by Calculated Risk on 10/24/2020 06:20:00 PM

Saturday, October 24, 2020

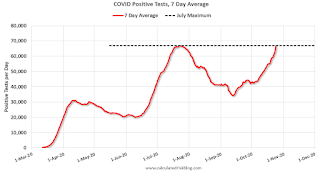

October 24 COVID-19 Test Results

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,044,804 test results reported over the last 24 hours.

There were 82,668 positive tests.

Over 17,700 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.9% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

We will probably see a new record 7-day average tomorrow.

Schedule for Week of October 25, 2020

by Calculated Risk on 10/24/2020 08:11:00 AM

The key reports this week are the advance estimate of Q3 GDP and September New Home sales.

Other key indicators include Personal Income and Outlays for September and Case-Shiller house prices for August.

For manufacturing, the Dallas and Richmond Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

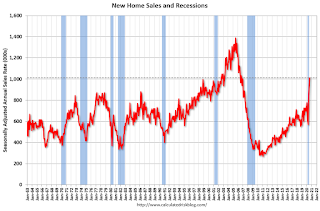

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 1,025 thousand SAAR, up from 1,011 thousand in August.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for October.

8:30 AM ET: Durable Goods Orders for September from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 4.2% year-over-year.

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 4.2% year-over-year.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October. This is the last of the regional surveys for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 3rd quarter 2020 (advance estimate). The consensus is that real GDP increased 31.9% annualized in Q3, up from negative 31.4% in Q2.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is initial claims increased to 800 thousand from 787 thousand last week.

10:00 AM: Pending Home Sales Index for September. The consensus is 4.5% increase in the index.

8:30 AM ET: Personal Income and Outlays for September. The consensus is for a 0.5% increase in personal income, and for a 1.0% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 59.3, down from 62.4 in September.

10:00 AM: University of Michigan's Consumer sentiment index (Final for October). The consensus is for a reading of 81.2.

Friday, October 23, 2020

October 23 COVID-19 Test Results

by Calculated Risk on 10/23/2020 07:04:00 PM

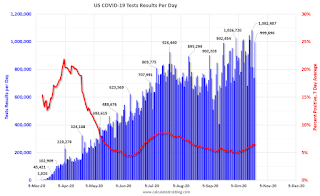

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,123,341 test results reported over the last 24 hours.

There were 83,010 positive tests (new record).

Over 16,800 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.4% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

Everyone needs to be vigilant or we might see record high 7-day average cases before the end of October.

Q3 GDP Forecasts

by Calculated Risk on 10/23/2020 11:42:00 AM

From Merrill Lynch:

The advance 3Q GDP report should reveal a historic 33% qoq saar rebound in real activity, driven largely by recoveries in consumption, residential and equipment investment. This forecast will recoup half of the decline in GDP during from the COVID shock. [Oct 23 estimate]From Nomura:

emphasis added

Base effects will drive Q3 2020 real GDP higher but monthly data suggest the recovery has entered a slower phase. We think real GDP rose 34.7% q-o-q saar (7.7% q- o-q unannualized) in Q3, highlighting the swifter-than-expected pandemic recovery thus far. As COVID-19 weighs on activity, we expect a more gradual recovery through H1 2021 before an acceleration in H2. [Oct 23 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 13.7% for 2020:Q3 and 3.5% for 2020:Q4. [Oct 23 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 35.3 percent on October 20, up from 35.2 percent on October 16. [Oct 20 estimate]It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 35% annualized increase in Q3 GDP, is about 7.8% QoQ, and would leave real GDP down about 3.3% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.2% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 35% annualized increase in real GDP would look like in Q3.

Even with a 35% annualized increase (about 7.8% QoQ), real GDP will be down about 3.3% from Q4 2019; a slightly smaller decline in real GDP than at the depth of the Great Recession.

NMHC: "October Apartment Market Conditions Showed Some Rebound from COVID-19 Impacts"

by Calculated Risk on 10/23/2020 11:30:00 AM

The National Multifamily Housing Council (NMHC) released their October report: October Apartment Market Conditions Showed Some Rebound from COVID-19 Impacts

Apartment market conditions moderated in the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for October 2020, as the industry continues to cope with the ongoing Covid-19 pandemic. While the Sales Volume (72), Equity Financing (62) and Debt Financing (73) indexes all came in above the breakeven level (50), the index for Market Tightness (35) indicated continued weakness.

“The ongoing Covid-19 pandemic continues to constrain economic activity, resulting in higher vacancies and lower rent growth for apartments overall,” noted NMHC Chief Economist Mark Obrinsky. “Still, industry professionals are observing more favorable conditions in many suburban markets. And, while this round marks the fourth consecutive quarter of deteriorating conditions, there was considerably more variation in responses compared to last quarter – less than half (49 percent) thought that market conditions were looser.”

...

The Market Tightness Index increased from 19 to 35, indicating looser market conditions. Nearly half (49 percent) of respondents reported looser market conditions than three months prior, compared to 18 percent who reported tighter conditions. One in three respondents (33 percent) felt that conditions were no different from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Declined Slightly

by Calculated Risk on 10/23/2020 09:19:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of October 20th.

From Forbearance Volumes Continue Modest Improvement from Pandemic-Related Peak

The market saw modest improvement in forbearances this past week, according to data from Black Knight’s McDash Flash Forbearance Tracker.

