by Calculated Risk on 12/04/2019 07:00:00 AM

Wednesday, December 04, 2019

MBA: Mortgage Applications Decreased in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 9.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 29, 2019. This week’s results include an adjustment for the Thanksgiving holiday.

... The Refinance Index decreased 16 percent from the previous week and was 61 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 33 percent compared with the previous week and was 24 percent lower than the same week one year ago.

...

U.S. Treasury rates stayed flat last week, as uncertainty surrounding the U.K. elections offset positive domestic news on consumer spending,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite the 30-year fixed rate remaining unchanged at 3.97 percent, mortgage applications fell last week, driven down by a 16 percent drop in refinances. Purchase applications were up slightly but declined 24 percent from a year ago. This week’s year-over-year comparisons were distorted by Thanksgiving being a week later this year.”

Added Kan, “The purchase market overall looks healthy as we enter the home stretch of 2019. The seasonally adjusted purchase index was at its highest level since July, as a combination of wage gains, slower home-price appreciation, and slightly easing inventory conditions continue to support increased activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) remained unchanged at 3.97 percent, with points increasing to 0.32 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is down 24% year-over-year unadjusted for the Thanksgiving holiday (the timing of the Holiday was different in 2019 compared to 2018).

Tuesday, December 03, 2019

Wednesday: ADP Employment, ISM Non-Mfg

by Calculated Risk on 12/03/2019 08:15:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 140,000 jobs added, up from 125,000 in October.

• At 10:00 AM, the ISM non-Manufacturing Index for November. The consensus is for a decrease to 54.5 from 54.7.

Is the Future still Bright?

by Calculated Risk on 12/03/2019 11:26:00 AM

It was almost seven years ago when I wrote "The Future's so Bright …" I noted that I was the most optimistic since the '90s, and that things would only getting better.

I pointed out that housing starts would increase significantly over the next several years, that state and local governments would start hiring again, that the budget deficit would decline sharply, and that household deleveraging was nearing and an end.

As I noted in January 2013: "There are several tailwinds for the economy, and the headwinds (like household deleveraging) are mostly subsiding."

Now the tailwinds are subsiding. Housing starts and new home sales are still positive, but the significant growth is behind us. For vehicle sales, the growth ended a few years ago, and sales are mostly moving sideways recently.

Some commercial real estate sectors - like hotels - growth is slowing. And the Federal budget deficit is increasing sharply.

Fortunately employment is solid, and household debt service and financial obligation ratios are at record lows.

I've also been positive on demographics too, but unfortunately with less immigration and more prime age deaths, the demographic outlook isn't as favorable as a few years ago (See Lawler:Lawler: Updated “Demographic” Outlook Using Recent Population Estimates by Age)

Census 2017 materially over-predicted births, materially under-predicted deaths (mainly for non-elderly adults), and somewhat over-predicted net international migration (NIM) for each of the last several years.And we haven't addressed some of the longer term challenges I mentioned seven years ago - such as rising health care expenditures, climate change, and income and wealth inequality - in fact policy over the last couple of years have made the situation worse.

I'm not on recession watch, and I expect further growth in 2020, but the future isn't as bright now.

CoreLogic: House Prices up 3.5% Year-over-year in October

by Calculated Risk on 12/03/2019 09:11:00 AM

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports October Home Prices Increased by 3.5% Year Over Year

Home prices nationwide, including distressed sales, increased year over year by 3.5% in October 2019 compared with October 2018 and increased month over month by 0.5% in October 2019 compared with September 2019 (revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results).CR Note: The YoY change in the CoreLogic index decreased over the last year, but is now moving sideways at around 3.5%.

“Local home-price growth can deviate widely from the change in our U.S. index. While we saw prices up 3.5% nationally last year, home prices also declined in 22 metropolitan areas. Price softness occurred in some high-cost urban areas and in metros with weak employment growth during the past year.” Dr. Frank Nothaft, Chief Economist for CoreLogic

The CoreLogic HPI Forecast indicates that home prices will increase by 5.4% on a year-over-year basis from October 2019 to October 2020. On a month-over-month basis, home prices are expected to increase by 0.2% from October 2019 to November 2019. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables.

emphasis added

Monday, December 02, 2019

30 Year Mortgage Rates at 3.75% Top Tier Scenarios

by Calculated Risk on 12/02/2019 09:06:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Up To 2-Week Highs

Mortgage rates increased moderately to begin the new week/month and had been increasing in general during the previous week. The net effect is some lenders are quoting rates that are an eighth of a point higher compared to those seen at the beginning of last week, and an average rate quote that's as high as it's been in just over 2 weeks.Tuesday:

In the bigger picture, this amount of movement is fairly tame. [Most Prevalent Rates For Top Tier Scenarios 30YR FIXED 3.75%]

emphasis added

• All day: Light vehicle sales for November. The consensus is for 16.8 million SAAR in November, up from the BEA estimate of 16.6 million SAAR in October 2019 (Seasonally Adjusted Annual Rate).

• At 10:00 AM, Corelogic House Price index for October.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 12/02/2019 02:55:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now mostly unchanged year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Nov 15, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 10% from a year ago, and CME futures are up 4% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war is a factor with reports that lumber exports to China have declined by 40% since last September.

