by Calculated Risk on 1/26/2021 12:54:00 PM

Tuesday, January 26, 2021

January Vehicle Sales Forecast: "Steady in January"

From Wards: U.S. Sales to Remain Steady in January But Production Losses Will Hurt Inventory (pay content)

This graph shows actual sales from the BEA (Blue), and Wards forecast for January (Red).

Sales have bounced back from the April low, but will likely be down around 5% year-over-year in January.

The Wards forecast of 16.1 million SAAR, would be down about 1% from December.

Real House Prices and Price-to-Rent Ratio in November

by Calculated Risk on 1/26/2021 10:12:00 AM

Here is the post earlier on Case-Shiller: Case-Shiller: National House Price Index increased 9.5% year-over-year in November

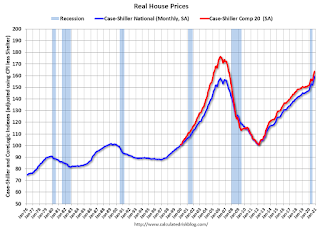

It has been over fourteen years since the bubble peak. In the Case-Shiller release today, the seasonally adjusted National Index (SA), was reported as being 26% above the previous bubble peak. However, in real terms, the National index (SA) is about 1% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 7% below the bubble peak.

The year-over-year growth in prices increased to 9.5% nationally.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $292,000 today adjusted for inflation (46%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

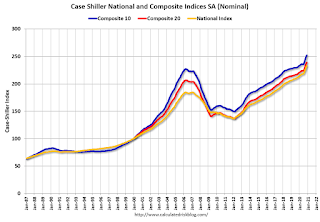

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to the bubble peak, and the Composite 20 index is back to early 2005.

In real terms, house prices are at 2005 levels.

Note that inflation was negative for a few months earlier this year, and that also boosted real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio had been moving mostly sideways, but picked up recently.

On a price-to-rent basis, the Case-Shiller National index is back to October 2004 levels, and the Composite 20 index is back to April 2004 levels.

In real terms, prices are back to 2005 levels, and the price-to-rent ratio is back to 2004.

Case-Shiller: National House Price Index increased 9.5% year-over-year in November

by Calculated Risk on 1/26/2021 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for November ("November" is a 3 month average of September, October and November prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P CoreLogic Case-Shiller Index Shows Annual Home Price Gains Climbed to 9.5% in November

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 9.5% annual gain in November, up from 8.4% in the previous month. The 10-City Composite annual increase came in at 8.8%, up from 7.6% in the previous month. The 20-City Composite posted a 9.1% year-over-year gain, up from 8.0% in the previous month.

Phoenix, Seattle and San Diego continued to report the highest year-over-year gains among the 19 cities (excluding Detroit) in November. Phoenix led the way with a 13.8% year-over-year price increase, followed by Seattle with a 12.7% increase and San Diego with a 12.3% increase. All 19 cities reported higher price increases in the year ending November 2020 versus the year ending October 2020.

...

The U.S. National Index posted a 1.1% month-over-month increase, while the 10-City and 20-City Composites both posted increases of 1.2% and 1.1% respectively, before seasonal adjustment in November. After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.4%, while the 10-City and 20-City Composites both posted increases of 1.4%. In November, all 19 cities (excluding Detroit) reported increases before and after seasonal adjustment.

“The trend of accelerating home prices that began in June 2020 has now reached its sixth month with November’s emphatic report,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “The National Composite Index gained 9.5% relative to its level a year ago, accelerating from October’s 8.4% increase. The 10- and 20-City Composites (up 8.8% and 9.1%, respectively) also rose more rapidly in November than they had done in October. The housing market’s strength was once again broadly-based: all 19 cities for which we have November data rose, and all 19 gained more in the 12 months ended in November than they had gained in the 12 months ended in October.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.4% in November (SA) from October.

The Composite 20 index is up 1.4% (SA) in November.

The National index is 26% above the bubble peak (SA), and up 1.4% (SA) in November. The National index is up 70% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 8.8% compared to November 2019. The Composite 20 SA is up 9.1% year-over-year.

The National index SA is up 9.5% year-over-year.

Note: According to the data, prices increased in 19 cities month-over-month seasonally adjusted.

Price increases were above expectations. I'll have more later.

NMHC: Rent Payment Tracker Shows Households Paying Rent Decreased 2.5% YoY

by Calculated Risk on 1/26/2021 08:00:00 AM

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 88.6 percent of apartment households made a full or partial rent payment by January 20 in its survey of 11.6 million units of professionally managed apartment units across the country.

This is a 2.5 percentage point, or 294,224 household decrease from the share who paid rent through January 20, 2020 and compares to 89.8 percent that had paid by December 20, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“While there is light at the end of the tunnel with the rollout of vaccines, the country and the multifamily industry continue to face steep challenges,” said Doug Bibby, NMHC President,. “The recently passed COVID relief package included $25 billion in desperately needed rental assistance as well as expanded unemployment insurance. Now, it is critical that those funds reach those in need as quickly and efficiently as possible.

