by Calculated Risk on 11/23/2021 05:43:00 PM

Tuesday, November 23, 2021

Freddie Mac: Mortgage Serious Delinquency Rate decreased in October

Freddie Mac reported that the Single-Family serious delinquency rate in October was 1.32%, down from 1.46% in September. Freddie's rate is down year-over-year from 2.89% in October 2020.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble, and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Also - for multifamily - delinquencies were at 0.10%, down from the peak of 0.20% in April 2021.

November 23rd COVID-19: New Cases and Hospitalizations Increasing

by Calculated Risk on 11/23/2021 05:15:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 59.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 196.0 | --- | ≥2321 | |

| New Cases per Day3🚩 | 93,668 | 84,051 | ≤5,0002 | |

| Hospitalized3🚩 | 42,841 | 40,688 | ≤3,0002 | |

| Deaths per Day3 | 1,009 | 1,032 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 19 states have between 50% and 59.9% fully vaccinated: Wisconsin at 59.3%, Nebraska, Iowa, Utah, Michigan, Texas, Kansas, Arizona, Nevada, South Dakota, North Carolina, Alaska, Ohio, Kentucky, Montana, Oklahoma, South Carolina, Missouri and Indiana at 50.5%.

Next up (total population, fully vaccinated according to CDC) are Georgia at 49.3%, Tennessee at 49.3%, Arkansas at 49.0%, Louisiana at 48.6% and North Dakota at 48.6%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Final Look: Local Housing Markets in October

by Calculated Risk on 11/23/2021 11:19:00 AM

Today, in the Real Estate Newsletter: Final Look: Local Housing Markets in October

Excerpt:

Here is a summary of active listings for the housing markets that have reported in October. For these markets, inventory was down 5.9% in October MoM from September, and down 26.5% YoY.You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Of these markets, inventories in Jacksonville, Miami and San Diego are at record lows. Sacramento and Washington, D.C. are the only markets with inventory up YoY in October (Austin is essentially unchanged YoY).

Inventory almost always declines seasonally in October, so the MoM decline is not a surprise. Last month, these markets were down 24.5% YoY, so the YoY decline in October is larger than in September. This is not indicating a slowing market.

In California, the C.A.R. reported inventory was down 18.3% YoY, but this isn’t included in the table since C.A.R. doesn’t report monthly numbers.

Update: The Coming Deceleration in House Price Growth

by Calculated Risk on 11/23/2021 09:16:00 AM

Last month, in the Real Estate Newsletter, I wrote: The Coming Deceleration in House Price Growth

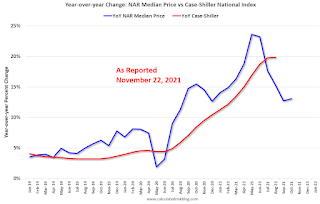

Here is an update to the graph:

Not only is Case-Shiller released with a lag (the release next week will be for September, whereas the NAR release yesterday was for October), but the 3-month average means the September release will include sales in July and August too.

Although median prices can be distorted by the mix, and repeat sales indexes (like Case-Shiller and the FHFA) are more accurate measures of house prices, the median price index might provide earlier hints on the direction of prices.

This graph - as of the NAR release in October 2020 (a year ago) - shows median prices started to take off, even though the most recent Case-Shiller report only showed a very modest pickup in prices.

The second graph - as of the NAR release yesterday - shows that Case-Shiller followed the median prices up, and that median prices are now falling.

Note: the NAR YoY change in September 2021 was revised down, so there was a slight uptick in October prices YoY.

