by Calculated Risk on 1/27/2020 10:14:00 AM

Monday, January 27, 2020

New Home Sales at 694,000 Annual Rate in December

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 694 thousand.

The previous three months were revised down, combined.

"Sales of new single‐family houses in December 2019 were at a seasonally adjusted annual rate of 694,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.4 percent below the revised November rate of 697,000, but is 23.0 percent above the December 2018 estimate of 564,000.

An estimated 681,000 new homes were sold in 2019. This is 10.3 percent above the 2018 figure of 617,000. "

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in December to 5.7 months from 5.5 months in November.

The months of supply increased in December to 5.7 months from 5.5 months in November. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of December was 327,000. This represents a supply of 5.7 months at the current sales rate."

On inventory, according to the Census Bureau:

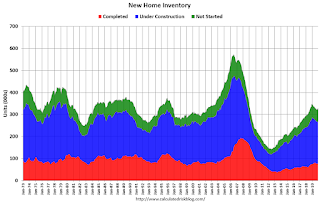

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In December 2019 (red column), 47 thousand new homes were sold (NSA). Last year, 38 thousand homes were sold in December.

The all time high for December was 87 thousand in 2005, and the all time low for December was 23 thousand in both 1966 and 2010.

This was below expectations of 730 thousand sales SAAR, and sales in the three previous months were revised down, combined. However this was still solid with sales up 23% year-over-year. I'll have more later today.

Sunday, January 26, 2020

Monday: New Home Sales

by Calculated Risk on 1/26/2020 08:04:00 PM

Weekend:

• Schedule for Week of January 26, 2020

Monday:

• At 10:00 AM ET, New Home Sales for December from the Census Bureau. The consensus is for 730 thousand SAAR, up from 719 thousand in November.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for January.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 49 and DOW futures are down 235 (fair value).

Oil prices were down over the last week with WTI futures at $52.87 per barrel and Brent at $59.40 barrel. A year ago, WTI was at $52, and Brent was at $59 - so oil prices are mostly unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.51 per gallon. A year ago prices were at $2.26 per gallon, so gasoline prices are up 25 cents per gallon year-over-year.

FOMC Preview

by Calculated Risk on 1/26/2020 12:09:00 PM

Expectations are there will be no change to policy when the FOMC meets this week. Also there should be minimal changes to the FOMC statement, and Fed Chair Powell will mostly repeat his comments from the December meeting.

There should be no surprises.

Here are some comments from Goldman Sachs chief economist Jan Hatzius and economist David Choi:

"The FOMC is set to keep the target range for the funds rate on hold at 1.5-1.75% at the January meeting ... We expect minimal changes to the statement, and for the policy guidance section to remain unchanged. … Economic conditions have changed little on net since the FOMC met in December, while financial conditions have eased significantly further. … Beyond the January meeting, we see a high bar for policy moves in either direction, and we expect the funds rate to remain unchanged in 2020.”For review, here are the December FOMC projections. In general the data has been close to expectations, suggesting no change in policy at this meeting.

Q1 2019 real GDP growth was at 3.1% annualized, Q2 at 2.0% and Q3 at 2.1%. Currently the consensus is for 2.1% in Q4. So 2019 was about as expected.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2019 | 2020 | 2021 | 2022 |

| Dec 2019 | 2.1 to 2.2 | 2.0 to 2.2 | 1.8 to 2.0 | 1.8 to 2.0 |

| Sept 2019 | 2.1 to 2.3 | 1.8 to 2.1 | 1.8 to 2.0 | NA |

The unemployment rate was at 3.5% in December. So the unemployment rate projection for Q4 2019 was correct. Note: My guess is the unemployment rate will decrease further in 2020, and I expect the FOMC to revised down unemployment projections for 2020 later this year.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2019 | 2020 | 2021 | 2022 |

