by Calculated Risk on 6/16/2021 04:09:00 PM

Wednesday, June 16, 2021

Alabama Real Estate in May: Sales Up 28% YoY, Inventory Down 45% YoY

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year. Remember sales were weak in April and May 2020 due to the pandemic, so the YoY sales comparison is easy.

For the entire state of Alabama:

Closed sales in May 2021 were 6,936, up 27.6% from 5,434 in May 2020.

Active Listings in May 2021 were 9,363, down 45.1% from 17,042 in May 2020.

Months of Supply was 1.3 Months in May 2021, compared to 3.1 Months in May 2020.

Inventory in May was down 2.3% from last month.

June 16th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/16/2021 04:01:00 PM

From NBC: Virtually all hospitalized Covid patients have one thing in common: They're unvaccinated

From MarketWatch: CDC says Delta COVID variant is ‘of concern,’ as experts warn of higher risks of infection and serious illness

The good news is the vaccines are very effective against the Delta variant for the fully vaccinated. The bad news - for the unvaccinated - is that the Delta variant is much more contagious than the previous variants, and also appears to be more virulent. Since it takes 5 to 6 week to become fully vaccinated, the unvaccinated should get their first shot now!

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 312,915,170, as of yesterday 311,886,674. Daily: 1.03 million.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 64.7% | 64.6% | 63.9% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 146.5 | 145.8 | 141.0 | ≥1601 |

| New Cases per Day3 | 12,415 | 12,676 | 14,142 | ≤5,0002 |

| Hospitalized3 | 14,015 | 14,232 | 16,532 | ≤3,0002 |

| Deaths per Day3 | 285 | 288 | 380 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | ||||

KUDOS to the residents of the 14 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, New Jersey, Maine, Rhode Island, Pennsylvania, New Mexico, California, New Hampshire, Maryland, Washington, New York and D.C. are all over 70%.

Next up are Illinois at 69.7%, Virginia at 69.5%, Minnesota at 68.8%, Delaware at 68.4%, Colorado at 68.2%, Oregon at 68.2% and Wisconsin at 64.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

FOMC Projections and Press Conference

by Calculated Risk on 6/16/2021 02:12:00 PM

Statement here.

Fed Chair Powell press conference video here starting at 2:30 PM ET.

Here are the projections. In March, most participants expected rates to remain at the current level through 2023. Now, most participants expect around two rates hikes in 2023.

Note that real GDP increased 6.4% annualized in Q1. And forecasts are for GDP to increase close to 10% in Q2 and Q3.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| June 2021 | 6.8 to 7.3 | 2.8 to 3.8 | 2.0 to 2.5 | |

| Mar 2021 | 5.8 to 6.6 | 3.0 to 3.8 | 2.0 to 2.5 | |

The unemployment rate was at 5.8% in May.

The unemployment rate was revised up slightly for 2021.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| June 2021 | 4.4 to 4.8 | 3.5 to 4.0 | 3.2 to 3.8 | |

| Mar 2021 | 4.2 to 4.7 | 3.6 to 4.0 | 3.2 to 3.8 | |

As of April 2021, PCE inflation was up 3.6% from April 2020. There was some base effect (since PCE inflation declined last year in the early months of the pandemic), but there was a clear pickup in inflation.

The projections for inflation were revised up and the FOMC sees inflation solidly above target in 2021.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| June 2021 | 3.1 to 3.5 | 1.9 to 2.3 | 2.0 to 2.2 | |

| Mar 2021 | 2.2 to 2.4 | 1.8 to 2.1 | 2.0 to 2.2 | |

PCE core inflation was up 3.1% in April year-over-year.

Projections for core inflation were revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| June 2021 | 2.9 to 3.1 | 1.9 to 2.3 | 2.0 to 2.2 | |

| Mar 2021 | 2.0 to 2.3 | 1.9 to 2.1 | 2.0 to 2.2 | |

FOMC Statement: No Policy Change

by Calculated Risk on 6/16/2021 02:03:00 PM

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

Progress on vaccinations has reduced the spread of COVID-19 in the United States. Amid this progress and strong policy support, indicators of economic activity and employment have strengthened. The sectors most adversely affected by the pandemic remain weak but have shown improvement. Inflation has risen, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee's maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

emphasis added

California May Housing: Sales up 87% YoY, "Signs of cooling"

by Calculated Risk on 6/16/2021 12:24:00 PM

Note: Remember sales were weak in April and May 2020 due to the pandemic, so the YoY comparison is easy.

The CAR reported: California home sales ease in May as statewide median price inches up to set another record, C.A.R. reports

After months of breakneck market competition, California home sales moderated in May as buyer fatigue set in, while the median home price set another record high, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Note that inventory was up 6.6% from April to May.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 445,660 in May, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2021 if sales maintained the May pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

May home sales dipped 2.7 percent on a monthly basis from 458,170 in April and up 86.7 percent from a year ago, when 238,740 homes were sold on an annualized basis. The sharp yearly sales jump was expected as the housing market was hit hard by the pandemic shutdown last year, when home sales dropped to the lowest level since the Great Recession.

“The overheated housing market is showing signs of a much-needed cooling and could be a sign of waning buyer interest as the torrid pace of home price increases and buyer fatigue adversely affected demand,” said C.A.R. President Dave Walsh. “We’re seeing many would-be buyers taking a break and hoping to see more listings as the economy reopens and prospective sellers list their homes for sale.”

...

