were above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Increases in the indexes for shelter, food, airline fares, and new vehicles were the largest contributors to the seasonally adjusted all items increase. The food index rose 0.9 percent over the month as the food at home index rose 1.0 percent. The energy index declined in April after rising in recent months. The index for gasoline fell 6.1 percent over the month, offsetting increases in the indexes for natural gas and electricity.

The index for all items less food and energy rose 0.6 percent in April following a 0.3-percent advance in March. Along with indexes for shelter, airline fares, and new vehicles, the indexes for medical care, recreation, and household furnishings and operations all increased in April. The indexes for apparel, communication, and used cars and trucks all declined over the month.

The all items index increased 8.3 percent for the 12 months ending April, a smaller increase than the 8.5-percent figure for the period ending in March. The all items less food and energy index rose 6.2 percent over the last 12 months. The energy index rose 30.3 percent over the last year, and the food index increased 9.4 percent, the largest 12-month increase since the period ending April 1981.

emphasis added

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 5/11/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 6, 2022.

... The Refinance Index decreased 2 percent from the previous week and was 72 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 8 percent lower than the same week one year ago.

“The increase in mortgage applications last week was driven by a strong gain in application activity for conventional and government purchase loans, even as mortgage rates rose to their highest level – 5.53 percent – since 2009. Despite a slow start to this year’s spring home buying season, prospective buyers are showing some resiliency to higher rates. Purchase activity has now increased for two straight weeks,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “More borrowers continue to utilize ARMs to combat higher rates. The share of ARMs increased to 11 percent of overall loans and to 19 percent by dollar volume.”

Added Kan, “The rapid rise in mortgages rates continues to hit the refinance market, with activity 70 percent below a year ago. Most homeowners refinanced to lower rates in the past two years.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.53 percent from 5.36 percent, with points increasing to 0.73 from 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 8% year-over-year unadjusted.

According to the MBA, purchase activity is down 8% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, May 10, 2022

Wednesday: CPI

by Calculated Risk on 5/10/2022 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for 0.2% increase in CPI (up 8.1% YoY), and a 0.4% increase in core CPI (up 6.1% YoY).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 220.2 | --- | ≥2321 | |

| New Cases per Day3🚩 | 74,712 | 60,554 | ≤5,0002 | |

| Hospitalized3🚩 | 13,538 | 12,047 | ≤3,0002 | |

| Deaths per Day3 | 323 | 331 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

Mortgage Originations by Credit Score and Age

by Calculated Risk on 5/10/2022 12:01:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Mortgage Originations by Credit Score and Age

A brief excerpt:

The NY Fed released the Q1 Quarterly Report on Household Debt and Credit this morning. Here are a couple of charts from the report.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The first graph shows mortgage originations by credit score (this includes both purchase and refinance). Look at the difference in credit scores in the recent period compared to the during the bubble years (2003 through 2006). Recently there have been almost no originations for borrowers with credit scores below 620, and few below 660. A significant majority of recent originations have been to borrowers with credit score above 760.

Solid underwriting is a key reason I’ve argued Don't Compare the Current Housing Boom to the Bubble and Bust, Look instead at the 1978 to 1982 period for lessons.

From the NY Fed:

Mortgage originations, measured as appearances of new mortgages on consumer credit reports and which include refinances, were at $859 billion in 2022Q1. This represented a decrease from the high volumes seen during 2021, but still was $197 billion higher than the volume seen in 2020Q1, just before the pandemic hit.

The median credit score of newly originated mortgages declined again, to 776, down from a series high in 2021Q1 of 788. Yet, credit scores on newly originated mortgages remain very high and reflect continuing high lending standards.

NY Fed Q1 Report: Total Household Debt Increases to $15.8 trillion

by Calculated Risk on 5/10/2022 11:10:00 AM

From the NY Fed: Total Household Debt Increases in Q1 2022, Driven by Mortgage and Auto Balances

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows a solid increase in total household debt in the first quarter of 2022, increasing by $266 billion (1.7%) to $15.84 trillion. Balances now stand $1.7 trillion higher than at the end of 2019, before the COVID-19 pandemic. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

Mortgage balances rose by $250 billion in the first quarter of 2022 and stood at $11.18 trillion at the end of March. In line with seasonal trends typically seen at the start of the year, credit card balances declined by $15 billion. Credit card balances are still $71 billion higher than Q1 2021 and represent a substantial year-over-year increase. Auto loan balances increased by $11 billion in the first quarter, while student loan balances increased by $14 billion and now stand at $1.59 trillion. In total, non-housing balances grew by $17 billion.

Mortgage and auto loan originations both declined in the first quarter, after historically high volumes in 2021. Mortgage originations were at $859 billion, representing a decline from the high volumes seen during 2021, yet still $197 billion higher than in Q1 2020, right before the pandemic hit the United States. The volume of newly originated auto loans was $177 billion during the first quarter, primarily reflecting an increase in auto prices. Aggregate limits on credit card accounts increased by $64 billion and now stand at $4.12 trillion–$224 billion above the pre-pandemic level.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

The first graph shows aggregate consumer debt increased in Q1. Household debt previously peaked in 2008 and bottomed in Q3 2013. Unlike following the great recession, there wasn't a huge decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $266 billion in the first quarter of 2022, a 1.7% rise from 2021Q4. Balances now stand at $15.84 trillion, $1.7 trillion higher than at the end of 2019, just before the Covid pandemic.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate was unchanged in Q1. From the NY Fed:

Aggregate delinquency rates were unchanged in the first quarter of 2022 and remain very low, after declining sharply through the beginning of the pandemic. Delinquency rates have been low in part due to forbearances (provided by both the CARES Act and voluntarily offered by lenders), which protect borrowers’ credit records from the reporting of skipped or deferred payments. Although these forbearances have ended for most types of debts, the pause on student loan payments remains in place. As of late March, 2.7% of outstanding debt was in some stage of delinquency, a 2.0 percentage point decrease from the fourth quarter of 2019, just before the COVID-19 pandemic hit the United States.There is much more in the report.

Second Home Market: South Lake Tahoe in April

by Calculated Risk on 5/10/2022 08:11:00 AM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes like the recent FHFA Targeted Increases to Enterprise Pricing Framework, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through April 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but up from the record low set in February 2022, and up slightly year-over-year. Prices are up 12.7% YoY (but the YoY change has been trending down).