by Calculated Risk on 9/13/2020 09:00:00 PM

Sunday, September 13, 2020

Sunday Night Futures

Weekend:

• Schedule for Week of September 13, 2020

• FOMC Preview

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 18 and DOW futures are up 135 (fair value).

Oil prices were down over the last week with WTI futures at $37.36 per barrel and Brent at $39.72 barrel. A year ago, WTI was at $55, and Brent was at $61 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.18 per gallon. A year ago prices were at $2.56 per gallon, so gasoline prices are down $0.38 per gallon year-over-year.

September 13 COVID-19 Test Results

by Calculated Risk on 9/13/2020 06:51:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 733,710 test results reported over the last 24 hours.

There were 38,543 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.3% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph).

By June, the percent positive had dropped below 5% (lower than today). If people stay vigilant, the number of cases might drop to the June low by the end of September (that would still be a large number of new cases, but progress).

FOMC Preview

by Calculated Risk on 9/13/2020 09:47:00 AM

Expectations are there will be no change to policy when the FOMC meets this week.

Here are some comments from Goldman Sachs economist David Mericle:

The Fed concluded its framework review between meetings with the adoption of a new flexible average inflation targeting strategy in August. We expect the FOMC to modify its post-meeting statement to recognize the new approach by replacing the current reference to its “symmetric 2 percent inflation objective” with a reference to “inflation that averages 2% over time.”For review, here are the June FOMC projections. Projections will be updated at this meeting and there will be substantial changes to GDP, the unemployment rate, and inflation projections.

The Summary of Economic Projections is likely to show large upgrades to the growth and unemployment forecasts in recognition of the surprisingly strong data over the last few months. But we expect that the median projection will still show an unemployment rate modestly above the longer-run rate and inflation just below 2% even at the end of the forecast horizon in 2023, a bit short of the conditions that we expect to eventually trigger liftoff.

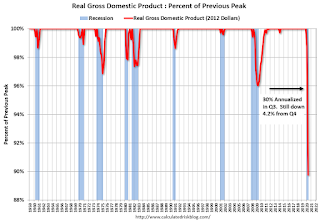

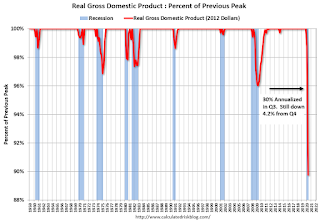

Note that GDP decreased at a 5.0% annual rate in Q1, and decreased at a 31.7% annual rate in Q2.

Most forecasts are for GDP to increase at a 25% to 35% annual rate in Q3.

It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 30% annualized increase in Q3 GDP, is about 6.8% QoQ, and would leave real GDP down about 4.2% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.2% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 30% annualized increase in real GDP would look like in Q3.

Even with a 30% annualized increase (about 6.8% QoQ), real GDP will be down about 4.2% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

Merrill Lynch is projecting:

We revise up our 3Q GDP forecast to 27% qoq saar from 15% previously, but take down 4Q to 3.0% qoq saar from 5.0%. 2Q GDP is tracking -31.6% qoq saar.Based on Merrill's projections, GDP would decline 4.0% in Q4 2020 compared to Q4 2019.

This suggests the FOMC will revise up their GDP projections for 2020, and possibly revise down their projections for the following years.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | -7.6 to -5.5 | 4.5 to 6.0 | 3.0 to 4.5 | |

The unemployment rate was at 8.4% in August. The unemployment rate declined faster than most expectations.

Note that the unemployment rate doesn't remotely capture the economic damage to the labor market. Not only are there almost 14 million people unemployed, close to 4 million people have left the labor force since January. And millions more are being supported by various provisions for the CARES Act - that hasn't been renewed

The unemployment rate will be revised down for all three years.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | 9.0 to 10.0 | 5.9 to 7.5 | 4.8 to 6.1 | |

As of July 2020, PCE inflation was up 1.0% from July 2019. The projections for inflation will be revised up this month.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | 0.6 to 1.0 | 1.4 to 1.7 | 1.6 to 1.8 | |

PCE core inflation was up 1.3% in July year-over-year. Projections for core inflation will be revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | 0.9 to 1.1 | 1.4 to 1.7 | 1.6 to 1.8 | |

Projections will change significantly this month, with GDP being revised up for 2020, and the unemployment rate revised down. Inflation will also be revised up.

Saturday, September 12, 2020

September 12 COVID-19 Test Results

by Calculated Risk on 9/12/2020 06:27:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 763,682 test results reported over the last 24 hours.

There were 37,295 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph).

By June, the percent positive had dropped below 5% (lower than today). If people stay vigilant, the number of cases might drop to the June low by the end of September (that would still be a large number of new cases, but progress).

