by Calculated Risk on 1/20/2022 03:33:00 PM

Thursday, January 20, 2022

Second Home Market: South Lake Tahoe in December

With the pandemic, there was a surge in 2nd home buying. In response, Fannie made some lending changes, from Jann Swanson at MortgageNewsDaily: Fannie Warns Lenders on Investment Properties and 2nd Homes.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from the lending changes.

This graph is for South Lake Tahoe since 2004 through December 2021, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low - above the record low set in March 2021, but down YoY - and prices are up sharply YoY.

More Analysis on December Existing Home Sales

by Calculated Risk on 1/20/2022 10:40:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: Existing-Home Sales Decreased to 6.18 million in December

Excerpt:

This graph shows existing home sales by month for 2020 and 2021.There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

This was the fifth consecutive month with sales down year-over-year. Sales will likely be down YoY in January 2022 too since were exceptionally strong last Winter.

...

[and on inventory] According to the NAR, inventory decreased to 0.92 million in December from 1.11 million in November. Inventory usually declines significantly in November and December as potential sellers remove their homes from the market for the holidays. Inventory is now at a record low.

NAR: Existing-Home Sales Decreased to 6.18 million in December

by Calculated Risk on 1/20/2022 10:18:00 AM

From the NAR: Annual Existing-Home Sales Hit Highest Mark Since 2006

Existing-home sales declined in December, snapping a streak of three straight months of gains, according to the National Association of Realtors®. Each of the four major U.S. regions witnessed sales fall in December from both a month-over-month and a year-over-year basis. Despite the drop, overall sales for 2021 increased 8.5%.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 4.6% from November to a seasonally adjusted annual rate of 6.18 million in December. From a year-over-year perspective, sales waned 7.1% (6.65 million in December 2020).

...

Total housing inventory at the end of December amounted to 910,000 units, down 18.0% from November and down 14.2% from one year ago (1.06 million). Unsold inventory sits at a 1.8-month supply at the present sales pace, down from 2.1 months in November and from 1.9 months in December 2020.

emphasis added

Click on graph for larger image.

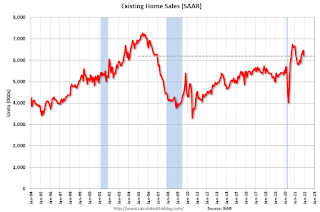

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December (6.18 million SAAR) were down 4.6% from last month and were 7.1% below the December 2020 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 0.91 million in December from 1.11 million in November.

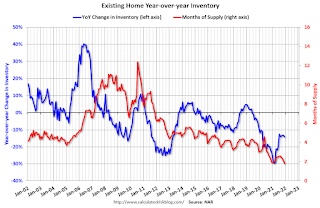

According to the NAR, inventory decreased to 0.91 million in December from 1.11 million in November.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 14.2% year-over-year in December compared to December 2020.

Inventory was down 14.2% year-over-year in December compared to December 2020. Months of supply declined to 1.8 months in December from 2.1 months in November.

This was below the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims Increase to 286,000

by Calculated Risk on 1/20/2022 08:34:00 AM

Note: This report is for the BLS January reference week.

The DOL reported:

In the week ending January 15, the advance figure for seasonally adjusted initial claims was 286,000, an increase of 55,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 230,000 to 231,000. The 4-week moving average was 231,000, an increase of 20,000 from the previous week's revised average. The previous week's average was revised up by 250 from 210,750 to 211,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 231,000.

The previous week was revised up.

Weekly claims were well above the consensus forecast, likely due to the current COVID wave.

Wednesday, January 19, 2022

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 1/19/2022 07:10:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims.

• Also at 8:30 AM, the Philly Fed manufacturing survey for January. The consensus is for a reading of 23.0, up from 15.4.

• At 10:00 AM, Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 6.45 million SAAR, down from 6.46 million. Housing economist Tom Lawler expects the NAR to report 6.33 million SAAR.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 209.5 | --- | ≥2321 | |

| New Cases per Day3 | 755,095 | 763,722 | ≤5,0002 | |

| Hospitalized3🚩 | 142,595 | 125,106 | ≤3,0002 | |

| Deaths per Day3 | 1,669 | 1,687 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

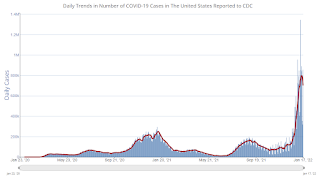

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

AIA: "Architecture firms end 2021 on a strong note" in December

by Calculated Risk on 1/19/2022 12:27:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture firms end 2021 on a strong note

As architecture firms ended 2021 on a high note with strong business conditions, staff recruitment is becoming a growing concern among firms.

December’s Architectural Billings Index (ABI) score of 52.0 was an increase from 51.0 in November (any score over 50 indicates billings growth). Despite a variety of concerns related to the omicron variant, labor shortages, and rising prices as well as limited availability of construction materials, firms continued to report a robust supply of work in the pipeline. Inquiries into new work and the value of new design contracts both remained strong, and backlogs, at an average of 6.5 months, remained near their highest levels since the AIA began tracking this metric in 2010.

“Since demand for design projects has been healthy over the last year, recruiting architectural staff to keep up with project workloads has been a growing concern for firms,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Architecture is one of the few industries where payrolls have already surpassed their pre-pandemic high, so meeting future staffing needs is a challenge that most firms will need to confront."

