by Calculated Risk on 12/06/2019 09:20:00 AM

Friday, December 06, 2019

Comments on November Employment Report

The headline jobs number at 266 thousand for November was above consensus expectations of 180 thousand, and the previous two months were revised up 41 thousand, combined. The unemployment rate decreased to 3.5%.

Earlier: November Employment Report: 266,000 Jobs Added, 3.5% Unemployment Rate

In November, the year-over-year employment change was 2.204 million jobs including Census hires.

Seasonal Retail Hiring

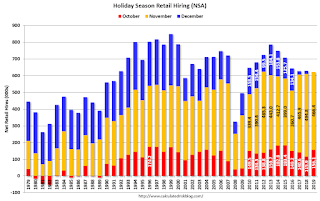

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 466 thousand workers (NSA) net in November. Note: this is NSA (Not Seasonally Adjusted).

In October and November combined, retailers hired about the same number of seasonal workers as in the previous two years.

Average Hourly Earnings

Wage growth was below expectations. From the BLS:

"In November, average hourly earnings for all employees on private nonfarm payrolls rose by 7 cents to $28.29. Over the last 12 months, average hourly earnings have increased by 3.1 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 3.1% YoY in November.

Wage growth had been generally trending up, but has weakened recently.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was unchanged in November at 82.8%, and the 25 to 54 employment population ratio was unchanged at 80.3%.

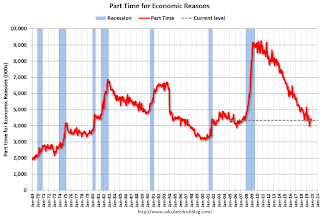

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 4.3 million, changed little in November. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in November to 4.332 million from 4.438 million in October. The number of persons working part time for economic reason has been generally trending down.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 6.9% in November.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.224 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.264 million in October.

Summary:

The headline jobs number was above expectations, and the previous two months were revised up. The headline unemployment rate decreased to 3.5%; however, wage growth was below expectations. Overall this was a solid report.

Note> The conclusion of the GM strike boosted employment in November, after negatively impacting employment in October.

In 2019, the economy has added 1.969 million jobs through November 2019 ex-Census, down from 2.452 million jobs during the same period of 2018 (although 2018 will be revised down with benchmark revision to be released in February 2020). So job growth has slowed.

November Employment Report: 266,000 Jobs Added, 3.5% Unemployment Rate

by Calculated Risk on 12/06/2019 08:44:00 AM

From the BLS:

Total nonfarm payroll employment rose by 266,000 in November, and the unemployment rate was little changed at 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in health care and in professional and technical services. Employment rose in manufacturing, reflecting the return of workers from a strike.

...

The change in total nonfarm payroll employment for September was revised up by 13,000 from +180,000 to +193,000, and the change for October was revised up by 28,000 from +128,000 to +156,000. With these revisions, employment gains in September and October combined were 41,000 more than previously reported.

...

In November, average hourly earnings for all employees on private nonfarm payrolls rose by 7 cents to $28.29. Over the last 12 months, average hourly earnings have increased by 3.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 266 thousand in November (private payrolls increased 254 thousand).

Payrolls for September and October were revised up 41 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In November, the year-over-year change was 2.204 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased in November to 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate decreased in November to 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio was unchanged at 61.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in November to 3.5%.

This was well above consensus expectations of 180,000 jobs added, and September and October were revised up by 41,000 combined. A solid report.

I'll have much more later ...

Thursday, December 05, 2019

Friday: Employment Report

by Calculated Risk on 12/05/2019 07:16:00 PM

My November Employment Preview.

Goldman's November Payrolls preview.

Friday:

• At 8:30 AM ET, Employment Report for November. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for December).

• At 3:00 PM, Consumer Credit from the Federal Reserve.

Goldman: November Payrolls Preview

by Calculated Risk on 12/05/2019 04:04:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 180k in November ... We expect a 46k boost from the end of the General Motors strike … We also believe some of the 68k ADP miss this month reflected legitimate weakness in the ADP jobs panel.

We estimate an unchanged unemployment rate at 3.6% …

emphasis added

November Employment Preview

by Calculated Risk on 12/05/2019 11:24:00 AM

Special Notes on GM Strike and the Decennial Census: The GM strike ended in October, and 46,000 workers were on strike during the BLS reference week in October. These workers returned to their jobs in November, and this should boost employment gains for November. Decennial Census: In August and September, the Census Bureau increased the number of temporary workers by 25,000. This phase of the Decennial Census ended mid-October, and most of these temporary workers were let go in October (20,000), however another 5,000 or so were probably let go in November.

On Friday at 8:30 AM ET, the BLS will release the employment report for November. The consensus is for an increase of 180,000 non-farm payroll jobs in October, and for the unemployment rate to be unchanged at 3.6%.

