by Calculated Risk on 10/27/2021 07:00:00 AM

Wednesday, October 27, 2021

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 22, 2021.

... The Refinance Index decreased 2 percent from the previous week and was 26 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 9 percent lower than the same week one year ago.

““Mortgage rates increased again last week, as the 30-year fixed rate reached 3.30 percent and the 15- year fixed rate rose to 2.59 percent – the highest for both in eight months. The increase in rates triggered the fifth straight decrease in refinance activity to the slowest weekly pace since January 2020. Higher rates continue to reduce borrowers’ incentive to refinance,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications picked up slightly, and the average loan size rose to its highest level in three weeks, as growth in the higher price segments continues to dominate purchase activity. Both new and existing-home sales last month were at their strongest sales pace since early 2021, but first-time home buyers are accounting for a declining share of activity. Home prices are still growing at a rapid clip, even if monthly growth rates are showing signs of moderation, and this is constraining sales in many markets, and particularly for first-timers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.30 percent from 3.23 percent, with points decreasing to 0.34 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With relatively low rates, the index remains somewhat elevated - but the recent bump in rates has slowed activity to the lowest level since January 2020.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 9% year-over-year unadjusted.

According to the MBA, purchase activity is down 9% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity was strong in the second half of 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, October 26, 2021

Zillow Case-Shiller House Price Forecast: September Price Growth Will Remain Strong

by Calculated Risk on 10/26/2021 07:33:00 PM

The Case-Shiller house price indexes for August were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow Research: August 2021 Case-Shiller Results & Forecast: Beginning to Ease Off the Gas

House price growth through August sustained July’s unprecedented velocity, but autumn’s reports indicate that the market is easing off the gas pedal.

...

Compared to August, homes took a little bit longer to sell in September and the for-sale inventory inched higher. In other words, though extraordinary market conditions pushed house prices skyward between the Spring of 2020 and the Summer of 2021, the latest signs indicate that the market is relenting. And while house price appreciation will remain elevated for the next several months, further acceleration is unlikely.

Monthly growth in September as reported by Case-Shiller is expected to accelerate from August in both the 10- and 20-city indices, and slow in the national index. Annual growth in September is expected to accelerate in the 20-city and national index, and slow in the 10-city index. S&P Dow Jones Indices is expected to release data for the September S&P CoreLogic Case-Shiller Indices on Tuesday, November 30.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 20.2% in September, up from 19.8% in August.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 20.2% in September, up from 19.8% in August.

Case-Shiller National Index up Record 19.8% Year-over-year in August; The Deceleration is coming

by Calculated Risk on 10/26/2021 04:13:00 PM

Today, in the Newsletter: Case-Shiller National Index up Record 19.8% Year-over-year in August; The Deceleration is coming

Excerpt (there is much more):

Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in Case-Shiller was at 1.43%; still historically high, but lower than the previous five months. House prices started increasing sharply in the Case-Shiller index in August 2020, so the last 13 months have all been historically very strong, but the peak MoM growth is behind us.

October 26th COVID-19: 30 Days till Thanksgiving; Need to Get Daily Cases Down Before Holidays

by Calculated Risk on 10/26/2021 04:06:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 57.4% | 57.0% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 190.7 | 189.3 | ≥2321 | |

| New Cases per Day3 | 65,953 | 78,197 | ≤5,0002 | |

| Hospitalized3 | 46,777 | 52,815 | ≤3,0002 | |

| Deaths per Day3 | 1,159 | 1,242 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 20 states have between 50% and 59.9% fully vaccinated: Delaware at 59.6%, Minnesota, Hawaii, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina, Ohio and Montana at 50.0%.

Next up (total population, fully vaccinated according to CDC) are Oklahoma at 49.7%, Indiana at 49.6%, South Carolina at 49.6%, Missouri at 49.5%, Arkansas at 47.7%, and Georgia at 47.6%.

Click on graph for larger image.

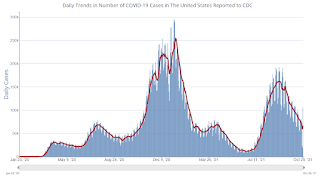

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

New Home Sales: Record 106 thousand homes have not been started

by Calculated Risk on 10/26/2021 12:06:00 PM

Today, in the Newsletter: New Home Sales: Record 106 thousand homes have not been started

Excerpt (there is much more):

The inventory of completed homes for sale was at 36 thousand in September, just above the record low of 33 thousand in March, April, May and July 2021. That is about 0.5 months of completed supply (just above the record low).

The inventory of new homes under construction is at 3.6 months - slightly above the normal level.

However, a record 106 thousand homes have not been started - about 1.6 months of supply - almost double the normal level. emphasis added

New Home Sales Increase to 800,000 Annual Rate in September

by Calculated Risk on 10/26/2021 10:09:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 800 thousand.

The previous three months were revised down significantly.

Sales of new single‐family houses in September 2021 were at a seasonally adjusted annual rate of 800,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 14.0 percent above the revised August rate of 702,000, but is 17.6 percent below the September 2020 estimate of 971,000

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are now declining year-over-year since sales soared following the first few months of the pandemic.

