by Calculated Risk on 10/12/2020 08:27:00 AM

Monday, October 12, 2020

Seven High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment - some of the sectors that will recover very slowly.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

The dashed line is the percent of last year for the seven day average.

This data is as of Oct 11th.

The seven day average is down 65% from last year (35% of last year).

There has been a slow increase from the bottom.

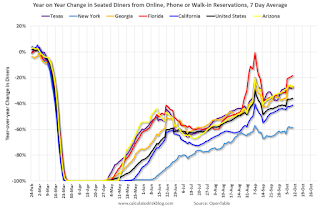

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through October 10, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

The 7 day average for New York is still off 59% YoY, and down 18% in Florida. There was a surge in restaurant dining around Labor Day - hopefully mostly outdoor dining.

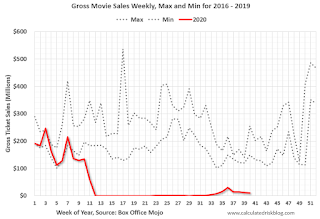

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through October 8th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through October 8th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up over the last few weeks, and were at $11 million last week (compared to usually around $200 million per week in the early Fall).

Some movie theaters are reopening (probably with limited seating at first).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - prior to 2020).

This data is through October 3rd.

Hotel occupancy is currently down 29.6% year-over-year.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

There was some recent boost from natural disasters - perhaps 1 or 2 percentage points total based on previous disasters - but so far there has been little business travel pickup that usually happens in the Fall.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .At one point, gasoline supplied was off almost 50% YoY.

As of October 2nd, gasoline supplied was only off about 6.0% YoY (about 94.0% of normal).

Note: I know several people that have driven to vacation spots - or to visit family - and they usually would have flown. So this might have boosted gasoline consumption and the expense of air travel.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through October 10th for the United States and several selected cities.

This data is through October 10th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is still only about 57% of the January level. It is at 50% in Los Angeles, and 59% in Houston.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider.This data is through Friday, October 9th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, October 11, 2020

Sunday Night Futures

by Calculated Risk on 10/11/2020 09:09:00 PM

Weekend:

• Schedule for Week of October 11, 2020

Monday:

• Columbus Day Holiday: Banks will be closed in observance of Columbus Day. The stock market will be open. No economic releases are scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $40.21 per barrel and Brent at $42.44 barrel. A year ago, WTI was at $55, and Brent was at $61 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.17 per gallon. A year ago prices were at $2.64 per gallon, so gasoline prices are down $0.47 per gallon year-over-year.

October 11 COVID-19 Test Results

by Calculated Risk on 10/11/2020 07:23:00 PM

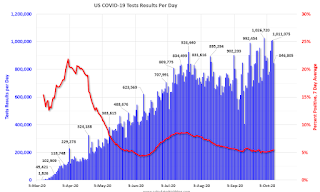

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 846,805 test results reported over the last 24 hours.

There were 46,776 positive tests.

Almost 7,700 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.5% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

Everyone needs to be vigilant or we might see record high cases this Fall and Winter.

U.S. Demographics: Largest 5-year cohorts, and Ten most Common Ages in 2019

by Calculated Risk on 10/11/2020 11:31:00 AM

IMPORTANT NOTE: The data below is based on the Census 2019 estimates. Housing economist Tom Lawler has pointed out some questions about earlier Census estimates, see: Lawler: "New Long-Term Population Projections Show Slower Growth than Previous Projections but Are Still Too High"

Six years ago, I wrote: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group.

Earlier the Census Bureau released the population estimates for 2019 by age, and I've updated the table from the previous post.

The table below shows the top 11 cohorts by size for 2010, 2019 (released this year), and Census Bureau projections for 2030.

In 2019, 8 of the top 10 cohorts were under 40 (the Boomers will be fading away), and by 2030 the top 11 cohorts will be the youngest 11 cohorts (the reason I included 11 cohorts).

There will be plenty of "gray hairs" walking around in 2030, but the key for the economy is the population in the prime working age group is now increasing.

This is positive for housing and the economy.

| Population: Largest 5-Year Cohorts by Year | ||||

|---|---|---|---|---|

| Largest Cohorts | 2010 | 2019 | 2030 | |

| 1 | 45 to 49 years | 25 to 29 years | 35 to 39 years | |

| 2 | 50 to 54 years | 30 to 34 years | 40 to 44 years | |

| 3 | 15 to 19 years | 55 to 59 years | 30 to 34 years | |

| 4 | 20 to 24 years | 35 to 39 years | 25 to 29 years | |

| 5 | 25 to 29 years | 20 to 24 years | 5 to 9 years | |

| 6 | 40 to 44 years | 15 to 19 years | 10 to 14 years | |

| 7 | 10 to 14 years | 10 to 14 years | Under 5 years | |

| 8 | 5 to 9 years | 60 to 64 years | 15 to 19 years | |

| 9 | Under 5 years | 50 to 54 years | 20 to 24 years | |

| 10 | 35 to 39 years | 45 to 49 years | 45 to 49 years | |

| 11 | 30 to 34 years | 5 to 9 years | 50 to 54 years | |

Click on graph for larger image.

This graph, based on the 2019 population estimate, shows the U.S. population by age in July 2019 according to the Census Bureau.

Note that the largest age groups are all in their mid-20s.

And below is a table showing the ten most common ages in 2010, 2019, and 2030 (projections are from the Census Bureau).

Note the younger baby boom generation dominated in 2010. By 2019 the millennials have taken over and the boomers are off the list.

