by Calculated Risk on 11/21/2020 07:19:00 PM

Saturday, November 21, 2020

November 21 COVID-19 Test Results; Record Hospitalizations

Note: Week-over-week case growth is slowing, so maybe cases per day will peak soon (A virtual Thanksgiving is recommended by the CDC). Stay Safe!!!

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,604,859 test results reported over the last 24 hours.

There were 178,309 positive tests.

Almost 25,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 11.1% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• 7-day average cases are at a new record.

• 7-day average deaths at highest level since May.

• Record Hospitalizations.

Schedule for Week of November 22, 2020

by Calculated Risk on 11/21/2020 08:11:00 AM

The key reports this week are October New Home sales, and the second estimate of Q3 GDP.

Other key indicators include Personal Income and Outlays for October and Case-Shiller house prices for September.

For manufacturing, the Richmond Fed manufacturing survey will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.This graph shows graph shows the Year over year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 5.8% year-over-year increase in the National index for September.

9:00 AM: FHFA House Price Index for September. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is initial claims decreased to 710 thousand from 742 thousand last week.

8:30 AM: Gross Domestic Product, 3nd quarter 2020 (Second estimate). The consensus is that real GDP increased 33.1% annualized in Q3, unchanged from the advance estimate of GDP.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 1.9% increase in durable goods orders.

10:00 AM: Personal Income and Outlays for October. The consensus is for a 0.1% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: New Home Sales for October from the Census Bureau.

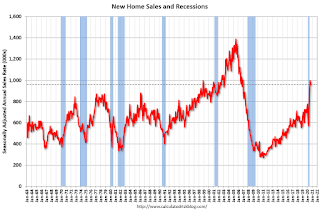

10:00 AM: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 975 thousand SAAR, up from 959 thousand in September.

10:00 AM: University of Michigan's Consumer sentiment index (Final for November). The consensus is for a reading of 77.0.

2:00 PM: FOMC Minutes, Meeting of November 4-5, 2020

All US markets will be closed in observance of the Thanksgiving Day Holiday.

The NYSE and the NASDAQ will close early at 1:00 PM ET.

Friday, November 20, 2020

November 20 COVID-19 Test Results; Record Cases, Hospitalizations

by Calculated Risk on 11/20/2020 06:59:00 PM

From Bloomberg on the Covid Tracking Project: Data Heroes of Covid Tracking Project Are Still Filling U.S. Government Void. Awesome work!

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,582,323 test results reported over the last 24 hours.

There were 192,805 positive tests.

Over 23,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.2% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• 7-day average cases are at a new record.

• 7-day average deaths at highest level since May.

• Record Hospitalizations.

Quarterly Starts by Purpose and Design

by Calculated Risk on 11/20/2020 02:32:00 PM

Along with the monthly housing starts for October this week, the Census Bureau released Quarterly Starts by Purpose and Design through Q3 2020.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale (red) were up 23.3% in Q3 2020 compared to Q3 2019.

Owner built starts (orange) were down 7.1% year-over-year.

Condos built for sale decreased, and are still low.

The 'units built for rent' (blue) and were up 6.4% in Q3 2020 compared to Q3 2019.

Q4 GDP Forecasts

by Calculated Risk on 11/20/2020 11:17:00 AM

Most economists are revisiting their Q4 forecasts, and many are not releasing weekly updates. In their previous forecasts, many assumed some additional disaster relief in Q4, and many underestimated the current surge in COVID.

Depending on further delays in disaster relief, and the impact of the current COVID surge, we might see some significant Q4 GDP downgrades soon.

"We estimate that the expiration of federal UI programs—PUA and PEUC—alone could be a drag of 1.5pp in 1Q. Cutoff of other provisions will be added headwinds at the start of the year."The high level of uncertainty over the next few months makes forecasting extremely difficult. The automated approaches (below) do not capture this uncertainty.

From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.86% for 2020:Q4. [Nov 20 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2020 is 5.6 percent on November 18, up from 5.4 percent on November 17. [Nov 18 estimate]It is also important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 3.3% annualized increase in Q4 GDP, is about 0.8% QoQ, and would leave real GDP down about 2.7% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q3 2020, and real GDP is currently off 3.5% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 3.3% annualized increase in real GDP would look like in Q4.