Last month, the BLS reported 128,000 jobs added in October (including 20,000 temporary Census fires).

Here is a summary of recent data:

• The ADP employment report showed an increase of 67,000 private sector payroll jobs in October. This was well below consensus expectations of 140,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index decreased in November to 46.6%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased around 40,000 in November. The ADP report indicated manufacturing jobs decreased 6,000 in November.

The ISM non-manufacturing employment index increased in November to 55.5%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll increased 220,000 in November.

Combined, the ISM surveys suggest employment gains at 180,000 suggesting gains close to consensus expectations.

• Initial weekly unemployment claims averaged 218,000 in November, up from 215,000 in October. For the BLS reference week (includes the 12th of the month), initial claims were at 228,000, up from 218,000 during the reference week the previous month.

This suggest a few more layoffs (during the reference week) in November than in October.

• The final November University of Michigan consumer sentiment index increased to 96.8 from the October reading of 95.5. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• The BofA job tracker bounced back in November suggesting 195K jobs added in November.

• Conclusion: There were special factors in October (GM strike, decennial Census layoffs) that reduced employment. In November, the resolution of the GM strike will boost employment. Based on these indicators, my guess is employment gains are close to expectations.

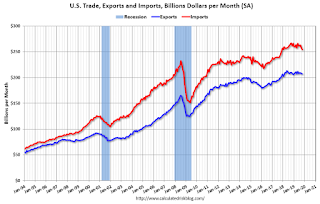

Trade Deficit decreased to $47.2 Billion in October

by Calculated Risk on 12/05/2019 08:44:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $47.2 billion in October, down $3.9 billion from $51.1 billion in September, revised.

October exports were $207.1 billion, $0.4 billion less than September exports. October imports were $254.3 billion, $4.3 billion less than September imports.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in October.

Exports are 25% above the pre-recession peak and down 1% to October 2018; imports are 10% above the pre-recession peak, and down 5% compared to October 2018.

In general, trade both imports and exports have moved more sideways or down recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in September and October.

Oil imports averaged $52.00 per barrel in October, down from $53.12 in September, and down from $61.25 in October 2018.

The trade deficit with China decreased to $31.3 billion in October, from $43.1 billion in October 2018.

Weekly Initial Unemployment Claims decrease to 203,000

by Calculated Risk on 12/05/2019 08:33:00 AM

The DOL reported:

In the week ending November 30, the advance figure for seasonally adjusted initial claims was 203,000, a decrease of 10,000 from the previous week's unrevised level of 213,000. The 4-week moving average was 217,750, a decrease of 2,000 from the previous week's unrevised average of 219,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 217,750.

This was lower than the consensus forecast.

Wednesday, December 04, 2019

Thursday: Trade Deficit, Unemployment Claims

by Calculated Risk on 12/04/2019 07:15:00 PM

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 213,000 last week.

• At 8:30 AM: Trade Balance report for October from the Census Bureau. The consensus is the trade deficit to be $49.0 billion. The U.S. trade deficit was at $52.5 billion in September.

Black Knight: House Price Index up 0.3% in October, Up 4.3% year-over-year

by Calculated Risk on 12/04/2019 01:12:00 PM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight:

Based on the latest data from the Black Knight HPI, October was a strong month for home price gains. And it makes perfect sense.

The annual home price growth rate rose from 3.9% in September to 4.25% in October.

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows their estimate of the MoM and YoY change in House Prices.

This index suggests a pickup in house price appreciation.

ISM Non-Manufacturing Index decreased to 53.9% in November

by Calculated Risk on 12/04/2019 10:05:00 AM

The November ISM Non-manufacturing index was at 53.9%, down from 54.7% in October. The employment index increased to 55.5%, from 53.7%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: November 2019 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 118th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM®Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 53.9 percent, which is 0.8 percentage points lower than the October reading of 54.7 percent. This represents continued growth in the non-manufacturing sector, at a slightly slower rate. The Non-Manufacturing Business Activity Index decreased to 51.6 percent, 5.4 percentage points lower than the October reading of 57 percent, reflecting growth for the 124th consecutive month. The New Orders Index registered 57.1 percent; 1.5 percentage points higher than the reading of 55.6 percent in October. The Employment Index increased 1.8 percentage points in November to 55.5 percent from the October reading of 53.7 percent. The Prices Index increased 1.9 percentage points from the October reading of 56.6 percent to 58.5 percent, indicating that prices increased in November for the 30th consecutive month. According to the NMI®, 12 non-manufacturing industries reported growth. The non-manufacturing sector had a slight pullback in November. The respondents hope for a resolution on tariffs and continue to be hampered by constraints in labor resources.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in November than in October.