by Calculated Risk on 1/17/2020 02:18:00 PM

Friday, January 17, 2020

Q4 GDP Forecasts: 1.2% to 2.0%

From Merrill Lynch

On balance retail sales cut our 4Q GDP tracking by 0.2pp to 2.0% qoq saar. [Jan 17 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.2% for 2019:Q4 and 1.7% for 2020:Q1. [Jan 17 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 1.8 percent on January 17, unchanged from January 16 after rounding. After this morning’s housing starts report from the U.S. Census Bureau and industrial production release from the Federal Reserve Board of Governors, a decrease in the nowcast of fourth-quarter real personal consumption expenditures growth from 1.6 percent to 1.4 percent was partly offset by an increase in the nowcast of real residential investment growth from 4.3 percent to 5.5 percent. [Jan 17 estimate]CR Note: These estimates suggest real GDP growth will be between 1.2% and 2.0% annualized in Q4.

Comments on December Housing Starts

by Calculated Risk on 1/17/2020 12:22:00 PM

Earlier: Housing Starts increased to 1.608 Million Annual Rate in December

Total housing starts in December were well above expectations and revisions to prior months were positive.

The housing starts report showed starts were up 16.9% in December compared to November, and starts were up 40.8% year-over-year compared to December 2018.

These were blow out numbers! This was the highest level for starts since December 2006 (end of the bubble). However, the weather was very nice in December, and the weather probably had a significant impact on the seasonally adjusted housing starts number. The winter months of December and January have the largest seasonal factors, so nice weather can really have an impact. Note that Permits were more inline with expectations (still solid).

Single family starts were up 29.6% year-over-year, and multi-family starts were up 74.6% YoY.

This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Starts were up 40.8% in December compared to December 2018.

For the year, starts were up 3.2% compared to 2018.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the comparison was easy in December.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - then completions caught up with starts- although starts are picking up a little again.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

BLS: Job Openings "Fell" to 6.8 Million in November

by Calculated Risk on 1/17/2020 10:06:00 AM

Notes: In November there were 6.800 million job openings, and, according to the November Employment report, there were 5.811 million unemployed. So, for the twenty-first consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (almost 5 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings fell to 6.8 million (-561,000) on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.8 million and 5.6 million, respectively. Within separations, the quits rate was unchanged at 2.3 percent and the layoffs and discharges rate was little changed at 1.1 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of total nonfarm quits was little changed in November at 3.5 million and the rate was unchanged at 2.3 percent. Quits increased in retail trade (+118,000), wholesale trade (+26,000), and nondurable goods manufacturing (+19,000). Quits decreased in other services (-63,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November, the most recent employment report was for December.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in November to 6.800 million from 7.361 million in October.

The number of job openings (yellow) are down 11% year-over-year.

Quits are up 4.6% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are at a high level, but have been declining - and are down 11% year-over-year. Quits are still increasing year-over-year.

Industrial Production Decreased in December

by Calculated Risk on 1/17/2020 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production declined 0.3 percent in December, as a decrease of 5.6 percent for utilities outweighed increases of 0.2 percent for manufacturing and 1.3 percent for mining. The drop for utilities resulted from a large decrease in demand for heating, as unseasonably warm weather in December followed unseasonably cold weather in November. For the fourth quarter as a whole, total industrial production moved down at an annual rate of 0.5 percent. At 109.4 percent of its 2012 average, total industrial production was 1.0 percent lower in December than it was a year earlier. Capacity utilization for the industrial sector fell 0.4 percentage point in December to 77.0 percent, a rate that is 2.8 percentage points below its long-run (1972–2018) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.0% is 2.8% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in December to 109.7. This is 25.6% above the recession low, and 3.8% above the pre-recession peak.

The change in industrial production and decrease in capacity utilization were below consensus expectations.

Housing Starts increased to 1.608 Million Annual Rate in December

by Calculated Risk on 1/17/2020 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in December were at a seasonally adjusted annual rate of 1,608,000. This is 16.9 percent above the revised November estimate of 1,375,000 and is 40.8 percent above the December 2018 rate of 1,142,000. Single‐family housing starts in December were at a rate of 1,055,000; this is 11.2 percent above the revised November figure of 949,000. The December rate for units in buildings with five units or more was 536,000.