“What's more, it is clear that is only a down payment on the financial support that will be necessary to make apartment residents and owners and operators whole - Moody's Analytics has estimated that back rent debt had reached $70 billion by the end of 2020 alone.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th (light color) and 20th (dark color) of the month.

This is mostly for large, professionally managed properties.

Monday, January 25, 2021

Tuesday: Case-Shiller House Prices

by Calculated Risk on 1/25/2021 09:16:00 PM

On Thursday, from 12:00 - 1:00 (PST), UCI Professor Chris Schwarz returns for the third year to the Irvine Chamber Business Outlook event.

Chris' presentations are great. This is free. Register here

Tuesday:

• At 9:00 AM ET, FHFA House Price Index for November. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM ET, S&P/Case-Shiller House Price Index for November. The consensus is for a 8.1% year-over-year increase in the Comp 20 index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for January.

• Also at 10:00 AM, State Employment and Unemployment (Monthly) for December 2020<

January 25 COVID-19 Test Results and Vaccinations

by Calculated Risk on 1/25/2021 07:29:00 PM

"Vaccinations in the U.S. began Dec. 14 with health-care workers, and so far 23.5 million shots have been given, according to a state-by-state tally by Bloomberg and data from the Centers for Disease Control and Prevention. In the last week, an average of 1.25 million doses per day were administered."Also check out the graphs at COVID-19 Vaccine Projections The site has several interactive graphs related to US COVID vaccinations including a breakdown of how many have had one shot, and how many have had both shots.

It is possible the 7-day average cases has peaked. Stay safe! I'm looking forward to not posting this data in a few months.

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,696,188 test results reported over the last 24 hours.

There were 133,067 positive tests.

Over 75,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.8% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.It is possible cases and hospitalizations have peaked, but are declining from a very high level.

MBA Survey: "Share of Mortgage Loans in Forbearance Increases Slightly to 5.38%"

by Calculated Risk on 1/25/2021 04:00:00 PM

Note: This is as of January 17th.

From the MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 5.38%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance increased slightly from 5.37% of servicers’ portfolio volume in the prior week to 5.38% as of January 17, 2021. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

The small increase in the share of loans in forbearance was led by a gain in the portfolio/PLS loan segment. The good news is that the forbearance numbers for GSE loans continues to decline more consistently, as these borrowers typically have stronger credit and more stable employment,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The rate of exits from forbearance slowed in the prior week, while the rate of new forbearance requests remained steady at a low level.”

Fratantoni added, “The latest housing market data show strong momentum entering 2021, with both the pace of home sales and new construction booming. We expect that this strong market could benefit homeowners who need to sell their home, as record-low inventory is causing for-sale homes to go under contract quickly and is pushing up home prices.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has generally been trending down.

The MBA notes: "Weekly forbearance requests as a percent of servicing portfolio volume (#) remained flat relative to the previous two weeks at 0.07 percent."

Record Low Mortgage Rates; Loans Taking 2 Months to Close

by Calculated Risk on 1/25/2021 02:02:00 PM

From Jann Swanson at MortgageNewsDaily: Loans Still Taking 2 Months to Close as Refi Demand Stays Strong

The interest rates on 30-year fixed rate mortgages originated in December reached an all-time low in ICE Mortgage Technology's (formerly Ellie Mae's) records, an average of 2.93 percent and a 4-basis point decline from the November rate. ... The time to close all loans increased to 58 days from 55 days in November with purchase loans, at 56 days compared to 49 days, accounting for all the increase. The refinance timeline remained at 59 days. [Today's Most Prevalent Rates For Top Tier Scenarios 30YR FIXED - 2.78%]

Click on graph for larger image.

Click on graph for larger image.This graph from Mortgage News Daily shows mortgage rates since January 2011.

Mortgage rates are essentially at record lows.

This graph is interactive, and you could view mortgage rates back to the mid-1980s - click here for interactive graph.

Housing Inventory Weekly Update: At Record Lows

by Calculated Risk on 1/25/2021 11:09:00 AM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year, and I'll be using some weekly sources.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Dallas Fed: "Texas Manufacturing Expansion Moderates" in January

by Calculated Risk on 1/25/2021 10:42:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Moderates

Texas factory activity continued to expand in January, albeit at a markedly slower pace, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 26.8 to 4.6, indicating a sharp deceleration in output growth.

Other measures of manufacturing activity also point to more muted growth this month. The new orders index dropped 13 points to 6.3, and the growth rate of orders index fell from 15.9 to 5.9. The capacity utilization index declined 10 points to 9.2, and the shipments index fell from 23.4 to 13.5.

Perceptions of broader business conditions continued to improve in January. The general business activity index remained positive but edged down from 10.5 to 7.0. The company outlook index also stayed in positive territory but retreated, from 18.2 to 10.3. Uncertainty regarding companies’ outlooks continued to rise; the index increased six points to 19.3.

Labor market measures indicated slightly slower growth in employment and a continued increase in work hours. The employment index came in at 16.6, down from 20.9 but still indicative of increased head counts.

emphasis added