by Calculated Risk on 9/13/2019 08:40:00 AM

Friday, September 13, 2019

Retail Sales increased 0.4% in August

On a monthly basis, retail sales increased 0.4 percent from July to August (seasonally adjusted), and sales were up 4.1 percent from August 2018.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for August 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $526.1 billion, an increase of 0.4 percent from the previous month, and 4.1 percent above August 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.5% in August.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.5% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.5% on a YoY basis.The increase in August was slightly above expectations. Sales in June and July were revised up. Overall a solid report.

Thursday, September 12, 2019

Friday: Retail Sales

by Calculated Risk on 9/12/2019 10:31:00 PM

Friday:

• At 8:30 AM ET, Retail sales for August will be released. The consensus is for a 0.3% increase in retail sales.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for September).

LA area Port Traffic Down Year-over-year in August

by Calculated Risk on 9/12/2019 04:38:00 PM

Special note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down slightly in August compared to the rolling 12 months ending in July. Outbound traffic was down 0.3% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing (although down slightly this year), and exports have mostly moved sideways over the last 8 years.

Early Look at 2020 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 9/12/2019 02:00:00 PM

The BLS reported this morning:

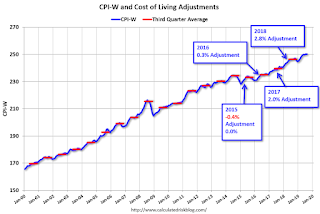

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.5 percent over the last 12 months to an index level of 250.112 (1982-84=100). For the month, the index was unchanged prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2018, the Q3 average of CPI-W was 246.352.

The 2018 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 1.5% year-over-year in August, and although this is early - we need the data for July, August and September - my current guess is COLA will probably be around 1.5% this year, the smallest increase since 2016.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2018 yet, but wages probably increased again in 2018. If wages increased the same as in 2017, then the contribution base next year will increase to around $137,600 in 2020, from the current $132,900.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

Cleveland Fed: Key Measures Show Inflation Above 2% YoY in August, Core PCE below 2%

by Calculated Risk on 9/12/2019 11:08:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.6% annualized rate) in August. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for August here. Motor fuel was down 34% annualized.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (0.7% annualized rate) in August. The CPI less food and energy rose 0.3% (3.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.9%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 2.4%. Core PCE is for July and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 2.6% annualized, trimmed-mean CPI was at 2.3% annualized, and core CPI was at 3.1% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%).

BLS: CPI increased 0.1% in August, Core CPI increased 0.3%

by Calculated Risk on 9/12/2019 08:35:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in August on a seasonally adjusted basis after rising 0.3 percent in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.7 percent before seasonal adjustment.Core inflation was above expectations in August. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.3 percent in August, the same increase as in June and July.

...

The all items index increased 1.7 percent for the 12 months ending August; the 12-month increase has remained in the range of 1.5 to 2.0 percent since the period ending December 2018. The index for all items less food and energy rose 2.4 percent over the last 12 months, its largest 12-month increase since July 2018.

emphasis added

Weekly Initial Unemployment Claims decreased to 204,000

by Calculated Risk on 9/12/2019 08:32:00 AM

The DOL reported:

In the week ending September 7, the advance figure for seasonally adjusted initial claims was 204,000, a decrease of 15,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 217,000 to 219,000. The 4-week moving average was 212,500, a decrease of 4,250 from the previous week's revised average. The previous week's average was revised up by 500 from 216,250 to 216,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 212,500.

This was lower than the consensus forecast.

Wednesday, September 11, 2019

Thursday: CPI, Unemployment Claims

by Calculated Risk on 9/11/2019 04:45:00 PM

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, down from 217 thousand the previous week.

• At 8:30 AM, The Consumer Price Index for August from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

Merrill on Retail "Consumer demand pulled back in August"

by Calculated Risk on 9/11/2019 02:19:00 PM

A few excerpts from two BofA Merrill Lynch research notes: Consumer demand pulled back in August

Based on the aggregated BAC credit and debit card data, retail sales ex-autos fell 0.5% month-over-month (mom) seasonally adjusted (sa). This reversed the 0.9% mom gain in July. As always, there were a number of "special factors" which we decipher in this note.And on confidence: The uneasy consumer

Amazon Prime Day and other retailers' summer promotions in mid-July provided a significant boost to spending, as we showed last month. In our view, these promotions effectively pulled forward demand into July and out of August.

…

Outside of the promotion distortions, we also think spending was dampened by weakening sentiment.

emphasis added

The consumer is beginning to worry. Since our last update in mid-August, the BofAML US consumer confidence indicator (USCCI) declined by 3.8 points to 50.1 based on data through September 9. It briefly dipped below the 50 breakeven level during the survey period indicating that the consumer is growing increasingly pessimistic.CR Note: Retail sales for August will be released on Friday, and the consensus is for a 0.3% increase in retail sales.

Houston Real Estate in August: Sales up 4% YoY, Inventory Up 8%

by Calculated Risk on 9/11/2019 12:19:00 PM

From the HAR: Houston Home Sales Sizzle in August

Temperatures weren’t the only thing soaring in August. Home sales registered another hot month, as low mortgage interest rates kept consumers in a buying mood. According to the latest monthly report from the Houston Association of Realtors (HAR), August sales of single-family homes throughout greater Houston totaled 8,679. That is up 3.9 percent year-over-year and marks the second largest one-month sales volume of all time; the record of 8,930 was set just last month. On a year-to-date basis, home sales are running 3.1 percent ahead of 2018’s record volume.Total active inventory was up 8.2% YoY to 45,062 properties from 41,650 properties in August 2018. Sales are on pace for a record year.

...

Housing inventory still remains ahead of 2018 levels. It reached a 4.2-months supply in August compared to 4.0 months a year earlier. So far in 2019, June and July marked the peak of inventory – a 4.3-months supply. Robust inventory and mortgage interest rates currently averaging 3.49 percent (according to Freddie Mac) have created a favorable climate for home buyers and paved the way for one of the strongest summers in Houston real estate history.

Sales of all property types increased 4.1 percent in August, totaling 10,375 units. That marks the second highest one-month volume of all time. The record for total property sales in a single month was 10,444 set just last month, in July 201[9], which also was the first time that figure broke the 10,00[0] mark. Total dollar volume for the month climbed 6.6 percent to $3.1 billion.

“This has been one of the hottest summers in Houston history, both in terms of temperatures and home sales,” said HAR Chair Shannon Cobb Evans with Better Homes and Gardens Real Estate Gary Greene. “The Houston real estate market typically slows a bit once school starts and we get into fall, but with interest rates as low as they’ve been and a steadily growing supply of homes, it’s possible that sales don’t let up until closer to the holidays. The rental segment has also been extremely active and looks to remain that way a while longer.”

emphasis added