by Calculated Risk on 7/23/2019 10:09:00 AM

Tuesday, July 23, 2019

NAR: Existing-Home Sales Decreased to 5.27 million in June

From the NAR: Existing-Home Sales Falter 1.7% in June

Existing-home sales weakened in June, as total sales saw a small decline after a previous month of gains, according to the National Association of Realtors®. While two of the four major U.S. regions recorded minor sales jumps, the other two – the South and the West – experienced greater declines last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 1.7% from May to a seasonally adjusted annual rate of 5.27 million in June. Sales as a whole are down 2.2% from a year ago (5.39 million in June 2018).

...

Total housing inventory at the end of June increased to 1.93 million, up from 1.91 million existing-homes available for sale in May, but unchanged from the level of one year ago. Unsold inventory is at a 4.4-month supply at the current sales pace, up from the 4.3 month supply recorded in both May and in June 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (5.27 million SAAR) were down 1.7% from last month, and were 2.2% below the June 2018 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.93 million in June from 1.91 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.93 million in June from 1.91 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was unchanged year-over-year in June compared to June 2018.

Inventory was unchanged year-over-year in June compared to June 2018. Months of supply increased to 4.4 months in June.

This was below the consensus forecast. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later …

Monday, July 22, 2019

Tuesday: Existing Home Sales, Richmond Fed Mfg Survey

by Calculated Risk on 7/22/2019 06:50:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Fall Again as Lenders Play Catch Up

Mortgage rates lower again today. The improvement was fairly decent given the amount of movement seen in the bond market. The reason for that has to do with the phenomenon we discussed on Friday whereby mortgage lenders are generally a bit cautious when it comes to adjusting rate sheets to keep pace with bond market movement. With that in mind, bonds had improved during the day on Friday, but most lenders didn't adjust rates in the afternoon. Simply put, we are seeing Friday afternoon's bond market improvement today. [Most Prevalent Rates 30YR FIXED - 3.875%]Tuesday:

emphasis added

• At 9:00 AM ET, FHFA House Price Index for May 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.34 million SAAR, unchanged from 5.34 million last month. Housing economist Tom Lawler expects the NAR to report 5.25 million SAAR.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for July.

Top Twenty Five GDP Quarters since 2000

by Calculated Risk on 7/22/2019 02:49:00 PM

A year ago I posted a list of the top twenty five GDP quarters since 2000. Here is an update.

The advance estimate of Q2 GDP data will be released this Friday, and the consensus estimate is for real GDP to increase 1.9% in Q2 2019 (Annualized).

Last year, in Q2 2018, GDP increased 4.2%, making it the tenth best quarter for real annualized GDP since Q1 2000.

As I've noted before, based on demographics, 2% is the new 4% (that is just simple arithmetic).

| Top 25 GDP Quarters since 2000 Real GDP, Annualized Rate | ||||

|---|---|---|---|---|

| GDP | Year | Quarter | President | |

| 1 | 7.5% | 2000 | Q2 | Clinton |

| 2 | 7.0% | 2003 | Q3 | GW Bush |

| 3 | 5.4% | 2006 | Q1 | GW Bush |

| 4 | 5.1% | 2014 | Q2 | Obama |

| 5 | 4.9% | 2014 | Q3 | Obama |

| 6 | 4.7% | 2011 | Q4 | Obama |

| 7 | 4.7% | 2003 | Q4 | GW Bush |

| 8 | 4.5% | 2005 | Q1 | GW Bush |

| 9 | 4.5% | 2009 | Q4 | Obama |

| 10 | 4.2% | 2018 | Q2 | Trump |

| 11 | 4.1% | 2004 | Q4 | GW Bush |

| 12 | 3.8% | 2004 | Q3 | GW Bush |

| 13 | 3.7% | 2010 | Q2 | Obama |

| 14 | 3.6% | 2005 | Q3 | GW Bush |

| 15 | 3.6% | 2013 | Q1 | Obama |

| 16 | 3.5% | 2002 | Q1 | GW Bush |

| 17 | 3.5% | 2003 | Q2 | GW Bush |

| 18 | 3.5% | 2006 | Q4 | GW Bush |

| 19 | 3.4% | 2018 | Q3 | Trump |

| 20 | 3.3% | 2015 | Q2 | Obama |

| 21 | 3.3% | 2015 | Q1 | Obama |

| 22 | 3.2% | 2013 | Q4 | Obama |

| 23 | 3.2% | 2013 | Q3 | Obama |

| 24 | 3.2% | 2012 | Q1 | Obama |

| 25 | 3.1% | 2019 | Q1 | Trump |

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 7/22/2019 10:34:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 13 July

The U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 7-13 July 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

n comparison with the week of 8-14 July 2018, the industry recorded the following:

• Occupancy: -2.4% to 74.2%

• Average daily rate (ADR): -0.6% to US$132.24

• Revenue per available room (RevPAR): -2.9% to US$98.08

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, close to-date compared to the previous 4 years.