My view is this is positive for both housing and the economy, especially in the 2020s.

| Population: Most Common Ages by Year | ||||

|---|---|---|---|---|

| 2010 | 2019 | 2030 | ||

| 1 | 50 | 28 | 39 | |

| 2 | 49 | 29 | 40 | |

| 3 | 19 | 27 | 38 | |

| 4 | 48 | 30 | 37 | |

| 5 | 47 | 26 | 36 | |

| 6 | 46 | 25 | 35 | |

| 7 | 20 | 31 | 41 | |

| 8 | 45 | 34 | 30 | |

| 9 | 18 | 24 | 34 | |

| 10 | 52 | 33 | 33 | |

Saturday, October 10, 2020

October 10 COVID-19 Test Results

by Calculated Risk on 10/10/2020 06:30:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,011,075 test results reported over the last 24 hours.

There were 57,206 positive tests.

Over 7,200 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.7% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

Everyone needs to be vigilant or we might see record high cases this Fall and Winter.

Schedule for Week of October 11, 2020

by Calculated Risk on 10/10/2020 08:11:00 AM

The key economic reports this week are September CPI and Retail Sales.

For manufacturing, September Industrial Production, and the October New York and Philly Fed surveys, will be released this week.

Columbus Day Holiday: Banks will be closed in observance of Columbus Day. The stock market will be open. No economic releases are scheduled.

8:30 AM: The Consumer Price Index for September from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for September from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

8:30 AM: The initial weekly unemployment claims report will be released. Initial claims were 840 thousand the previous week.

8:30 AM ET: The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 15.0, down from 17.0.

8:30 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of 14.5, down from 15.0.

8:30 AM ET: Retail sales for September will be released. The consensus is for a 0.7% increase in retail sales.

8:30 AM ET: Retail sales for September will be released. The consensus is for a 0.7% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 4.0% on a YoY basis in August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 71.9%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for October).

Friday, October 09, 2020

October 9 COVID-19 Test Results; Most Cases in Over 2 Months

by Calculated Risk on 10/09/2020 06:32:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,013,588 test results reported over the last 24 hours.

There were 57,542 positive tests.

Over 6,500 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.7% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people would stay vigilant, the number of cases might drop to the June low in November - but that is looking unlikely.

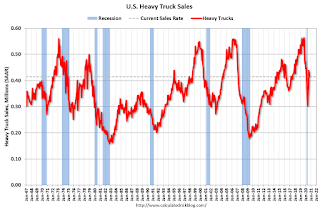

U.S. Heavy Truck Sales down 26% Year-over-year in September

by Calculated Risk on 10/09/2020 02:08:00 PM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the September 2020 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all time high of 575 thousand SAAR in September 2019.

However heavy truck sales started declining late last year due to lower oil prices.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Click on graph for larger image.

Heavy truck sales really declined towards the end of March due to COVID-19 and the collapse in oil prices.

Heavy truck sales are now back to March 2020 levels, but still below February 2020 (pre-COVID).

Heavy truck sales were at 415 thousand SAAR in September, down from 438 thousand SAAR in August, and down 26% from 563 thousand SAAR in September 2019.

Year-to-date heavy truck sales are down 28% compared to the same period in 2019 (288.5 thousand in 2020 compared to 399.4 thousand in 2019 through September).

Q3 GDP Forecasts

by Calculated Risk on 10/09/2020 12:23:00 PM

From Merrill Lynch:

We are tracking 33% qoq saar for 3Q GDP growth. [Oct 9 estimate]From Goldman Sachs:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +35% (qoq ar).. [Oct 9 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 14.1% for 2020:Q3 and 4.8% for 2020:Q4. [Oct 9 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 35.2 percent on October 9, slightly down from 35.3 percent on October 6. [Oct 9 estimate]It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 30% annualized increase in Q3 GDP, is about 6.8% QoQ, and would leave real GDP down about 4.2% from Q4 2019.

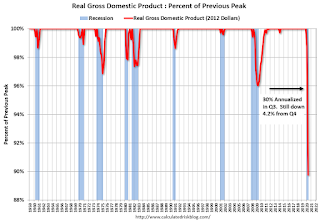

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.2% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 30% annualized increase in real GDP would look like in Q3.

Even with a 30% annualized increase (about 6.8% QoQ), real GDP will be down about 4.2% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Declined Sharply

by Calculated Risk on 10/09/2020 08:22:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of October 6th.

From Forbearances See Largest Single Week Decline Yet

After a slight uptick last week, active forbearance volumes plummeted over the past seven days, falling by 649K from the week prior. An 18% reduction in the number of active forbearances, this represents the largest single-week decline since the beginning of the pandemic and its related fallout in the U.S. housing market.

New data from Black Knight’s McDash Flash Forbearance Tracker shows that as the first wave of forbearances from April are hitting the end of their initial six-month term, the national forbearance rate has decreased to 5.6%. This figure is down from 6.8% last week, with active forbearances falling below 3 million for the first time since mid-April.

Click on graph for larger image.

This decline noticeably outpaced the 435K weekly reduction we saw when the first wave of cases hit the three-month point back in July.

As of October 6, 2.97 million homeowners remain in COVID-19-related forbearance plans, representing $614 billion in unpaid principal.

...

Though the market continues to adjust to historic and unprecedented conditions, these are clear signs of long-term improvement. We hope to see a continuation of the promising trend of forbearance reduction in the coming weeks, as an additional 800K forbearance plans are slated to reach the end of their initial six-month term in the next 30 days.