by Calculated Risk on 7/02/2020 08:55:00 AM

Thursday, July 02, 2020

Weekly Initial Unemployment Claims decrease to 1,427,000

The DOL reported:

In the week ending June 27, the advance figure for seasonally adjusted initial claims was 1,427,000, a decrease of 55,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 1,480,000 to 1,482,000. The 4-week moving average was 1,503,750, a decrease of 117,500 from the previous week's revised average. The previous week's average was revised up by 500 from 1,620,750 to 1,621,250.The previous week was revised up.

emphasis added

This does not include the 839,563 initial claims for Pandemic Unemployment Assistance (PUA).

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 1,503,750.

This was close to the consensus forecast of 1.4 million initial claims and the previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims increased to 19,290,000 (SA) from 19,231,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 12,853,163 receiving Pandemic Unemployment Assistance (PUA). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

June Employment Report: 4.8 Million Jobs Added, 11.1% Unemployment Rate

by Calculated Risk on 7/02/2020 08:41:00 AM

From the BLS:

Total nonfarm payroll employment rose by 4.8 million in June, and the unemployment rate declined to 11.1 percent, the U.S. Bureau of Labor Statistics reported today. These improvements in the labor market reflected the continued resumption of economic activity that had been curtailed in March and April due to the coronavirus (COVID-19) pandemic and efforts to contain it. In June, employment in leisure and hospitality rose sharply. Notable job gains also occurred in retail trade, education and health services, other services, manufacturing, and professional and business services.

...

The change in total nonfarm payroll employment for April was revised down by 100,000, from -20.7 million to -20.8 million, and the change for May was revised up by 190,000, from +2.5 million to +2.7 million. With these revisions, employment in April and May combined was 90,000 higher than previously reported.

emphasis added

Click on graph for larger image.

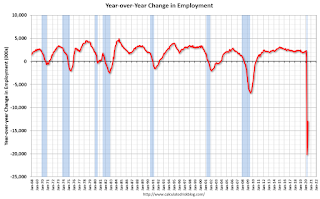

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In June, the year-over-year change was -12.957 million jobs.

Total payrolls increased by 4.8 million in June.

Payrolls for April and May were revised up 90 thousand combined.

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession is by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

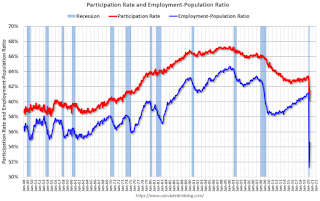

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 61.5% in June. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 61.5% in June. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 54.6% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in June to 11.1%.

This was well above consensus expectations of 3,070,000 jobs added, and April and May were revised up by 90,000 combined.

I'll have much more later …

Wednesday, July 01, 2020

Thursday: Employment Report, Initial Unemployment Claims, Trade Deficit

by Calculated Risk on 7/01/2020 08:47:00 PM

Thursday:

• At 8:30 AM ET, Employment Report for June. The consensus is for 3,074,000 jobs added, and for the unemployment rate to decrease to 12.3%.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a 1.400 million initial claims, down from 1.480 million the previous week.

• Also at 8:30 AM, Trade Balance report for May from the Census Bureau. The consensus is the trade deficit to be $52.4 billion. The U.S. trade deficit was at $49.4 Billion the previous month.

July 1 COVID-19 Test Results, Highest Percent Positive Since Early May, Over 50,000 Positive

by Calculated Risk on 7/01/2020 06:40:00 PM

UPDATE: First post didn't include California numbers. Now updated.

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day.

There were 621,114 test results reported over the last 24 hours.

There were 52,982 positive tests. This is the most daily positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.5% (red line).

For the status of contact tracing by state, check out testandtrace.com.

FOMC Minutes: Pandemic "Posed considerable downside risks to the economic outlook over the medium term"

by Calculated Risk on 7/01/2020 02:07:00 PM

From the Fed: Minutes of the Federal Open Market Committee June 9-10, 2020. A few excerpts:

Over the intermeeting period, risk sentiment improved, on net, as optimism over reopening the economy, potential coronavirus treatments, the unexpectedly positive May employment situation report, and other indicators that suggest that economic activity may be rebounding more than offset concerns arising from otherwise dire economic data releases, warnings from health experts that openings may have been premature, and renewed tensions between the United States and China. Equity prices rose, and corporate bond spreads narrowed notably. ...