Seasonally, the occupancy rate will now stay at a high level during the Summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Chicago Fed "Index Points to Economic Growth near Historical Trend in June"

by Calculated Risk on 7/22/2019 08:35:00 AM

From the Chicago Fed: Index Points to Economic Growth near Historical Trend in June

The Chicago Fed National Activity Index (CFNAI) ticked up to –0.02 in June from –0.03 in May. One of the four broad categories of indicators that make up the index increased from May, and two of the four categories made negative contributions to the index in June. The index’s three-month moving average, CFNAI-MA3, ticked up to –0.26 in June from –0.27 in May.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in June (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, July 21, 2019

Sunday Night Futures

by Calculated Risk on 7/21/2019 06:56:00 PM

Weekend:

• Schedule for Week of July 21, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for June. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $56.17 per barrel and Brent at $63.23 barrel. A year ago, WTI was at $68, and Brent was at $73 - so oil prices are down about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.76 per gallon. A year ago prices were at $2.83 per gallon, so gasoline prices are down about 3% year-over-year.

By Request, and Just For Fun: Stock Market as Barometer of Policy Success

by Calculated Risk on 7/21/2019 11:49:00 AM

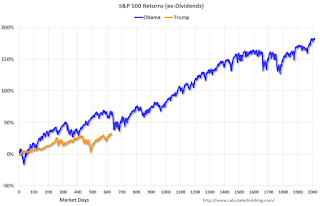

By request, here is an update to the chart showing market performance under Presidents Trump and Obama.

Note: I don't think the stock market is a great measure of policy performance, but some people do - and I'm having a little fun with them.

There are some observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 31% under Mr. Trump - compared to up 63% under Mr. Obama for the same number of market days.

Note: There was a market sell-off during Mr. Obama's third year, so the market performance might be closer over the next 60 days.

Saturday, July 20, 2019

Schedule for Week of July 21, 2019

by Calculated Risk on 7/20/2019 08:11:00 AM

The key reports this week are the advance estimate of Q2 GDP, and June New and Existing Home Sales.

For manufacturing, the July Richmond and Kansas City Fed manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

9:00 AM: FHFA House Price Index for May 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.34 million SAAR, unchanged from 5.34 million last month.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.34 million SAAR, unchanged from 5.34 million last month.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report 5.25 million SAAR.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for June from the Census Bureau.

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 655 thousand SAAR, up from 626 thousand in May.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, down from 216 thousand last week.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.7% increase in durable goods orders.

10:00 AM: The Q2 2019 Housing Vacancies and Homeownership report from the Census Bureau.

11:00 AM: the Kansas City Fed manufacturing survey for July. This is the last of regional manufacturing surveys for June.

8:30 AM: Gross Domestic Product, 2nd quarter 2019 (advance estimate), and annual update. The consensus is that real GDP increased 1.9% annualized in Q2, down from 3.1% in Q1.

Friday, July 19, 2019

Lawler: Early Read on Existing Home Sales in June

by Calculated Risk on 7/19/2019 01:37:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in June

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.25 million in June, down 1.7% from May’s preliminary estimate and down 2.6% from last June’s seasonally adjusted pace. Unadjusted sales should show a steeper YOY decline, reflecting this June’s lower business day count relative to last June’s.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of June should be about 2.6% higher than last June.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 4.8% from a year earlier.

CR Note: Existing home sales for June are scheduled to be released on Tuesday, July 23rd. The consensus is the NAR will report sales of 5.36 million SAAR.

Q2 GDP Forecasts: 1.4% to 2.3%

by Calculated Risk on 7/19/2019 11:58:00 AM

From Merrill Lynch:

Strong retail sales in June boosted our 2Q GDP tracking by 0.6pp to 2.3% qoq saar. [July 19 estimate]From Goldman Sachs:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +1.4% (qoq ar). [July 17 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.4% for 2019:Q2 and 1.9% for 2019:Q3. [July 19 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2019 is 1.6 percent on July 17, unchanged from July 16. [July 17 estimate]CR Note: These estimates suggest real GDP growth will be around 2% annualized in Q2.