| Dec 2019 | 3.5 to 3.6 | 3.5 to 3.7 | 3.5 to 3.9 | 3.5 to 4.0 |

| Sept 2019 | 3.6 to 3.7 | 3.6 to 3.8 | 3.6 to 3.9 | NA |

As of November 2019, PCE inflation was up 1.5% from November 2018 So PCE inflation projections were close.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2019 | 2020 | 2021 | 2022 |

| Dec 2019 | 1.4 to 1.5 | 1.8 to 1.9 | 2.0 to 2.1 | 2.0 to 2.2 |

| Sept 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 | NA |

PCE core inflation was up 1.6% in November year-over-year. So Core PCE inflation was revised also close to expectations.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2019 | 2020 | 2021 | 2022 |

| Dec 2019 | 1.6 to 1.7 | 1.9 to 2.0 | 2.0 to 2.1 | 2.0 to 2.2 |

| Sept 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 | NA |

Saturday, January 25, 2020

Schedule for Week of January 26, 2020

by Calculated Risk on 1/25/2020 08:11:00 AM

The key reports scheduled for this week are the advance estimate of Q4 GDP and December New Home sales. Other key indicators include December Personal Income and Outlays and November Case-Shiller house prices.

For manufacturing, the Dallas and Richmond Fed manufacturing surveys will be released.

The FOMC meets this week, and no change to policy is expected at this meeting.

10:00 AM: New Home Sales for December from the Census Bureau.

10:00 AM: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the sales rate for last month.

The consensus is for 730 thousand SAAR, up from 719 thousand in November.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for January.

8:30 AM: Durable Goods Orders for December. The consensus is for a 0.5% increase in durable goods.

9:00 AM ET: S&P/Case-Shiller House Price Index for December.

9:00 AM ET: S&P/Case-Shiller House Price Index for December.This graph shows the Year over year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.4% year-over-year increase in the Comp 20 index for December.

10:30 AM: Richmond Fed Survey of Manufacturing Activity for January. This is the last of regional manufacturing surveys for January.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for December. The consensus is for a 0.5% increase in the index.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 211,000 last week.

8:30 AM: Gross Domestic Product, 4th quarter 2019 (Advance estimate). The consensus is that real GDP increased 2.1% annualized in Q4, the same as in Q3.

10:00 AM: the Q4 2019 Housing Vacancies and Homeownership from the Census Bureau.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 48.5, up from 48.2 in December.

10:00 AM: University of Michigan's Consumer sentiment index (Final for January). The consensus is for a reading of 99.1.

Friday, January 24, 2020

Q4 GDP Forecasts: 1.2% to 2.2%

by Calculated Risk on 1/24/2020 12:49:00 PM

The preliminary estimate of Q4 GDP will be released on Thursday, January 30th. The consensus is that annualized real GDP increased 2.2% in Q4.

From Merrill Lynch

We expect GDP growth in 4Q to hold steady at 2.0% qoq saar. [Jan 24 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.2% for 2019:Q4 and 1.7% for 2020:Q1. [Jan 24 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 1.8 percent on January 17. [Jan 17 estimate]CR Note: These estimates suggest real GDP growth will be between 1.2% and 2.2% annualized in Q4.

BLS: December Unemployment rates at New Series Lows in Eight States

by Calculated Risk on 1/24/2020 10:52:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in December in 11 states, higher in 4 states, and stable in 35 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Eight states had jobless rate decreases from a year earlier, 1 state had an increase, and 41 states and the District had little or no change. The national unemployment rate, 3.5 percent, was unchanged over the month but was 0.4 percentage point lower than in December 2018.

...

South Carolina, Utah, and Vermont had the lowest unemployment rates in December, 2.3 percent each. The rates in Colorado (2.5 percent), Florida (3.0 percent), Georgia (3.2 percent), Illinois (3.7 percent), Oregon (3.7 percent), South Carolina (2.3 percent), Utah (2.3 percent), and Washington (4.3 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.1 percent.

emphasis added

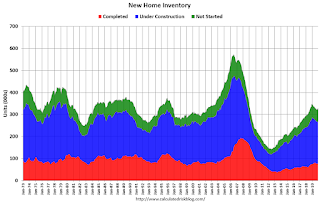

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue). Note that Alaska is at a series low (since 1976). Three states and the D.C. have unemployment rates above 5%; Alaska, Mississippi and West Virginia.