Schedule for Week of September 13, 2020

by Calculated Risk on 9/12/2020 08:11:00 AM

The key economic reports this week are August Housing Starts and Retail Sales.

For manufacturing, August Industrial Production, and the September New York and Philly Fed surveys, will be released this week.

The FOMC meets this week, and no change to policy is expected.

No major economic releases scheduled.

8:30 AM ET: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 5.9, up from 3.7.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 1.0% increase in Industrial Production, and for Capacity Utilization to increase to 71.5%.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for August will be released. The consensus is for a 1.0% increase in retail sales.

8:30 AM ET: Retail sales for August will be released. The consensus is for a 1.0% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 4.2% on a YoY basis in July.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 78, unchanged from 78 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

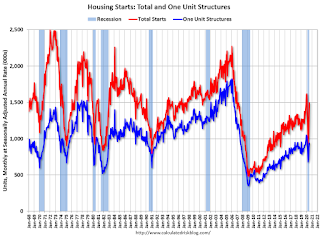

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. This graph shows single and total housing starts since 1968.

The consensus is for 1.470 million SAAR, down from 1.496 million SAAR.

8:30 AM: The initial weekly unemployment claims report will be released. The early consensus is for a 900 thousand initial claims, up from 884 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 15.5, down from 17.2.

10:00 AM: State Employment and Unemployment (Monthly) for August 2020

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for September).

Friday, September 11, 2020

September 11 COVID-19 Test Results

by Calculated Risk on 9/11/2020 06:42:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 765,997 test results reported over the last 24 hours.

There were 44,927 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph).

By June, the percent positive had dropped below 5% (lower than today). If people stay vigilant, the number of cases might drop to the June low by the end of September (that would still be a large number of new cases, but progress).

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 9/11/2020 01:32:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of September 8th.

From 1.7M Forbearance Plans Set to Expire in September

Improvement in the number of active forbearance plans continued this past week. Entering the month, more than 2M forbearance plans were set to expire in September.

That number’s already down 350K to 1.7M in the first full week of the month as those expirations begin to be assessed for extensions and removals.

After dropping by nearly 150K last week, the total number of mortgages in active forbearance declined another 66K (-2%) this week.

...

All in all, active forbearances are now down 238K (-6%) over the past 30 days, as servicers continue to proactively work their way through the wave of forbearance plans set to expire in September.

As of September 8, 3.7M homeowners remain in COVID-19-related forbearance plans. That’s down more than 22% from the peak of over 4.7M in late May

emphasis added

Click on graph for larger image.

Click on graph for larger image.CR Note: We might see an increase in forbearance requests in September without further relief, although the lack of disaster relief is probably hitting renters harder.

Q3 GDP Forecasts

by Calculated Risk on 9/11/2020 11:29:00 AM

From Merrill Lynch:

We revise up our 3Q GDP forecast to 27% qoq saar from 15% previously, but take down 4Q to 3.0% qoq saar from 5.0%. 2Q GDP is tracking -31.6% qoq saar. [Sept 11 estimate]From Goldman Sachs:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +35% (qoq ar). [Sept 10 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 15.6% for 2020:Q3 and 7.3% for 2020:Q4. [Sept 11 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 30.8 percent on September 10, up from 29.6 percent on September 3. [Sept 10 estimate]It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 30% annualized increase in Q3 GDP, is about 6.8% QoQ, and would leave real GDP down about 4.2% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.2% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 30% annualized increase in real GDP would look like in Q3.

Even with a 30% annualized increase (about 6.8% QoQ), real GDP will be down about 4.2% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

Cleveland Fed: Key Measures Show Inflation increased Year-over-year in August

by Calculated Risk on 9/11/2020 11:15:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% August. The 16% trimmed-mean Consumer Price Index rose 0.3% in August. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details for August here. Used cars and trucks increased at a 88% annualized rate in August.

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.7%, the trimmed-mean CPI rose 2.5%, and the CPI less food and energy rose 1.7%. Core PCE is for July and increased 1.3% year-over-year.

Even with the increases in inflation in July and August, overall inflation will not be a concern during the crisis.

Early Look at 2021 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 9/11/2020 08:40:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.4 percent over the last 12 months to an index level of 253.597 (1982-84=100). For the month, the index rose 0.4 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2019, the Q3 average of CPI-W was 250.200.

The 2019 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 1.4% year-over-year in August, and although this is very early - we need the data for September - my current guess is COLA will increase over 1% this year, but lower than the 1.6% last year, and the smallest increase since 2016.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2019 yet, but wages probably increased again in 2019. If wages increased the same as in 2018, then the contribution base next year will increase to around $142,700 in 2021, from the current $137,700.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).