...

• Regional averages: South (56.4); Midwest (51.0); West (47.5); Northeast (45.3)

• Sector index breakdown: mixed practice (60.6); multi-family residential (49.2); commercial/industrial (49.2); institutional (47.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.0 in December, up from 51.0 in November. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index was below 50 for eleven consecutive months but has been positive for the last eleven months.

December Housing Starts: Most Housing Units Under Construction Since 1973

by Calculated Risk on 1/19/2022 10:42:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: December Housing Starts: Most Housing Units Under Construction Since 1973

Excerpt:

The 1.595 million total starts in 2021 were up 15.6% from 1.380 million in 2020. Starts in 2021 were the most since 2006 when 1.801 million units were started.There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).

Red is single family units. Currently there are 769 thousand single family units under construction (SA). This is the highest level since February 2007.

For single family, most of these homes are already sold (Census counts sales when contract is signed). The reason there are so many homes is probably due to construction delays. Since most of these are already sold, it is unlikely this is “overbuilding”, or that this will impact prices (although the buyers will be moving out of their current home or apartment once these homes are completed).

Blue is for 2+ units. Currently there are 750 thousand multi-family units under construction. This is the highest level since July 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Census will release data in March (part of February survey) on the length of time from start to completion, and that will probably show long delays in 2021. In 2020, it took an average of 6.8 months from start to completion for single family homes, and 15.4 months for buildings with 2 or more units.

Combined, there are 1.519 million units under construction. This is the most since November 1973.

Housing Starts Increased to 1.702 million Annual Rate in December

by Calculated Risk on 1/19/2022 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in December were at a seasonally adjusted annual rate of 1,702,000. This is 1.4 percent above the revised November estimate of 1,678,000 and is 2.5 percent (±13.8 percent)* above the December 2020 rate of 1,661,000. Single‐family housing starts in December were at a rate of 1,172,000; this is 2.3 percent below the revised November figure of 1,199,000. The December rate for units in buildings with five units or more was 524,000.

An estimated 1,595,100 housing units were started in 2021. This is 15.6 percent (±4.0 percent) above the 2020 figure of 1,379,600.

Building Permits:

Privately‐owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,873,000. This is 9.1 percent above the revised November rate of 1,717,000 and is 6.5 percent above the December 2020 rate of 1,758,000. Single‐family authorizations in December were at a rate of 1,128,000; this is 2.0 percent above the revised November figure of 1,106,000. Authorizations of units in buildings with five units or more were at a rate of 675,000 in December. [Special Note: In December, there was a large increase in building permits issued in Philadelphia, PA. Philadelphia enacted several real estate tax changes for residential projects permitted after December 31, 2021.]

An estimated 1,724,700 housing units were authorized by building permits in 2021. This is 17.2 percent (±0.6 percent) above the 2020 figure of 1,471,100.

emphasis added

Click on graph for larger image.

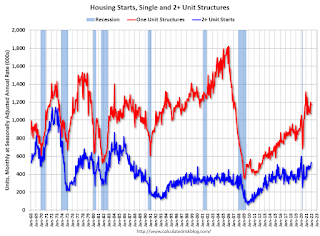

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) increased in December compared to November. Multi-family starts were up 53% year-over-year in December.

Single-family starts (red) decreased in December and were down 10.9% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in December were above expectations and starts in October and November were revised up slightly, combined.

I'll have more later …

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/19/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 14, 2022.

... The Refinance Index decreased 3 percent from the previous week and was 49 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 8 percent from one week earlier. The unadjusted Purchase Index increased 14 percent compared with the previous week and was 13 percent lower than the same week one year ago.

“Mortgage rates hit their highest levels since March 2020, leading to the slowest pace of refinance activity in over two years. The 30-year fixed rate reached 3.64 percent and has increased more than 30 basis points over the past two weeks. FHA and VA refinance declines drove most of the refinance slowdown,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite the increase in rates, purchase applications jumped almost 8 percent, with conventional purchase applications accounting for much of the stronger activity. The average loan size for a purchase application set a record at $418,500. The continued rise in purchase loan application sizes is driven by high home price appreciation and the lack of housing inventory on the market – especially for entry-level homes. The slower growth in government purchase activity is also contributing to the larger loan balances and suggests that prospective first-time buyers are struggling to find homes to buy in their price range.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 3.64 percent from 3.52 percent, with points remaining unchanged at 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 13% year-over-year unadjusted.

According to the MBA, purchase activity is down 13% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, January 18, 2022

Wednesday: Housing Starts

by Calculated Risk on 1/18/2022 08:52:00 PM

From Matthew Graham at Mortgage News Daily: Remember Mortgage Rates in the 2's? They're Closer to 4% Now

One of the very few welcome byproducts of the pandemic was the pervasive availability of new all-time low mortgage rates. Depending on when you checked in, you were highly likely to see top tier 30yr fixed rates in the 2% range. ... The average lender is now up to 3.75% after starting the day at 3.625%. [30 year fixed 3.70%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for December. The consensus is for 1.655 million SAAR, down from 1.679 million SAAR.

• During the day, The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 209.3 | --- | ≥2321 | |

| New Cases per Day3 | 701,277 | 752,342 | ≤5,0002 | |

| Hospitalized3🚩 | 137,384 | 120,397 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,746 | 1,664 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.