by Calculated Risk on 7/28/2021 02:05:00 PM

Wednesday, July 28, 2021

FOMC Statement: No Policy Change; Economy has "made progress"

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have shown improvement but have not fully recovered. Inflation has risen, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. Last December, the Committee indicated that it would continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward its maximum employment and price stability goals. Since then, the economy has made progress toward these goals, and the Committee will continue to assess progress in coming meetings. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

emphasis added

Zillow Case-Shiller House Price Forecast: "Expected to decelerate", 16.2% YoY in June

by Calculated Risk on 7/28/2021 01:02:00 PM

The Case-Shiller house price indexes for May were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: May 2021 Case-Shiller Results & Forecast: Growth Continues Climb

The forces that have propelled home price growth to new highs over the past year remain in place and are offering little evidence of abating.

...

The housing market’s historically tight inventory conditions finally started to ease in May, but that did little to immediately tame the record-strong home price appreciation that the market has experienced in recent months. The number available homes across the nation finally ticked up this spring, albeit from a historically low reference point, after spending most of the last year in a steady decline. Still, price pressures remain very firm and appear ready to stay that way in the months to come. Indeed, sharply-rising prices do appear to have priced out some home shoppers, particularly those looking to enter the market for the first time, and causing fatigue among would-be buyers. But overall demand for homes remains very firm, as bidding wars persist and the still-relatively few homes available for sales continue to fly off the shelves at a historically fast pace. Increased inventory levels should eventually help tame the record-high pace of price appreciation, but it’s going to take a while.

Monthly and annual growth in June as reported by Case-Shiller is expected to decelerate from May and April 2020 in all three main indices. S&P Dow Jones Indices is expected to release data for the June S&P CoreLogic Case-Shiller Indices on Tuesday, August 24.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 16.2% in June, from 16.6% in May.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 16.2% in June, from 16.6% in May. The Zillow forecast is for the 20-City index to be up 16.5% YoY in June from 17.0% in May, and for the 10-City index to be up 16.1% YoY compared to 16.4% YoY in May.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 7/28/2021 10:23:00 AM

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now closer to normal (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Jed Kolko's article from 2014 (currently Chief Economist at Indeed) "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through May 2021). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings declined following the bubble, however the recent price surge changed the month-over-month pattern.

The swings in the seasonal factors have decreased, and the seasonal factors has been moving back towards more normal levels.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 7/28/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 23, 2021.

... The Refinance Index increased 9 percent from the previous week and was 10 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 18 percent lower than the same week one year ago.

“The 10-year Treasury yield fell last week, as investors grew concerned about increasing COVID-19 case counts and the downside risks to the current economic recovery. Refinance applications jumped, as the 30-year fixed mortgage rate declined to its lowest level since February 2021, and the 15-year rate fell to another record low dating back to 1990,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Refinances for conventional loans increased over 11%. With over 95% of refinance applications for fixed rate mortgages, borrowers are looking to secure a lower rate for the life of their loan.”

Added Kan, “The purchase index decreased for the second week in a row to its lowest level since May 2020, and has now declined on an annual basis for the past three months. Potential buyers continue to be put off by extremely high home prices and increased competition. The FHFA reported yesterday that May home prices were 18% higher than a year ago, continuing a seven-month trend of unprecedented home-price growth.”

...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $548,250) decreased to 3.11 percent from 3.13 percent, with points decreasing to 0.27 from 0.32 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated, and increased this week as rates declined.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 18% year-over-year unadjusted.

According to the MBA, purchase activity is down 18% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, July 27, 2021

Wednesday: FOMC Announcement

by Calculated Risk on 7/27/2021 09:00:00 PM

On the FOMC meeting: FOMC Preview: Probably Too Soon for Hints on Tapering

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, FOMC Meeting Announcement. No change to policy is expected at this meeting.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

July 27th COVID-19, New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 7/27/2021 03:48:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 342,607,540, as of a week ago 338,491,374. Average doses last week: 0.59 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 69.1% | 69.0% | 68.3% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 163.3 | 163.2 | 161.6 | ≥1601 |

| New Cases per Day3🚩 | 56,816 | 53,865 | 36,105 | ≤5,0002 |

| Hospitalized3🚩 | 27,802 | 26,379 | 19,417 | ≤3,0002 |

| Deaths per Day3🚩 | 281 | 267 | 215 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 67.8%, Utah at 67.3%, Wisconsin at 66.9%, South Dakota at 65.9%, Kansas at 65.7%, Iowa at 65.3%, Nevada at 64.9% and Arizona at 64.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

House Prices and Inventory

by Calculated Risk on 7/27/2021 02:18:00 PM

Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Click on graph for larger image.

Click on graph for larger image.This graph below shows existing home months-of-supply (inverted, from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through May 2021).

In the June existing home sales report released last week, the NAR reported months-of-supply increased to 2.6 month in June. There is a seasonal pattern to inventory, but this is still very low - and prices are increasing sharply.

Real House Prices and Price-to-Rent Ratio in April

by Calculated Risk on 7/27/2021 12:05:00 PM

Here is the post earlier on Case-Shiller: Case-Shiller: National House Price Index increased 16.6% year-over-year in May

It has been over fifteen years since the bubble peak. In the Case-Shiller release today, the seasonally adjusted National Index (SA), was reported as being 38% above the previous bubble peak. However, in real terms, the National index (SA) is about 6% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 2% below the bubble peak.