Construction Spending Decreased in October

by Calculated Risk on 12/02/2019 10:20:00 AM

From the Census Bureau reported that overall construction spending decreased in October:

Construction spending during October 2019 was estimated at a seasonally adjusted annual rate of $1,291.1 billion, 0.8 percent below the revised September estimate of $1,301.8 billion. The October figure is 1.1 percent above the October 2018 estimate of $1,277.4 billion. During the first ten months of this year, construction spending amounted to $1,086.5 billion, 1.7 percent below the $1,105.2 billion for the same period in 2018.Both private and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $956.3 billion, 1.0 percent below the revised September estimate of $966.1 billion. ...

In October, the estimated seasonally adjusted annual rate of public construction spending was $334.8 billion, 0.2 percent below the revised September estimate of $335.6 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018 - and is now 25% below the bubble peak.

Non-residential spending is 8% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 3% above the previous peak in March 2009, and 28% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up slightly. Non-residential spending is down 4% year-over-year. Public spending is up 10% year-over-year.

This was below consensus expectations, however construction spending for August and September were revised up.

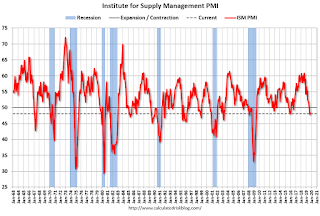

ISM Manufacturing index Decreased to 48.1 in November

by Calculated Risk on 12/02/2019 10:05:00 AM

The ISM manufacturing index indicated contraction in November. The PMI was at 48.1% in November, down from 48.3% in October. The employment index was at 46.6%, down from 47.7% last month, and the new orders index was at 47.2%, down from 49.1%.

From the Institute for Supply Management: November 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in November, and the overall economy grew for the 127th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The November PMI® registered 48.1 percent, a decrease of 0.2 percentage point from the October reading of 48.3 percent. The New Orders Index registered 47.2 percent, a decrease of 1.9 percentage points from the October reading of 49.1 percent. The Production Index registered 49.1 percent, up 2.9 percentage points compared to the October reading of 46.2 percent. The Backlog of Orders Index registered 43 percent, down 1.1 percentage points compared to the October reading of 44.1 percent. The Employment Index registered 46.6 percent, a 1.1-percentage point decrease from the October reading of 47.7 percent. The Supplier Deliveries Index registered 52 percent, a 2.5-percentage point increase from the October reading of 49.5 percent. The Inventories Index registered 45.5 percent, a decrease of 3.4 percentage points from the October reading of 48.9 percent. The Prices Index registered 46.7 percent, a 1.2-percentage point increase from the October reading of 45.5 percent. The New Export Orders Index registered 47.9 percent, a 2.5-percentage point decrease from the October reading of 50.4 percent. The Imports Index registered 48.3 percent, a 3-percentage point increase from the October reading of 45.3 percent.

“Comments from the panel were consistent with the previous month, with sentiment improving compared to October. November was the fourth consecutive month of PMI® contraction, at a faster rate compared to the prior month. Demand contracted, with the New Orders Index contracting faster, the Customers’ Inventories Index remaining at ‘too low’ levels and the Backlog of Orders Index contracting for the seventh straight month (and at a faster rate). The New Export Orders Index returned to contraction territory, likely contributing to the faster contraction of the New Orders Index. Consumption (measured by the Production and Employment indexes) contracted, due primarily to lack of demand, but contributed positively (a combined 1.8-percentage point increase) to the PMI® calculation. Inputs — expressed as supplier deliveries, inventories and imports — were again lower in November, due primarily to contraction in inventories that was partially offset by supplier deliveries returning to ‘slowing.’ This resulted in a combined 0.9-percentage point decrease in the Supplier Deliveries and Inventories indexes. Imports contraction softened. Overall, inputs indicate (1) supply chains are meeting demand and (2) companies are less confident that materials received will be consumed in a reasonable time period. Prices decreased for the sixth consecutive month, at a slower rate.”

“Global trade remains the most significant cross-industry issue."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 49.2%, and suggests manufacturing contracted further in November.

Sunday, December 01, 2019

Monday: ISM Manufacturing, Construction Spending

by Calculated Risk on 12/01/2019 06:28:00 PM

Weekend:

• Schedule for Week of December 1, 2019

Monday:

• At 10:00 AM, ISM Manufacturing Index for November. The consensus is for 49.2%, up from 48.3%. The PMI was at 48.3% in October, the employment index was at 47.7%, and the new orders index was at 49.1%.

• Also at 10:00 AM, Construction Spending for October. The consensus is for 0.4% increase in spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 6, and DOW futures are down 64 (fair value).

Oil prices were down over the last week with WTI futures at $55.76 per barrel and Brent at $61.05 barrel. A year ago, WTI was at $51, and Brent was at $60 - so oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.59 per gallon. A year ago prices were at $2.59 per gallon, so gasoline prices are unchanged year-over-year.

Hotels: Occupancy Rate Increased Sharply Year-over-year due to Timing of Thanksgiving

by Calculated Risk on 12/01/2019 12:57:00 PM

Note: Due to the timing of Thanksgiving, the occupancy rate was up sharply YoY last week, and will be down sharply YoY in the report next week.

From HotelNewsNow.com: STR: US hotel results for week ending 23 November

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 17-23 November 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 18-24 November 2018, the industry recorded the following:

• Occupancy: +17.7% to 61.2%

• Average daily rate (ADR): +10.8% to US$124.71

• Revenue per available room (RevPAR): +30.4% to US$76.32

STR analysts note the positive performance is due to the year-over-year comparison with the week of Thanksgiving in 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will decline into the winter.

Data Source: STR, Courtesy of HotelNewsNow.com