by Calculated Risk on 6/09/2021 05:07:00 PM

Wednesday, June 09, 2021

June 9th COVID-19 New Cases, Vaccinations, Hospitalizations

Congratulations to the residents of Massachusetts on joining the 80% club! Well done. Go for 90%!!!

According to the CDC, on Vaccinations.

Total doses administered: 304,753,476, as of yesterday 303,923,667. Daily: 0.83 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 63.9% | 63.8% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 141.0 | 140.4 | ≥1601 |

| New Cases per Day3 | 14,142 | 13,483 | ≤5,0002 |

| Hospitalized3 | 16,532 | 16,835 | ≤3,0002 |

| Deaths per Day3 | 360 | 370 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the 13 states that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, Maine, New Jersey, Rhode Island, Pennsylvania, New Mexico, New Hampshire, California, Maryland, and Washington are all over 70%.

Next up are D.C. at 69.3%, New York at 69.2%, Illinois at 68.7%, Virginia at 68.4%, Minnesota at 68.3%, Delaware at 67.6%, Colorado at 67.3% and Oregon at 67.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Houston Real Estate in May: Sales Up 56% YoY, Inventory Down 41% YoY

by Calculated Risk on 6/09/2021 01:35:00 PM

I'm tracking sales for many local markets. Note that sales slumped at the beginning of the pandemic, so the year-over-year increase in sales is crazy.

From the HAR: Houston Housing Blazes Its Way Through Uncharted Territory in May

Houston area home sales set new records in May as consumers took advantage of historically low interest rates in snapping up an ever-dwindling supply of properties for sale. What resulted was a nearly 50 percent jump in sales volume compared to the same month last year, when real estate was still in the process of recovering from coronavirus-related lockdown orders. Limited supply, strong buyer demand and increased construction costs all contributed to record high home prices.Single family inventory declined 40.6% year-over-year from 38,048 in May 2020 to 22,607 in May 2021. This is just 1.4 months of supply.

According to the latest Houston Association of Realtors (HAR) Market Update, single-family homes sales surged 48.2 percent compared to last May, with 9,702 units sold versus 6,546 a year earlier. That marks the greatest one-month year-over-year sales volume increase of all time and is the market’s twelfth consecutive positive month of sales. On a year-to-date basis, home sales are leading 2020’s record pace by 29.5 percent.

Homes priced from $750,000 and above led the way in May sales volume, shattering all previous measurements with a whopping 291.0 percent year-over-year increase. That was followed by the $500,000 to $750,000 segment, which rocketed 166.0 percent. This unprecedented surge in high-dollar homebuying is responsible for pushing pricing to record-setting levels. The single-family home average price rose 29.7 percent to $387,105 and the median price increased 21.7 percent to $304,000.

Sales of all property types totaled 12,100 – the second highest volume of all time. That is up 55.5 percent from May 2020. Total dollar volume for the month soared 100.5 percent to $4.4 billion.

“We are witnessing the most energized Houston real estate market in history,” said HAR Chairman Richard Miranda with Keller Williams Platinum. “Sellers maintain the upper hand, and buyers are not just meeting their demands. They are exceeding them, as we hear endless accounts of offers coming in that are thousands of dollars above list price. It’s difficult to predict how and when this incredible housing run will end.”

emphasis added

Note that inventory was down slightly in May compared to the previous month (April 2021) - and has essentially been flat for the last three months.

Housing and Demographics: The Next Big Shift

by Calculated Risk on 6/09/2021 10:35:00 AM

NOTE: This graph uses the Vintage 2019 estimates. There are questions about these estimates, and we will have much better data when the 2020 Decennial Census data is released.

Click on graph for larger image.

Click on graph for larger image.This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group last decade (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group peaked in 2018 / 2019 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak around 2023.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase further over this decade.

The current demographics are now very favorable for home buying - and will remain positive for most of the decade.