A total of twelve states are at a series low: Alabama, Alaska, California, Colorado, Florida, Georgia, Illinois, Nevada, Oregon, South Carolina, Utah and Washington.

Sacramento Housing in December: Sales Up 12.7% YoY, Active Inventory down 38.8% YoY

by Calculated Risk on 1/24/2020 08:30:00 AM

From SacRealtor.org: December market sees inventory drop 27%

December closed with 1,244 sales, up slightly from 1,242 in November. Compared to one year ago (1,104), the current figure is up 12.7%.1) Overall sales increased to 1,244 in December, up from 1,104 in December 2018. Sales were up slightly from November 2019 (previous month), and up 12.7% from December 2018.

...

Over the last three months the Active Listing Inventory has decreased from 2,301 units in October to 1,803 units in November to 1,315 units for December. From October to December, this is a 43% decrease. From November to December, this is a 27% decrease. The Months of Inventory dropped from 1.5 to 1.1 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. [Note: Compared to December 2018, inventory is down 38.8%] .

...

The Median DOM (days on market) increased from 15 to 19 and the Average DOM increased from 29 to 32. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

2) Active inventory was at 1,315, down from 2,149 in December 2018. That is down 38.8% year-over-year. This is the eighth consecutive month with a YoY decline following 20 months of YoY increases in inventory.

Thursday, January 23, 2020

Hotels: Occupancy Rate Increases Year-over-year

by Calculated Risk on 1/23/2020 04:43:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 18 January

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 12-18 January 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 13-19 January 2019, the industry recorded the following:

• Occupancy: +1.1% to 58.9%

• Average daily rate (ADR): +5.2% to US$130.99

• Revenue per available room (RevPAR): +6.4% to US$77.16

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The early average occupancy rate in 2020 is tracking the last few years.

Seasonally, the 4-week average of the occupancy rate will increase over the next several months..

Data Source: STR, Courtesy of HotelNewsNow.com

LA area Port Traffic Down Year-over-year in December

by Calculated Risk on 1/23/2020 01:30:00 PM

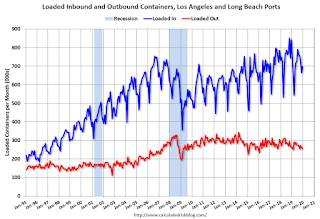

Special note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 1.7% in December compared to the rolling 12 months ending in November. Outbound traffic was down 0.2% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports had been increasing (although down in 2019), and exports have mostly moved sideways over the last 8 years - but have also moved down recently.

Kansas City Fed: "Tenth District Manufacturing Activity Nearly Flat in January"

by Calculated Risk on 1/23/2020 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Nearly Flat in January

The Federal Reserve Bank of Kansas City released the January Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity was nearly flat in January while expectations for future activity expanded.Another weak Tenth District manufacturing report.

“Regional factory activity was down only slightly in January, and firms reported a modest increase in employment,” said Wilkerson. “Contacts reported slightly less difficulty finding workers than six months ago, but still over 60 percent of firms were experiencing labor shortages.”

...

The month-over-month composite index was -1 in January, slightly higher than -5 in December and -2 in November. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The slight decrease in district manufacturing activity was driven by declines in: nonmetallic mineral products, primary metal, fabricated metal products, computer and electronic products, beverage and tobacco products, and printing manufacturing, while several other industries improved. Most month-over-month indexes remained slightly negative in January, and inventories continued to decline. However, the month-over-month employment index rose back into positive territory for the first time in over six months and the supplier delivery time index was also slightly positive.

emphasis added