BLS: October Unemployment rates down in 37 States, Higher in 8 States

by Calculated Risk on 11/20/2020 10:14:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in October in 37 states and the District of Columbia, higher in 8 states, and stable in 5 states, the U.S. Bureau of Labor Statistics reported today. Forty-seven states and the District had jobless rate increases from a year earlier and three states had little or no change. The national unemployment rate declined by 1.0 percentage point over the month to 6.9 percent but was 3.3 points higher than in October 2019.Hawaii and Nevada are being impacted by the lack of tourism.

Nonfarm payroll employment increased in 32 states, decreased in 2 states, and was essentially unchanged in 16 states and the District of Columbia in October 2020. Over the year, nonfarm payroll employment decreased in 48 states and the District and was essentially unchanged in 2 states.

...

Hawaii had the highest unemployment rate in October, 14.3 percent, followed by Nevada, 12.0 percent. Nebraska and Vermont had the lowest rates, 3.0 percent and 3.2 percent, respectively.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 11/20/2020 09:17:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of November 17th.

From Black Knight: Forbearances Tick Up After Two-Week Decline

After falling by 273,000 (9 percent) over the past two weeks, forbearance volumes edged slightly upward this week.

This week’s rise was a result of an increase of 15,000 forbearances among FHA/VA loans, along with 14,000 and 1,000 additional loans in forbearance among private label securities/bank portfolios and the GSEs, respectively.

Despite these mild increases, there is still good news for the mortgage servicing market – the number of active forbearances remains down 7 percent from the same time in October. As of Nov. 17, there are 2.77 million active forbearances nationwide, down from a peak of 4.76 million in late May.

...

Click on graph for larger image.

Mid-month incremental increases have been common so far, with the strongest declines typically being seen early in the month as forbearance plans expire. 82 percent of active forbearance cases have had their terms extended.

emphasis added

Thursday, November 19, 2020

November 19 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 11/19/2020 08:07:00 PM

The CDC is now recommending no travel for Thanksgiving.

"As cases continue to increase rapidly across the United States, the safest way to celebrate Thanksgiving is to celebrate at home with the people you live with."Please be careful, especially over the holidays. Thanksgiving, Christmas and New Years will be tough this year, but keep your guard up - plan now to have a safe holiday.

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,469,206 test results reported over the last 24 hours.

There were 182,832 positive tests.

Over 21,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.4% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• 7-day average cases are at a new record.

• 7-day average deaths at highest level since May.

• Record Hospitalizations.

Comments on October Existing Home Sales

by Calculated Risk on 11/19/2020 01:59:00 PM

Earlier: NAR: Existing-Home Sales Increased to 6.85 million in October

A few key points:

1) This was the highest sales rate since 2006. Some of the increase over the last few months was probably related to pent up demand from the shutdowns in March and April. There are going to be some difficult comparisons next year!

2) Inventory is very low, and was down 19.8% year-over-year (YoY) in October. This is the lowest level of inventory for October since at least the early 1990s.

3) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the Consensus.

This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April, May, and June, sales to date are up about 2.4% compared to the same period in 2019.

Sales NSA in October (573,000) were 24% above sales last year in October (462,000). This was the all time high for October (NSA).

Hotels: Occupancy Rate Declined 32.7% Year-over-year

by Calculated Risk on 11/19/2020 11:17:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 14 November

U.S. weekly hotel occupancy slipped further from previous weeks, according to the latest data from STR through 14 November.Since there is a seasonal pattern to the occupancy rate - see graph below - we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

8-14 November 2020 (percentage change from comparable week in 2019):

• Occupancy: 43.2% (-32.7%)

• Average daily rate (ADR): US$90.58 (-28.6%)

• Revenue per available room (RevPAR): US$39.11 (-52.0%)

After ranging between 48% and 50% occupancy from mid-July into the later portion of October, the last three weeks have produced levels of 44.4%, 44.1% and 43.2%.

emphasis added

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

| 11/14 | -32.7% |

This suggests no improvement over the last 9 weeks, and occupancy might be getting worse.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Seasonally we'd expect the occupancy rate to decline into the new year. Note that there was little pickup in business travel that usually happens in the Fall.

Note: Y-axis doesn't start at zero to better show the seasonal change.