by Calculated Risk on 9/16/2020 07:07:00 PM

Wednesday, September 16, 2020

September 16 COVID-19 Test Results

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 665,622 test results reported over the last 24 hours.

There were 40,021 positive tests.

Over 13,000 people have died from COVID in the first half of September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.0% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low by the end of September - although this seems unlikely now (that would still be a large number of new cases, but progress).

FOMC Projections and Press Conference

by Calculated Risk on 9/16/2020 02:09:00 PM

Statement here.

Fed Chair Powell press conference video here starting at 2:30 PM ET.

Here are the projections.

Note that GDP decreased at a 5.0% annual rate in Q1, and decreased at a 31.7% annual rate in Q2.

Most forecasts are for GDP to increase at a 25% to 35% annual rate in Q3.

It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 30% annualized increase in Q3 GDP, is about 6.8% QoQ, and would leave real GDP down about 4.2% from Q4 2019.

The course of the economy will depend on the course of the pandemic, so the FOMC has to factor in their expectations of when the pandemic will subside and end (and no one knows at this time).

This FOMC revised up their GDP projections for 2020, and revised down their projections for the following years.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | -4.0 to -3.0 | 3.6 to 4.7 | 2.5 to 3.3 | 2.4 to 3.0 |

| June 2020 | -7.6 to -5.5 | 4.5 to 6.0 | 3.0 to 4.5 | NA |

The unemployment rate was at 8.4% in August. The unemployment rate declined faster than most expectations.

Note that the unemployment rate doesn't remotely capture the economic damage to the labor market. Not only are there almost 14 million people unemployed, close to 4 million people have left the labor force since January. And millions more are being supported by various provisions for the CARES Act - that hasn't been renewed

The unemployment rate was revised down for all three years.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | 7.0 to 8.0 | 5.0 to 6.2 | 4.0 to 5.0 | 3.5 to 4.4 |

| June 2020 | 9.0 to 10.0 | 5.9 to 7.5 | 4.8 to 6.1 | NA |

As of July 2020, PCE inflation was up 1.0% from July 2019. The projections for inflation were revised up this month.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | 1.1 to 1.3 | 1.6 to 1.9 | 1.7 to 1.9 | 1.9 to 2.0 |

| June 2020 | 0.6 to 1.0 | 1.4 to 1.7 | 1.6 to 1.8 | NA |

PCE core inflation was up 1.3% in July year-over-year. Projections for core inflation were revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | 1.3 to 1.5 | 1.6 to 1.8 | 1.7 to 1.9 | 1.9 to 2.0 |

| June 2020 | 0.9 to 1.1 | 1.4 to 1.7 | 1.6 to 1.8 | NA |

FOMC Statement: "The Committee will aim to achieve inflation moderately above 2 percent for some time"

by Calculated Risk on 9/16/2020 02:02:00 PM

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. Economic activity and employment have picked up in recent months but remain well below their levels at the beginning of the year. Weaker demand and significantly lower oil prices are holding down consumer price inflation. Overall financial conditions have improved in recent months, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, over coming months the Federal Reserve will increase its holdings of Treasury securities and agency mortgage-backed securities at least at the current pace to sustain smooth market functioning and help foster accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Loretta J. Mester; and Randal K. Quarles.

Voting against the action were Robert S. Kaplan, who expects that it will be appropriate to maintain the current target range until the Committee is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals as articulated in its new policy strategy statement, but prefers that the Committee retain greater policy rate flexibility beyond that point; and Neel Kashkari, who prefers that the Committee to indicate that it expects to maintain the current target range until core inflation has reached 2 percent on a sustained basis.

emphasis added

Phoenix Real Estate in August: Sales Up 1.7% YoY, Active Inventory Down 38% YoY

by Calculated Risk on 9/16/2020 11:49:00 AM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 8,878 in August, dowm from 10,303 in July, and up from 8,726 in August 2019. Sales were down 13.8% from July 2020 (last month), and up 1.7% from August 2019.

2) Active inventory was at 8,328, down from 13,350 in August 2019. That is down 38% year-over-year.

3) Months of supply increased to 1.52 in August, up from 1.26 in July. This is very low.

Sales are reported at the close of escrow, so these sales were mostly signed in June and July.

NMHC: Rent Payment Tracker Shows Decline in Households Paying Rent in September

by Calculated Risk on 9/16/2020 10:44:00 AM

From the NMHC: NMHC Rent Payment Tracker Finds 86.2 Percent of Apartment Households Paid Rent as of September 13

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 86.2 percent of apartment households made a full or partial rent payment by September 13 in its survey of 11.4 million units of professionally managed apartment units across the country.

This is a 2.4-percentage point, or 279,457-household decrease from the share who paid rent through September 13, 2019 and compares to 86.9 percent that had paid by August 13, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“While it remains clear that many apartment residents continue to prioritize their housing obligations and that apartment owners and operators remain committed to meeting them halfway with creative and nuanced approaches, the reality is that the second week of September figures shows ongoing deterioration of rent payment figures - representing hundreds of thousands of households who are increasingly at risk,” said Doug Bibby, NMHC President.