The Unsold Inventory Index (UII) improved slightly from 1.6 months in April to 1.8 months in May but remained sharply below last year’s level. The month-over-month rise in inventory is partly due a slight increase in housing supply, but a slowdown in housing demand in May also contributed to a bump in the index. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

Active listings reached the highest level in six months after a 6.6 percent monthly increase in May and continued to inch up, following the seasonal pattern. Housing supply typically climbs during this time of the year and usually remains on an upward trend until late July/early August. The pace of growth on a month-to-month basis is on par with the average growth rate of 6.7 percent from April to May recorded between 2015 to 2019.

emphasis added

Comments on May Housing Starts

by Calculated Risk on 6/16/2021 10:22:00 AM

Earlier: Housing Starts increased to 1.572 Million Annual Rate in May

The housing starts report showed total starts were up 3.6% in May compared to the previous month, and total starts were up 50.3% year-over-year compared to May 2020.

The first graph shows the month to month comparison for total starts between 2020 (blue) and 2021 (red).

Click on graph for larger image.

Click on graph for larger image.Starts were up 50.3% in May compared to May 2020. The year-over-year comparison will be easy again in June, but will be more difficult starting in July.

2020 was off to a strong start before the pandemic, and with low interest rates, and little competing existing home inventory, starts finished 2020 strong.

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- then starts picked up a little again late last year, but have fallen off with the pandemic.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Single family starts are getting back to more normal levels, but I still expect some further increases in single family starts and completions on a rolling 12 month basis - especially given the low level of existing home inventory.

Housing Starts increased to 1.572 Million Annual Rate in May

by Calculated Risk on 6/16/2021 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in May were at a seasonally adjusted annual rate of 1,572,000. This is 3.6 percent above the revised April estimate of 1,517,000 and is 50.3 percent above the May 2020 rate of 1,046,000. Single‐family housing starts in May were at a rate of 1,098,000; this is 4.2 percent above the revised April figure of 1,054,000. The May rate for units in buildings with five units or more was 465,000.

Building Permits:

Privately‐owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,681,000. This is 3.0 percent below the revised April rate of 1,733,000, but is 34.9 percent above the May 2020 rate of 1,246,000. Single‐family authorizations in May were at a rate of 1,130,000; this is 1.6 percent below the revised April figure of 1,148,000. Authorizations of units in buildings with five units or more were at a rate of 494,000 in May.

emphasis added

Click on graph for larger image.

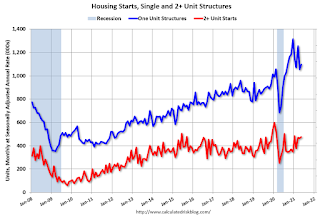

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased slightly in May compared to April. Multi-family starts were up 50% year-over-year in May.

Single-family starts (blue) increased in May, and were up 51% year-over-year (starts slumped at the beginning of the pandemic).

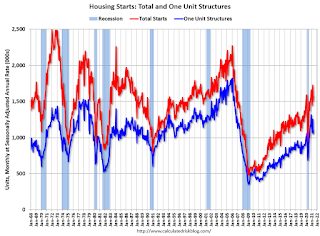

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in May were below expectations, and starts in March and April were revised down.

I'll have more later …

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 6/16/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 11, 2021. The previous week’s results included an adjustment for the Memorial Day holiday.

... The Refinance Index increased 6 percent from the previous week and was 22 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 17 percent lower than the same week one year ago.

“Mortgage applications bounced back after three weeks of declines, increasing over 4 percent last week. Both purchase and refinance applications were up, including a 5.5 percent gain in refinances. The jump in refinances was the result of the 30-year fixed rate falling for the third straight week to 3.11 percent – the lowest since early May. U.S. Treasury yields have slid because of the uncertainty in the financial markets regarding inflation and how the Federal Reserve may act over the next few months,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase activity also rebounded, even as supply constraints continue to slow the housing market. An almost 5 percent increase in government purchase applications drove most of last week’s gain while also tempering the recent growth in loan sizes. Purchase applications were still down 17 percent from a year ago, which was when the mortgage market started seeing large post-shutdown increases in activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 3.11 percent from 3.15 percent, with points increasing to 0.36 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated, and picked up this week as rates declined.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 17% year-over-year unadjusted.

According to the MBA, purchase activity is down 17% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now more difficult since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, June 15, 2021

Wednesday: Housing Starts, FOMC Statement

by Calculated Risk on 6/15/2021 08:48:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for May. The consensus is for 1.630 million SAAR, up from 1.569 million SAAR in April.

• At 2:00 PM, FOMC Meeting Announcement. No change to policy is expected at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

Second Home Market: South Lake Tahoe in May

by Calculated Risk on 6/15/2021 03:59:00 PM

Three months ago, from Jann Swanson at MortgageNewsDaily: Fannie Warns Lenders on Investment Properties and 2nd Homes. This action will result in higher interest rates on 2nd home and investment property mortgages.

I'm looking at data for some second home markets - and will track those markets to see if there is an impact from the lending changes.

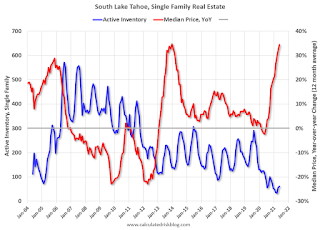

This graph is for South Lake Tahoe since 2004 through May 2021, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12 month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Note that inventory was high while prices were declining - and significantly lower inventory in 2012 suggested the bust was over. (Tracking inventory helped me call the bottom for housing way back in February 2012, see:The Housing Bottom is Here)

Currently inventory is just above the record low set two months ago, and prices are up sharply YoY. This will be interesting to watch.