An estimated 1,289,800 housing units were started in 2019. This is 3.2 percent above the 2018 figure of 1,249,900.

Building Permits:

Privately‐owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,416,000. This is 3.9 percent below the revised November rate of 1,474,000, but is 5.8 percent above the December 2018 rate of 1,339,000. Single‐family authorizations in December were at a rate of 916,000; this is 0.5 percent below the revised November figure of 921,000. Authorizations of units in buildings with five units or more were at a rate of 458,000 in December.

An estimated 1,368,800 housing units were authorized by building permits in 2019. This is 3.9 percent above the 2018 figure of 1,317,900.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were up in December compared to November. Multi-family starts were up 68.6% year-over-year in December.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last several years.

Single-family starts (blue) increased in December, and were up 29.6% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in December were well above expectations and revisions were positive.

I'll have more later …

Thursday, January 16, 2020

Friday: Housing Starts, Industrial Production, Job Openings

by Calculated Risk on 1/16/2020 07:20:00 PM

Friday:

• At 8:30 AM ET, Housing Starts for December. The consensus is for 1.378 million SAAR, up from 1.365 million SAAR.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to be decrease to 77.1%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for January). The consensus is for a reading of 99.3.

• At 10:00 AM, Job Openings and Labor Turnover Survey for November from the BLS.

Hotels: Occupancy Rate Decreases Year-over-year

by Calculated Risk on 1/16/2020 04:25:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 11 January

The U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 5-11 January 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 6-12 January 2019, the industry recorded the following:

• Occupancy: -3.1% to 51.7%

• Average daily rate (ADR): -4.7% to US$120.43

• Revenue per available room (RevPAR): -7.7% to US$62.30

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The early average occupancy rate in 2020 is tracking last year.

Seasonally, the 4-week average of the occupancy rate will increase over the next several months..

Data Source: STR, Courtesy of HotelNewsNow.com

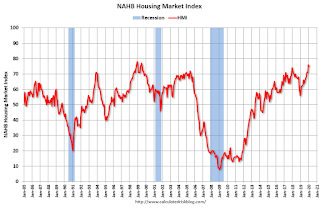

NAHB: Builder Confidence Decreased to 75 in January

by Calculated Risk on 1/16/2020 10:08:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 75, down from 76 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Begins Year Strong as Single-Family Growth Continues

Builder confidence in the market for newly-built single-family homes edged one point lower to 75 in January, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI). The last two monthly readings mark the highest sentiment levels since July of 1999. Low interest rates and a healthy labor market combined with a need for additional inventory is setting the stage for further home building gains in 2020.

...

The HMI index charting traffic of prospective buyers increased one point to 58, the highest level since December 2017. The gauge measuring current sales conditions fell three points to 81 and the component measuring sales expectations in the next six months held steady at 79.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose one point to 62, the Midwest increased three points to 66 and the West moved one point higher to 84. The South remained unchanged at 76.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast and another very strong reading.

Philly Fed Manufacturing Suggests Activity Increased in January

by Calculated Risk on 1/16/2020 09:19:00 AM

From the Philly Fed: Current Manufacturing Indicators Suggest Growth in January

Manufacturing activity in the region increased this month, according to results from the January Manufacturing Business Outlook Survey. The survey’s indicators for current activity, new orders, shipments, and employment were all positive and increased from their readings in December. The survey’s future activity indexes remained at relatively high readings, suggesting continued optimism about growth for the next six months.This was well above the consensus forecast. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity increased nearly 15 points this month, from a revised reading of 2.4 in December to 17.0 … Manufacturers continued to report expanding employment this month. The employment index increased 3 points to 19.3.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through January), and five Fed surveys are averaged (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

These early reports suggest the ISM manufacturing index will likely rebound into positive territory in January.

Retail Sales increased 0.3% in December

by Calculated Risk on 1/16/2020 09:08:00 AM

On a monthly basis, retail sales increased 0.3 percent from November to December (seasonally adjusted), and sales were up 5.8 percent from December 2018.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for December 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $529.6 billion, an increase of 0.3 percent from the previous month, and 5.8 percent above December 2018. Total sales for the 12 months of 2019 were up 3.6 percent from 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.1% in December.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 5.5% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 5.5% on a YoY basis.The increase in December was at expectations, however sales in October and November were revised down.