The second graph shows New Home Months of Supply.

The months of supply decreased in September to 5.7 months from 6.5 months in August.

The months of supply decreased in September to 5.7 months from 6.5 months in August. The all time record high was 12.1 months of supply in January 2009. The all time record low was 3.5 months, most recently in October 2020.

This is in the normal range (about 4 to 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of September was 379,000. This represents a supply of 5.7 months at the current sales rate"

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In September 2021 (red column), 65 thousand new homes were sold (NSA). Last year, 77 thousand homes were sold in September.

The all time high for September was 99 thousand in 2005, and the all time low for September was 24 thousand in 2011.

This was above expectations of 760 thousand SAAR, however sales in the three previous months were revised down significantly. I'll have more later today.

Case-Shiller: National House Price Index increased 19.8% year-over-year in August

by Calculated Risk on 10/26/2021 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3 month average of June, July and August prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: Annual Home Price Gains Remained High in August According To S&P Corelogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 19.8% annual gain in August, remaining the same as the previous month. The 10- City Composite annual increase came in at 18.6%, down from 19.2% in the previous month. The 20- City Composite posted a 19.7% year-over-year gain, down from 20.0% in the previous month.

Phoenix, San Diego, and Tampa reported the highest year-over-year gains among the 20 cities in August. Phoenix led the way with a 33.3% year-over-year price increase, followed by San Diego with a 26.2% increase and Tampa with a 25.9% increase. Eight of the 20 cities reported higher price increases in the year ending August 2021 versus the year ending July 2021.

...

Before seasonal adjustment, the U.S. National Index posted a 1.2% month-over-month increase in August, while the 10-City and 20-City Composites both posted increases of 0.8% and 0.9%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.4%, and the 10-City and 20-City Composites both posted increases of 0.9% and 1.2%, respectively. In August, all 20 cities reported increases before and after seasonal adjustments.

“The U.S. housing market showed continuing strength in August 2021,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI. Every one of our city and composite indices stands at its all-time high, and year-over-year price growth continues to be very strong, although moderating somewhat from last month’s levels.

“In August 2021, the National Composite Index rose 19.84% from year-ago levels, marginally ahead of July’s 19.75% increase. This slowing acceleration was also evident in our 10- and 20-City Composites, which rose 18.6% and 19.7% respectively, modestly less than their rates of gain in July. Price gains were once again broadly distributed, as all 20 cities rose, although in most cases at a slower rate than had been the case a month ago.

“We have previously suggested that the strength in the U.S. housing market is being driven in part by a reaction to the COVID pandemic, as potential buyers move from urban apartments to suburban homes. More data will be required to understand whether this demand surge represents an acceleration of purchases that would have occurred anyway over the next several years, or reflects a secular change in locational preferences. August’s data are consistent with either explanation. August data also suggest that the growth in housing prices, while still very strong, may be beginning to decelerate.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.9% in August (SA).

The Composite 20 index is up 1.2% (SA) in August.

The National index is 45% above the bubble peak (SA), and up 1.4% (SA) in August. The National index is up 96% from the post-bubble low set in February 2012 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 18.6% compared to July 2020. The Composite 20 SA is up 19.7% year-over-year.

The National index SA is up 19.8% year-over-year.

Price increases were slightly below expectations. I'll have more later.

Monday, October 25, 2021

Tuesday: Case-Shiller House Prices, New Home Sales

by Calculated Risk on 10/25/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Improve Modestly From Long-Term Highs

Mortgage rates began the day right in line with Friday afternoon's latest levels. Lenders likely would have been able to offer lower rates if the bond market hadn't begun the day at weaker levels (bond market weakness = higher rates, all other things being equal). As the day progressed, bonds improved enough for most lenders to make positive adjustments. The so-called mid-day reprices left the average lender in just slightly better shape on the day. [30 year fixed 3.27%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 20.1% year-over-year.

• Also at 9:00 AM, FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for September from the Census Bureau. The consensus is for 760 thousand SAAR, up from 740 thousand in August.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for October.

October Vehicle Sales Forecast: "First Month-to-Month Improvement Since April"

by Calculated Risk on 10/25/2021 06:34:00 PM

From WardsAuto: October U.S. Light-Vehicle Sales Forecast to Show First Month-to-Month Improvement Since April (pay content)

Low inventories and supply issues continue to impacting vehicle sales.

This graph shows actual sales from the BEA (Blue), and Wards forecast for October (Red).

The Wards forecast of 12.6 million SAAR, would be up about 3.5% from last month, and down 23% from a year ago (sales were solid in October 2020, as sales recovered from the depths of the pandemic).

Freddie Mac: Mortgage Serious Delinquency Rate decreased in September

by Calculated Risk on 10/25/2021 05:30:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in September was 1.46%, down from 1.62% in August. Freddie's rate is down year-over-year from 3.04% in September 2020.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble, and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Also - for multifamily - delinquencies were at 0.12%, unchanged from 0.12% in August, and down from the peak of 0.20% in April 2021.