Note: the NAR YoY change in September 2021 was revised down, so there was a slight uptick in October prices YoY.Monday, November 22, 2021

"Mortgage Rates Under Pressure After Powell Nomination and Bond Auctions"

by Calculated Risk on 11/22/2021 06:23:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Under Pressure After Powell Nomination and Bond Auctions

Mortgage rates began the new week on a bad note with the average lender full erasing the improvement seen on Friday. This leaves many lenders at their highest levels since April, but in those cases, it should be noted that today's rates are extremely close to those seen in late October. In other words, we're essentially back in line with the highest levels in more than 7 months. [30 year fixed 3.24%]

emphasis added

November 22nd COVID-19: New Cases and Hospitalizations Increasing

by Calculated Risk on 11/22/2021 03:05:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 59.2% | 58.8% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 196.4 | 195.3 | ≥2321 | |

| New Cases per Day3🚩 | 91,021 | 81,495 | ≤5,0002 | |

| Hospitalized3🚩 | 40,755 | 40,485 | ≤3,0002 | |

| Deaths per Day3 | 985 | 1,042 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 19 states have between 50% and 59.9% fully vaccinated: Wisconsin at 59.3%, Nebraska, Iowa, Utah, Michigan, Texas, Kansas, Arizona, Nevada, South Dakota, North Carolina, Alaska, Ohio, Kentucky, Montana, Oklahoma, South Carolina, Missouri and Indiana at 50.5%.

Next up (total population, fully vaccinated according to CDC) are Georgia at 49.3%, Tennessee at 49.2%, Arkansas at 49.0%, Louisiana at 48.6% and North Dakota at 48.4%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

More Analysis on Existing Home Sales

by Calculated Risk on 11/22/2021 10:35:00 AM

Today, in the Real Estate Newsletter: Existing-Home Sales Increased to 6.34 million in October

Excerpt:

Sales in October (6.34 million SAAR) were up 0.8% from last month, and were 5.8% below the October 2020 sales rate.You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Some of the increase in sales since the beginning of the pandemic was probably related to record low mortgage rates, strong second home buying, a strong stock market and favorable demographics.

Also, the delay in the 2020 buying season pushed the seasonally adjusted number to very high levels over the winter. This means there are going to be some difficult year-over-year (YoY) comparisons in the last quarter of 2021.

This graph shows existing home sales by month for 2020 and 2021.

This was the third month this year with sales down year-over-year. This should continue through the rest of the year, since sales averaged 6.7million SAAR over the last three months of 2020.

NAR: Existing-Home Sales Increased to 6.34 million in October

by Calculated Risk on 11/22/2021 10:11:00 AM

From the NAR: Existing-Home Sales Inch Up 0.8% in October

Existing-home sales increased in October, marking two straight months of growth, according to the National Association of Realtors®. Two of the four major U.S. regions saw month-over-month sales climb, one region reported a drop and the fourth area held steady in October. On a year-over-year basis, each region witnessed sales decrease.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 0.8% from September to a seasonally adjusted annual rate of 6.34 million in October. Sales fell 5.8% from a year ago (6.73 million in October 2020).

...

Total housing inventory at the end of October amounted to 1.25 million units, down 0.8% from September and down 12.0% from one year ago (1.42 million). Unsold inventory sits at a 2.4-month supply at the current sales pace, equal to September's supply, and down from 2.5 months in October 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October (6.34 million SAAR) were up 0.8% from last month, and were 5.8% below the October 2020 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.25 million in October from 1.26 million in September.

According to the NAR, inventory decreased to 1.25 million in October from 1.26 million in September.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 12.0% year-over-year in October compared to October 2020.

Inventory was down 12.0% year-over-year in October compared to October 2020. Months of supply was unchanged at 2.4 months in October from 2.4 months in September.

This was above the consensus forecast. I'll have more later.

Housing Inventory Nov 22nd Update: Inventory Down 2.3% Week-over-week

by Calculated Risk on 11/22/2021 09:46:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 11/22/2021 08:35:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of November 20th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 14.3% from the same day in 2019 (85.7% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through November 20, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - and appears to be declining slightly again. The 7-day average for the US is down 5% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $89 million last week, down about 66% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through November 13th. The occupancy rate was down 4.0% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of November 12th, gasoline supplied was up slightly compared to the same week in 2019.

There was the ninth week, out of the last 20, that gasoline supplied was up slightly compared to the same week in 2019 - so consumption is running close to 2019 levels now.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through November 20th

This data is through November 20th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 112% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, November 19th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".