Forbearance volumes fell by 11K from the prior week, which was the result of larger declines among GSE loans (14K) and portfolio-held and privately securitized loans (2K) being offset by an increase of 5K in FHA/VA loans in forbearance.

Click on graph for larger image.

As of Oct. 20, nearly 3 million borrowers remain in active COVID-19 forbearance plans, which represents 5.6% of first lien mortgages. This is a noticeable reduction from the market’s peak of 4.76 million in late May. More than 80% of remaining forbearance plans have had their terms extended with their servicer.

Despite the muted improvement seen this week, overall forbearance volumes are down 623K month-over-month, driven by the large reduction in loans in active forbearance plans at the beginning of the month. This marks a 17% decline from September, showing sustained downward movement in forbearance volumes.

emphasis added

Thursday, October 22, 2020

October 22 COVID-19 Test Results

by Calculated Risk on 10/22/2020 06:42:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 999,696 test results reported over the last 24 hours.

There were 76,560 positive tests.

Over 15,900 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.7% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

Everyone needs to be vigilant or we might see record high 7-day average cases before the end of October.

Black Knight: National Mortgage Delinquency Rate Decreased in September

by Calculated Risk on 10/22/2020 01:03:00 PM

Note: Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Serious Delinquencies Improved in September for the First Time Since the Start of the Pandemic

• The number of seriously delinquent mortgages (90+ days) fell by 43,000 in September, marking the first such improvement in serious delinquencies since the start of the pandemicAccording to Black Knight's First Look report, the percent of loans delinquent decreased 3.1% in September compared to August, and increased 89% year-over-year.

• More than 2.3 million homeowners – five times the number entering 2020 – remain 90 or more days past due, but not in foreclosure

• The national delinquency rate fell in September to 6.66%, down from 6.88% the month prior

• Early-stage delinquencies continue to show strong improvement, with rolls from current to 30-days delinquent, as well as the number of borrowers less than 90 days delinquent, having returned to pre-pandemic levels

• Both foreclosure starts and foreclosure sales continue to remain muted given the widespread foreclosure moratoriums still in place

emphasis added

The percent of loans in the foreclosure process decreased 2.9% in September and were down 29% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 6.66% in September, down from 6.88% in August.

The percent of loans in the foreclosure process decreased in September to 0.34%, from 0.35% in August.

The number of delinquent properties, but not in foreclosure, is up 1,688,000 properties year-over-year, and the number of properties in the foreclosure process is down 71,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Sept 2020 | Aug 2020 | Sept 2019 | Sept 2018 | |

| Delinquent | 6.66% | 6.88% | 3.53% | 3.97% |

| In Foreclosure | 0.34% | 0.35% | 0.48% | 0.52% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 3,542,000 | 3,679,000 | 1,854,000 | 2,049,000 |

| Number of properties in foreclosure pre-sale inventory: | 181,000 | 187,000 | 252,000 | 268,000 |

| Total Properties | 3,722,000 | 3,867,000 | 2,106,000 | 2,317,000 |

NMHC: Rent Payment Tracker Shows Households Paying Rent Declined in October

by Calculated Risk on 10/22/2020 11:50:00 AM

From the NMHC: NMHC Rent Payment Tracker Finds 90.6 Percent of Apartment Households Paid Rent as of October 20

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 90.6 percent of apartment households made a full or partial rent payment by October 20 in its survey of 11.4 million units of professionally managed apartment units across the country.

This is a 1.8-percentage point, or 199,224-household decrease from the share who paid rent through October 20, 2019 and compares to 90.1 percent that had paid by September 20, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“The importance of the initial support provided to apartment residents by the CARES Act is becoming increasingly clear,” said Doug Bibby, NMHC President. “However, that support has now long since expired and the savings households were able to build are evaporating quickly. NMHC continues to urge lawmakers to come together and pass meaningful assistance to support renters and keep America’s rental housing sector stable.”

emphasis added

This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 20th of the month.

CR Note: This is mostly for large, professionally managed properties.

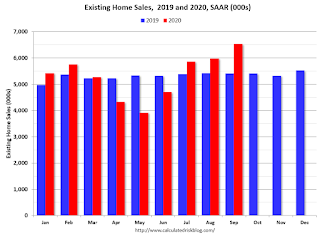

Comments on September Existing Home Sales

by Calculated Risk on 10/22/2020 11:24:00 AM

Earlier: NAR: Existing-Home Sales Increased to 6.54 million in September

A few key points:

1) This was the highest sales rate since 2006. Existing home sales are counted at the close of escrow, so the September report was mostly for contracts signed in July and August - when the economy was much more open than in March and April. Some of the increase over the last few months was probably related to pent up demand from the shutdowns in March and April. However, with the high unemployment rate and the high rate of COVID infections, housing might be under some pressure in 2021. That is difficult to predict and depends on the course of the pandemic.

2) Inventory is very low, and was down 19.2% year-over-year (YoY) in September. This is the lowest level of inventory for September since at least the early 1990s.

3) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the Consensus.

This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April, May, and June, sales to date are only down about 0.2% compared to the same period in 2019.

Sales NSA in September (560,000) were 24% above sales last year in September(450,000).