by Calculated Risk on 11/20/2019 08:23:00 PM

Wednesday, November 20, 2019

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 219,000 initial claims, down from 225,000 last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for November. The consensus is for a reading of 7.5, up from 5.6.

• At 10:00 AM, Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.49 million SAAR, up from 5.38 million in September. Housing economist Tom Lawler expects the NAR to report sales of 5.36 million SAAR (take the under!).

CAR on California October Housing: Sales up 1.9% YoY, Inventory down 18%

by Calculated Risk on 11/20/2019 02:44:00 PM

The CAR reported: California housing market holds steady in October, C.A.R. reports

Shrinking inventory subdued California home sales and held home sales and prices steady in October, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 404,240 units in October, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the October pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

October’s sales figure was up 0.1 percent from the 404,030 level in September and up 1.9 percent from home sales in October 2018 of a revised 396,720.

“The California housing market continued to see gradual improvement in recent months as the current mortgage environment remains favorable to those who want to buy a home. With interest rates remaining historically low for the foreseeable future, motivated buyers finding that homes are slightly more affordable may seize the opportunity and resume their home search,” said 2020 C.A.R. President Jeanne Radsick, a second-generation REALTOR® from Bakersfield, Calif. “Additionally, the condominium loan policies that went into effect mid-October could help buyers for whom single-family homes are out of reach.”

...

After 15 straight months of year-over-year increases, active listings fell for the fourth straight month, dropping 18.0 percent from year ago. The decline was the largest since May 2013.

The Unsold Inventory Index (UII), which is a ratio of inventory over sales, was 3.0 months in October, down from 3.6 in both September 2019 and October 2018. It was the lowest level since June 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.

emphasis added

FOMC Minutes: "Most participants judged that the stance of policy, after a 25 basis point reduction at this meeting, would be well calibrated"

by Calculated Risk on 11/20/2019 02:14:00 PM

From the Fed: Minutes of the Federal Open Market Committee, October 29-30, 2019. A few excerpts:

With regard to monetary policy beyond this meeting, most participants judged that the stance of policy, after a 25 basis point reduction at this meeting, would be well calibrated to support the outlook of moderate growth, a strong labor market, and inflation near the Committee's symmetric 2 percent objective and likely would remain so as long as incoming information about the economy did not result in a material reassessment of the economic outlook. However, participants noted that policy was not on a preset course and that they would be monitoring the effects of the Committee's recent policy actions, as well as other information bearing on the economic outlook, in assessing the appropriate path of the target range for the federal funds rate. A couple of participants expressed the view that the Committee should reinforce its postmeeting statement with additional communications indicating that another reduction in the federal funds rate was unlikely in the near term unless incoming information was consistent with a significant slowdown in the pace of economic activity..

emphasis added

AIA: "Architecture Billings Index Rebounds After Two Down Months"

by Calculated Risk on 11/20/2019 10:37:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Rebounds After Two Down Months

Following a two month decline in demand for design services, architecture billings got a bounce in October, according to a new report released today from the American Institute of Architects (AIA).

The Architecture Billings Index (ABI) score in October is 52.0, up from the September score of 49.7. This score reflects an increase in design services (any score above 50 indicates an increase in billings). During October, both the new project inquiries and design contracts scores moderated from September but remained positive, posting scores of 57.9 and 52.9 respectively.

“Although ongoing uncertainty over the direction of economic growth persists, a strong stock market and growing payrolls at U.S. businesses continue to generate more construction projects,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “With most regional and sector billing scores at architecture firms improving from the previous month, we’re seeing a bit of a rebound from disappointing levels of design activity in recent months.”

...

• Regional averages: South (55.5); West (51.3); Midwest (49.9); Northeast (47.2)

• Sector index breakdown: mixed practice (55.2); multi-family residential (54.0); institutional (49.9); commercial/industrial (49.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.0 in October, up from 49.7 in September. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 8 of the previous 12 months, suggesting some further increase in CRE investment in 2020 - but three of the previous four months were negative.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 11/20/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 15, 2019. This week’s results include an adjustment for the Veterans Day holiday.

... The Refinance Index decreased 8 percent from the previous week and was 152 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 7 percent from one week earlier. The unadjusted Purchase Index decreased 8 percent compared with the previous week and was 7 percent higher than the same week one year ago.

...