“This sadly comes as little surprise given that Congress and the Administration have failed to come back to the table and extend the critical protections that supported apartment residents and the nation’s consumer base during the initial months of the pandemic.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th of the month.

CR Note: This is mostly for large, professionally managed properties. It appears fewer people are paying their rent this year compared to last year - down 2.4 percentage points from a year ago - and also down 0.7 percentage points compared to last month at the same point (August 2020).

Declining, but not falling off a cliff.

NAHB: Builder Confidence Increased to 83 in September, Record High

by Calculated Risk on 9/16/2020 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 83, up from 78 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Soars to an All-Time High, Lumber Risks Remain

In a strong signal that housing is leading the economic recovery, builder confidence in the market for newly-built single-family homes increased five points to hit an all-time high of 83 in September, according to the latest NAHB/Wells Fargo Housing Market Index (HMI) released today. The previous highest reading of 78 in the 35-year history of the series was set last month and also matched in December 1998.

“Historic traffic numbers have builders seeing positive market conditions, but many in the industry are worried about rising costs and delays for building materials, especially lumber,” said NAHB Chairman Chuck Fowke. “More domestic lumber production or tariff relief is needed to avoid a slowdown in the market in the coming months.”

“Lumber prices are now up more than 170% since mid-April, adding more than $16,000 to the price of a typical new single-family home,” said NAHB Chief Economist Robert Dietz. “That said, the suburban shift for home building is keeping builders busy, supported on the demand side by low interest rates. In another sign of this growing trend, builders in other parts of the country have reported receiving calls from customers in high-density markets asking about relocating.”

...

All the HMI indices posted their highest readings ever in September. The HMI index gauging current sales conditions rose four points to 88, the component measuring sales expectations in the next six months increased six points to 84 and the measure charting traffic of prospective buyers posted a nine-point gain to 73.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased 11 points to 76, the Midwest increased nine points to 72, the South rose eight points to 79 and the West increased seven points to 85.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast.

Housing and homebuilding have been one of the best performing sectors during the pandemic.

Retail Sales increased 0.6% in August

by Calculated Risk on 9/16/2020 08:39:00 AM

On a monthly basis, retail sales increased 0.6 percent from July to August (seasonally adjusted), and sales were up 2.6 percent from August 2019.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for August 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $537.5 billion, an increase of 0.6 percent from the previous month, and 2.6 percent above August 2019. Total sales for the June 2020 through August 2020 period were up 2.4 percent from the same period a year ago. The June 2020 to July 2020 percent change was revised from up 1.2 percent to up 0.9 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in August.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.0% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.0% on a YoY basis.The increase in August was below expectations, and sales in June and July were revised down, combined.

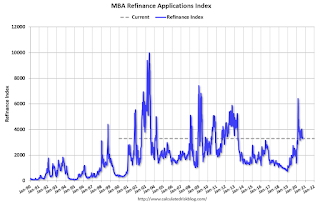

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 9/16/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 11, 2020. This week’s results include an adjustment for the Labor Day holiday.

... The Refinance Index decreased 4 percent from the previous week and was 30 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 12 percent compared with the previous week and was 6 percent higher than the same week one year ago.

“Mortgage rates held steady last week, and the 30-year fixed rate – at 3.07 percent – has now stayed near the 3 percent mark for the past two months. A 5 percent decline in conventional refinances pulled the overall index lower, but activity was still 30 percent higher than last year. With the flurry of refinance activity reported over the past several months, demand may be slowing as remaining borrowers in the market potentially wait for another sizeable drop in rates,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Applications to buy a home also decreased last week, but the underlying trend remains strong. Purchase activity has outpaced year-ago levels for 17 consecutive weeks, with a stronger growth in loans with higher balances pushing MBA’s average loan size to a new survey high of $370,200.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) remained unchanged at 3.07 percent, with points decreasing to 0.32 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index is up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 6% year-over-year unadjusted (like last week, this year-over-year percent was distorted by the timing of Labor Day).

Note: Red is a four-week average (blue is weekly).

Tuesday, September 15, 2020

Wednesday: Retail Sales, FOMC Meeting, Homebuilder Confidence

by Calculated Risk on 9/15/2020 09:00:00 PM

Here is my FOMC Preview

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for August will be released. The consensus is for a 1.0% increase in retail sales.

• At 10:00 AM, The September NAHB homebuilder survey. The consensus is for a reading of 78, unchanged from 78 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 2:00 PM, FOMC Meeting Announcement. No change to policy is expected at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

September 15 COVID-19 Test Results

by Calculated Risk on 9/15/2020 06:49:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 685,033 test results reported over the last 24 hours.

There were 35,445 positive tests.

Almost 12,000 people have died from COVID in the first half of September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.2% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low by the end of September - although this seems unlikely now (that would still be a large number of new cases, but progress).