The year-over-year growth in prices increased to 16.6% nationally.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be over $303,000 today adjusted for inflation (51.5%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is 6% above the bubble peak, and the Composite 20 index is back to late-2005.

In real terms, house prices are close to previous peak levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio had been moving more sideways, but picked up significantly recently.

On a price-to-rent basis, the Case-Shiller National index is back to June 2005 levels, and the Composite 20 index is back to November 2004 levels.

In real terms, prices are close to 2005 peak levels, and the price-to-rent ratio is back to late 2004, early 2005.

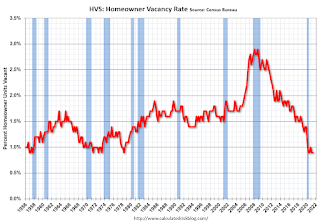

HVS: Q2 2021 Homeownership and Vacancy Rates

by Calculated Risk on 7/27/2021 10:48:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q2 2021.

It is likely the results of this survey were significantly distorted by the pandemic.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

"National vacancy rates in the second quarter 2021 were 6.2 percent for rental housing and 0.9 percent for homeowner housing. The rental vacancy rate was 0.5 percentage points higher than the rate in the second quarter 2020 (5.7 percent) and 0.6 percentage points lower than the rate in the first quarter 2021 (6.8 percent). The homeowner vacancy rate of 0.9 percent was virtually the same as the rate in the second quarter 2020 (0.9 percent) and virtually the same as the rate in the first quarter 2021 (0.9 percent).

The homeownership rate of 65.4 percent was 2.5 percentage points lower than the rate in the second quarter 2020 (67.9 percent) and not statistically different from the rate in the first quarter 2021 (65.6 percent)."

Click on graph for larger image.

Click on graph for larger image.The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The Census Bureau will released data for 2020 soon.

The results starting in Q2 2020 were distorted by the pandemic.

The HVS homeowner vacancy was unchanged at 0.9% in Q2.

The HVS homeowner vacancy was unchanged at 0.9% in Q2. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

Case-Shiller: National House Price Index increased 16.6% year-over-year in May

by Calculated Risk on 7/27/2021 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Reports Record High Annual Home Price Gain Of 16.6% In May

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 16.6% annual gain in May, up from 14.8% in the previous month. The 10-City Composite annual increase came in at 16.4%, up from 14.5% in the previous month. The 20-City Composite posted a 17.0% year-over-year gain, up from 15.0% in the previous month.

Phoenix, San Diego, and Seattle reported the highest year-over-year gains among the 20 cities in May. Phoenix led the way with a 25.9% year-over-year price increase, followed by San Diego with a 24.7% increase and Seattle with a 23.4% increase. All 20 cities reported higher price increases in the year ending May 2021 versus the year ending April 2021.

...

Before seasonal adjustment, the U.S. National Index posted a 2.1% month-over-month increase in May, while the 10-City and 20-City Composites both posted increases of 1.9% and 2.1%, respectively

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.7%, and the 10-City and 20-City Composites both posted increases of 1.7% and 1.8%, respectively. In May, all 20 cities reported increases before and after seasonal adjustments.

“Housing price growth set a record for the second consecutive month in May 2021,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI. “The National Composite Index marked its twelfth consecutive month of accelerating prices with a 16.6% gain from year-ago levels, up from 14.8% in April. This acceleration is also reflected in the 10- and 20-City Composites (up 16.4% and 17.0%, respectively). The market’s strength continues to be broadly-based: all 20 cities rose, and all 20 gained more in the 12 months ended in May than they had gained in the 12 months ended in April. Prices in 18 of our 20 cities now stand at all-time highs, as do the National Composite and both the 10- and 20-City indices.

“A month ago, I described April’s performance as “truly extraordinary,” and this month I find myself running out of superlatives. The 16.6% gain is the highest reading in more than 30 years of S&P CoreLogic Case-Shiller data. As was the case last month, five cities – Charlotte, Cleveland, Dallas, Denver, and Seattle – joined the National Composite in recording their all-time highest 12-month gains. Price gains in all 20 cities were in the top quartile of historical performance; in 17 cities, price gains were in top decile.

“We have previously suggested that the strength in the U.S. housing market is being driven in part by reaction to the COVID pandemic, as potential buyers move from urban apartments to suburban homes. May’s data continue to be consistent with this hypothesis. This demand surge may simply represent an acceleration of purchases that would have occurred anyway over the next several years. Alternatively, there may have been a secular change in locational preferences, leading to a permanent shift in the demand curve for housing. More time and data will be required to analyze this question.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.7 in May (SA).

The Composite 20 index is up 1.8% (SA) in May.

The National index is 38% above the bubble peak (SA), and up 1.7% (SA) in May. The National index is up 86% from the post-bubble low set in February 2012 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 16.4% compared to May 2020. The Composite 20 SA is up 17.0% year-over-year.

The National index SA is up 164.6% year-over-year.

Price increases were slightly above expectations. I'll have more later.