The next big housing shift will be when the Baby Boom generation starts to downsize and move to retirement communities. No cohort is monolithic - some people will age-in-place until they pass away, others will move in with family (or family will move in with their parents), and some will move to retirement communities.

There is no magic age that people reach and start to transition, but looking at prior generations, it seems to start when people are around 80 years old.

This graph shows the longer term trend for two key age groups: 60 to 79, and 80+.

This graph shows the longer term trend for two key age groups: 60 to 79, and 80+.This graph is from 2010 to 2060 (all data from BLS: current to 2060 is projected).

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 6/09/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 4, 2021. This week’s results include an adjustment for the Memorial Day holiday.

... The Refinance Index decreased 5 percent from the previous week and was 27 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 0.3 percent from one week earlier. The unadjusted Purchase Index decreased 11 percent compared with the previous week and was 24 percent lower than the same week one year ago.

“Most of the decline in mortgage rates came late last week, with the 30-year fixed-rate mortgage declining to 3.15 percent. This likely impacted refinance applications, which fell 5 percent for both conventional and government loans. With fewer homeowners able to take advantage of lower rates, the refinance share dipped to the lowest level since April,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications were up slightly last week, and the large annual decline was the result of Memorial Day 2021 being compared to a non-holiday week, as well as the big upswing in applications seen last May once pandemic-induced lockdowns started to lift.”

Added Kan, “The average loan size on a purchase application edged down to $407,000, below the record $418,000 set in February, but still far above 2020’s average of $353,900. Home-price growth continues to accelerate, driven by favorable demographics, the recovering job market and economy, and housing demand far outpacing supply.”

...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $548,250) decreased to 3.29 percent from 3.34 percent, with points decreasing to 0.32 from 0.38 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated, but this is the lowest level since February 2020 (pre-pandemic).

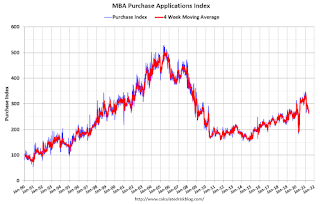

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 24% year-over-year unadjusted.

According to the MBA, purchase activity is down 24% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now more difficult since purchase activity picked up in late May 2020. This week, the unadjusted comparison is especially ugly (holiday week this year vs non-holiday week last year).

Note: Red is a four-week average (blue is weekly).

Tuesday, June 08, 2021

June 8th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/08/2021 06:13:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 303,923,667, as of yesterday 302,851,917. Daily: 1.07 million.

| COVID Metrics | |||

|---|---|---|---|

| Current | Yesterday | Goal | |

| Percent over 18, One Dose | 63.8% | 63.7% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 140.4 | 139.7 | ≥1601 |

| New Cases per Day3 | 13,391 | 13,472 | ≤5,0002 |

| Hospitalized3 | 16,835 | 16,585 | ≤3,0002 |

| Deaths per Day3 | 370 | 328 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | |||

KUDOS to the residents of the 13 states that have already achieved the 70% goal: Vermont and Hawaii are over 80%, plus Massachusetts, Connecticut, Maine, New Jersey, Rhode Island, Pennsylvania, New Mexico, New Hampshire, California, Maryland, and Washington are all over 70%.

Next up are D.C. at 69.2%, New York at 69.1%, Illinois at 68.6%, Virginia at 68.4%, Minnesota at 68.1%, Delaware at 67.6%, Colorado at 67.3% and Oregon at 67.1%.

North Texas Real Estate in May: Sales Up 30% YoY, Inventory Down 62% YoY

by Calculated Risk on 6/08/2021 01:30:00 PM

Note: Remember, sales were weak in April and May last year. I'm posting data for many local markets around the U.S. The story is the same everywhere ... inventory is very low.

From the NTREIS for North Texas (including Dallas/Ft. Worth):

Single Family Homes sold in May 2021 were 10,712, up 27.3% from 8,418 in May 2020.

Combined, sales were up 30.4% year-over-year.