...

Participants noted that the coronavirus outbreak was causing tremendous human and economic hardship across the United States and around the world. The virus and the measures taken to protect public health induced sharp declines in economic activity and a surge in job losses. Weaker demand and significantly lower oil prices were holding down consumer price inflation. Financial conditions had improved, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

...

In their discussion of monetary policy for this meeting, members agreed that the coronavirus outbreak was causing tremendous human and economic hardship across the United States and around the world. The virus and the measures taken to protect public health had induced sharp declines in economic activity and a surge in job losses. Consumer price inflation was being held down by weaker demand and significantly lower oil prices. Financial conditions had improved, in part reflecting policy measures to support the economy and the flow of credit to U.S. households, businesses, and communities. Members agreed that the Federal Reserve was committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum-employment and price-stability goals.

Members further concurred that the ongoing public health crisis would weigh heavily on economic activity, employment, and inflation in the near term and posed considerable downside risks to the economic outlook over the medium term. In light of these developments, members decided to maintain the target range for the federal funds rate at 0 to 1/4 percent. Members noted that they expected to maintain this target range until they were confident that the economy had weathered recent events and was on track to achieve the Committee's maximum-employment and price-stability goals.

emphasis added

June Employment Preview

by Calculated Risk on 7/01/2020 01:13:00 PM

On Thursday at 8:30 AM ET, the BLS will release the employment report for June (Friday is a holiday). The consensus is for an increase of 3.1 million non-farm payroll jobs, and for the unemployment rate to decrease to 12.3%.

Last month, the BLS reported 2,509,000 jobs added in May and the unemployment rate decreased to 13.3%.

There was quite a bit of discussion last month on misclassification of workers, and it is likely the actual unemployment rate was much higher than 13.3% last month. The BLS put out a note on Monday discussing this issue: Update on the Misclassification that Affected the Unemployment Rate. The BLS is working with the Census Bureau (Census conducts the survey), to minimize misclassification going forward. This means the unemployment rate might be higher than expected in June.

Merrill Lynch economists wrote this morning: "We expect continued recovery in the June jobs report with nonfarm payroll growth of 2.8mn, picking up from +2.5mn in May. The unemployment rate is likely to fall to 12.5% with strong job gains but also a tick up in labor participation."

Note that the ADP report showed 2.369 million private sector jobs added in June; below expectations.

The usual indicators are somewhat useless again this month. For example, the ISM manufacturing employment index increased in June to 42.1% from 31.1% in May, but still well below 50. This would suggest around 60,000 manufacturing jobs lost in June - although ADP showed 88,000 manufacturing jobs added.

And the weekly claims report showed 1.48 million initial unemployment claims last week (about 2.2 million initial claims including Pandemic Unemployment Assistance). This is extremely high, but well down from the reference weeks in April and May.

IMPORTANT: The employment report will probably show a large increase in state and local government education hiring. This is because of a quirk in the seasonal adjustment, see: Will State and Local Governments Hire 1 Million Teachers in June and July? No, but ...

• Conclusion: It appears that quite a few jobs were added in June, and according to the ADP report, many of the jobs were in leisure and hospitality, as restaurants and bars reopened. Some of those jobs will probably be lost in July with the surge in COVID cases.

No matter what the June report shows, there will be millions and millions of people unemployed, and the course of the economy will be determined by the course of the virus.

Construction Spending Decreased in May

by Calculated Risk on 7/01/2020 11:05:00 AM

From the Census Bureau reported that overall construction spending decreased in May:

Construction spending during May 2020 was estimated at a seasonally adjusted annual rate of $1,356.4 billion, 2.1 percent below the revised April estimate of $1,386.1 billion. The May figure is 0.3 percent above the May 2019 estimate of $1,352.9 billion. During the first five months of this year, construction spending amounted to $543.2 billion, 5.7 percent above the $513.7 billion for the same period in 2019.Private spending decreased and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,001.2 billion, 3.3 percent below the revised April estimate of $1,035.2 billion. ...