“U.S. and China trade anxieties and protests in Hong Kong pulled U.S. Treasuries lower last week, and the 30-year fixed mortgage rate followed the same path, dipping below 4 percent,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite lower rates, mortgage applications decreased 2.2 percent, driven by an 8 percent slide in refinance activity. Rates have stayed in the same narrow range of around 4 percent since July, so we may be starting to see the expected slowdown in refinancing as the pool of eligible homeowners shrinks.”

Added Kan, “Purchase applications were 7 percent higher than a year ago, which adds another solid data point to the recent increases in new home sales and housing starts. There may be signs that housing inventory is starting to meaningfully rise, which will help with affordability and provide more choices for potential homebuyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.99 percent from 4.03 percent, with points increasing to 0.33 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 7% year-over-year.

Tuesday, November 19, 2019

Wednesday: FOMC Minutes

by Calculated Risk on 11/19/2019 06:46:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes, Meeting of October 29-30, 2019

Phoenix Real Estate in October: Sales up 9.3% YoY, Active Inventory Down 20.7% YoY

by Calculated Risk on 11/19/2019 04:49:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 7,848 in October, from 7,850 in September, and up from 7,182 in October 2018. Sales were essentially unchanged from September 2019 (last month), and up 9.3% from October 2018.

2) Active inventory was at 14,427, down from 18,193 in October 2018. That is down 20.7% year-over-year.

3) Months of supply increased to 2.35 months in October from 2.27 months in September. This is low.

This is another market with increasing sales and falling inventory.

Sacramento Housing in October: Sales Up 7.1% YoY, Active Inventory DOWN 25% YoY

by Calculated Risk on 11/19/2019 02:03:00 PM

From SacRealtor.org: Sales volume jumps for October, prices remain flat

October saw a 10.6% increase in sales volume, jumping from 1,393 in September to 1,540 units this month. Compared to one year ago (1,438), the current figure is up 7.1%.1) Overall sales increased to 1,540 in October, up from 1,438 in October 2018. Sales were up 10.6% from September 2019 (previous month), and up 7.1% from October 2018.

...

The Active Listing Inventory decreased from 2,457 to 2,301 units. The Months of Inventory decreased from 1.8 to 1.5 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. [Note: Compared to October 2018, inventory is down 24.1%] .

...

The Median DOM (days on market) increased from at 12 to 14 and the Average DOM increased from 25 to 28. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,540 sales this month, 71% (1,094) were on the market for 30 days or less and 86.6% (1,335) were on the market for 60 days or less.

emphasis added

2) Active inventory was at 2,301, down from 3,060 in October 2018. That is down 24.8% year-over-year. This is the sixth consecutive YoY decline following 20 months of YoY increases in inventory.

BLS: October Unemployment rates at New Series Lows in Alabama, California, Maine and South Carolina

by Calculated Risk on 11/19/2019 12:18:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in October in 4 states, higher in 2 states, and stable in 44 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Eight states had jobless rate decreases from a year earlier, 3 states had increases, and 39 states and the District had little or no change. The national unemployment rate, 3.6 percent, was little changed over the month and from October 2018.

...

Vermont had the lowest unemployment rate in October, 2.2 percent. The rates in Alabama (2.8 percent), California (3.9 percent), Maine (2.8 percent), and South Carolina (2.6 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue). Note that Alaska is at a series low (since 1976). Two states and the D.C. have unemployment rates above 5%; Alaska and Mississippi.

A total of nine states are at a series low: Alabama, Alaska, California, Colorado, Georgia, Illinois, Maine, South Carolina, and Texas.

Comments on October Housing Starts

by Calculated Risk on 11/19/2019 09:45:00 AM

Earlier: Housing Starts increased to 1.314 Million Annual Rate in October

Total housing starts in October were at expectations and revisions to prior months were minor.

The housing starts report showed starts were up 3.8% in October compared to September, and starts were up 8.5% year-over-year compared to October 2018.

Single family starts were up 8.2% year-over-year, and multi-family starts were up 10.7% YoY.

This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Starts were up 3.8% in October compared to October 2018.

Year-to-date, starts are down 0.6% compared to the same period in 2018.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the comparisons in November and December will be easy.

My guess was starts would be down slightly year-over-year in 2019 compared to 2018, but nothing like the YoY declines we saw in February and March. Now it seems likely starts will be up in 2019 compared to 2018.

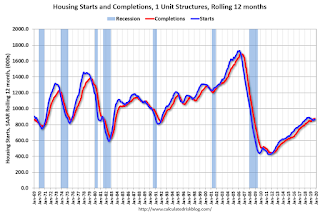

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - then completions caught up with starts.

As I've been noting for several years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.