Single Family Active Listings in May 2021 were 7,067, down 63.5% from 19,398 in May 2020.

Combined, active listings declined 62.4% year-over-year.

Although down sharply year-over-year, active inventory was up slightly compared to last month.

New Hampshire Real Estate in May: Sales Up 12% YoY, Inventory Down 55% YoY

by Calculated Risk on 6/08/2021 12:24:00 PM

Note: Remember sales were weak in April and May 2020 due to the pandemic. I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the New Hampshire Realtors for the entire state:

Inventory in May was up 5.8% from last month.

Las Vegas Real Estate in May: Sales up 98% YoY, Inventory down 66% YoY

by Calculated Risk on 6/08/2021 11:01:00 AM

Remember - sales slumped in April and May 2020, so the year-over-year sales comparisons are crazy.

The Las Vegas Realtors reported Southern Nevada home prices reach new heights while supply stays low; LVR housing statistics for May 2021

A report released Tuesday by Las Vegas REALTORS® (LVR) shows local home prices continuing to reach new heights while the local housing supply remains near historically low levels.1) Overall sales (single family and condos) were up 97.6% year-over-year from 2,075 in May 2020 to 4,100 in May 2021.

...

LVR reported a total of 4,100 existing local homes, condos and townhomes sold during May. Compared to the same time last year, May sales were up 87.3% for homes and up 144.9% for condos and townhomes. So far this year, local home sales are on pace to exceed last year’s total.

…

By the end of May, LVR reported 2,031 single-family homes listed for sale without any sort of offer. Although down 65.0% from the same time last year, Martinez noted the number of homes listed without offers actually increased for the third straight month. For condos and townhomes, the 529 properties listed without offers in May were slightly more than were listed during the previous month, though that inventory is still down 70.1% from the same time last year.

...

With eviction and foreclosure bans still in place, the number of so-called distressed sales remains near historically low levels. LVR reported that short sales and foreclosures combined accounted for just 0.7% of all existing local property sales in May. That compares to 1.5% of all sales one year ago, 2.0% of all sales two years ago, 2.6% three years ago and 6.8% four years ago. Martinez suggested that these percentages may rise slightly when government moratoriums are lifted.

emphasis added

2) Active inventory (single-family and condos) is down 66.2% from a year ago, from a total of 7,567 in May 2020 to 2,560 in May 2021. And months of inventory is extremely low.

3) Active inventory is up 9.1% from the previous month (April 2021).

BLS: Job Openings Increased to Record 9.3 Million in April

by Calculated Risk on 6/08/2021 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings reached a series high of 9.3 million on the last business day of April, the U.S. Bureau of Labor Statistics reported today. Hires were little changed at 6.1 million. Total separations increased to 5.8 million. Within separations, the quits rate reached a series high of 2.7 percent while the layoffs and discharges rate decreased to a series low of 1.0 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the most recent employment report was for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March and April 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in April to 9.286 million from 8.288 million in March. This is a new record high for this series.

The number of job openings (yellow) were up 100% year-over-year. This is a comparison to the worst of the pandemic.

Quits were up 88% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits"). This is a record high for Quits too.

Trade Deficit Decreased to $68.9 Billion in April

by Calculated Risk on 6/08/2021 08:42:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $68.9 billion in April, down $6.1 billion from $75.0 billion in March, revised.

April exports were $205.0 billion, $2.3 billion more than March exports. April imports were $273.9 billion, $3.8 billion less than March imports.

emphasis added

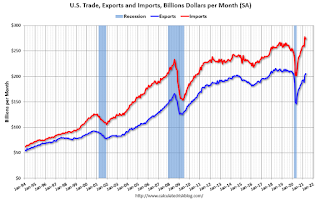

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in April.

Exports are up 36.6% compared to April 2020; imports are up 34.9% compared to April 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports much more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $25.8 billion in April, from $22.3 billion in April 2020.