In May, the estimated seasonally adjusted annual rate of public construction spending was $355.2 billion, 1.2 percent above the revised April estimate of $350.9 billion.

Click on graph for larger image.

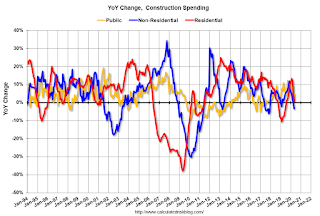

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 21% below the previous peak.

Non-residential spending is 12% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 9% above the previous peak in March 2009, and 35% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up slightly. Non-residential spending is down 3.4% year-over-year. Public spending is up 4.7% year-over-year.

This was below consensus expectations of a 1% increase in spending, however construction spending for the previous year was revised up.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors.

ISM Manufacturing index Increased to 52.6 in June

by Calculated Risk on 7/01/2020 10:05:00 AM

The ISM manufacturing index indicated expansion in June. The PMI was at 52.6% in June, up from 43.1% in May. The employment index was at 42.1%, up from 32.1% last month, and the new orders index was at 56.4%, up from 31.8%.

From the Institute for Supply Management: June 2020 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in June, with the overall economy notching a second month of growth after one month of contraction, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.This was above expectations of 49.0%, but the employment index indicated further contraction.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The June PMI® registered 52.6 percent, up 9.5 percentage points from the May reading of 43.1 percent. This figure indicates expansion in the overall economy for the second straight month after April’s contraction, which ended a period of 131 consecutive months of growth. The New Orders Index registered 56.4 percent, an increase of 24.6 percentage points from the May reading of 31.8 percent. The Production Index registered 57.3 percent, up 24.1 percentage points compared to the May reading of 33.2 percent. The Backlog of Orders Index registered 45.3 percent, an increase of 7.1 percentage points compared to the May reading of 38.2 percent. The Employment Index registered 42.1 percent, an increase of 10 percentage points from the May reading of 32.1 percent. The Supplier Deliveries Index registered 56.9 percent, down 11.1 percentage points from the May figure of 68 percent.

emphasis added

This suggests manufacturing expanded slightly in June, after the steep collapse in the previous months.

ADP: Private Employment increased 2,369,000 in June

by Calculated Risk on 7/01/2020 08:19:00 AM

Private sector employment increased by 2,369,000 jobs from May to June according to the June ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 3,000,000 private sector jobs added in the ADP report.

“Small business hiring picked up in the month of June,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “As the economy slowly continues to recover, we are seeing a significant rebound in industries that once experienced the greatest job losses. In fact, 70 percent of the jobs added this month were in the leisure and hospitality, trade and construction industries.”

The BLS report will be released Thursday (Friday is a holiday), and the consensus is for 3,074,000 non-farm payroll jobs added in June.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 7/01/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 26, 2020.

... The Refinance Index decreased 2 percent from the previous week and was 74 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 15 percent higher than the same week one year ago.

“Mortgage applications fell last week despite mortgage rates hitting another record low in MBA’s survey. Investors are contemplating the risks of the recent resurgence of COVID-19 cases to the labor market and economy, and Treasury rates and mortgage rates are moving lower as a result,” said Joel Kan, MBA’s Associative Vice President of Economic and Industry Forecasting. “After two months of strong growth, purchase applications declined for the second week in a row. The weakening in activity is potentially a signal that pent-up demand is starting to wane and that low housing supply is limiting prospective buyers’ options. The average purchase application loan size increased to a record high in our survey – more proof that tight inventory conditions are leading to faster price growth.”

Added Kan, “Refinance applications also decreased but remained 74 percent higher than a year ago. The 30-year fixed rate has been below the 3.5 percent mark since late March. It is possible that many borrowers have already refinanced or are waiting for rates to go even lower.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.29 percent from 3.30 percent, with points increasing to 0.36 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is up signficantly from last year.

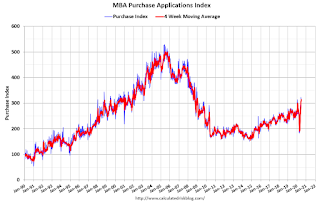

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 15% year-over-year.

Note: Red is a four-week average (blue is weekly).