by Calculated Risk on 5/20/2019 10:46:00 AM

Monday, May 20, 2019

Quarterly Housing Starts by Intent

Here is a graph I haven't updated in some time. From the Census Bureau "Started and Completed by Purpose of Construction" through Q1 2019.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were down about 4% in Q1 2019 compared to Q1 2018.

Owner built starts were down about 6.5% year-over-year.

And condos built for sale not far above the record low.

The 'units built for rent' (blue) had increased significantly following the great recession, but are now moving mostly sideways - and were down 18% in Q1 2019 compared to Q1 2018.

Chicago Fed "Index Points to Slower Economic Growth in April"

by Calculated Risk on 5/20/2019 08:54:00 AM

From the Chicago Fed: Index Points to Slower Economic Growth in April

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) fell to –0.45 in April from +0.05 in March. Three of the four broad categories of indicators that make up the index decreased from March, and two of the four categories made negative contributions to the index in April. The index’s three-month moving average, CFNAI-MA3, moved down to –0.32 in April from –0.24 in March.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in April (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, May 19, 2019

Sunday Night Futures

by Calculated Risk on 5/19/2019 08:05:00 PM

Weekend:

• Schedule for Week of May 19, 2019

Monday:

• 8:30 AM ET, Chicago Fed National Activity Index for April. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 8 and DOW futures are up 88 (fair value).

Oil prices were up over the last week with WTI futures at $63.35 per barrel and Brent at $72.85 per barrel. A year ago, WTI was at $71, and Brent was at $78 - so oil prices are down about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.84 per gallon. A year ago prices were at $2.92 per gallon, so gasoline prices are down 8 cents per gallon year-over-year.

Hotels: Occupancy Rate Decreased Slightly Year-over-year

by Calculated Risk on 5/19/2019 12:07:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 11 May

The U.S. hotel industry reported mostly positive year-over-year results in the three key performance metrics during the week of 5-11 May 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 6-12 May 2018, the industry recorded the following:

• Occupancy: -0.3% to 68.3%

• Average daily rate (ADR): +1.2% to US$131.72

• Revenue per available room (RevPAR): +0.9% to US$89.94

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A decent start for 2019, close - to-date - compared to the previous 4 years.

Seasonally, the occupancy rate will mostly move sideways during the Spring, and then increase during the Summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, May 18, 2019

Schedule for Week of May 19, 2019

by Calculated Risk on 5/18/2019 08:11:00 AM

The key reports this week are April New and Existing Home Sales.

For manufacturing, the May Kansas City manufacturing survey will be released.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.36 million SAAR, up from 5.21 million.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.36 million SAAR, up from 5.21 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.31 million SAAR for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of April 30-May 1, 2019

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 212 thousand last week.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 678 thousand SAAR, down from 692 thousand in March.

11:00 AM: the Kansas City Fed manufacturing survey for May.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 2.0% decrease in durable goods orders.

Friday, May 17, 2019

Lawler: Early Read on Existing Home Sales in April

by Calculated Risk on 5/17/2019 07:19:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in April

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.31 million in April, up 1.9% from March’s preliminary estimate (which was below what state and local realtor data would have suggested), and down 2.2% from last April’s seasonally adjusted pace. Unadjusted sales last month should be relatively flat from last April, with the SA/NSA gap reflecting this April’s higher business day count relative to last April’s.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of March should be about 4.4% higher than last March.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 3.5% from a year earlier.

CR Note: Existing home sales for April are scheduled to be released on Tuesday, May 21st. The consensus is NAR will report sales of 5.36 million SAAR.

Sacramento Housing in April: Sales Down 6% YoY, Active Inventory up slightly YoY

by Calculated Risk on 5/17/2019 03:04:00 PM

The Sacramento Housing Statistics:

1) Overall sales increased to 1,496 in April, down from 1,587 in April 2018. Sales were up 13.3% from March 2019 (last month), and down 5.7% from April 2018.

2) Active inventory was at 2,094, up from 2,082 in April 2018. That is up slightly, 0.6% year-over-year. This is the nineteenth consecutive month with a YoY increase in active inventory.

Inventory is still low - months of inventory is at 1.4 months, probably closer to 4 months would be normal.

Q2 GDP Forecasts: 1% to 2%

by Calculated Risk on 5/17/2019 12:47:00 PM

From Merrill Lynch:

Based on the latest high frequency data, 2Q GDP is already tracking only 1.8%, down 0.3pp from our prior forecast. [May 17 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.8% for 2019:Q2. [May 17 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2019 is 1.2 percent on May 16, up from 1.1 percent on May 15. [May 16 estimate]CR Note: These early estimates suggest real GDP growth will be under 2% annualized in Q2.

BLS: Unemployment Rates in April at New Series Lows in Pennsylvania, Vermont, and Wisconsin

by Calculated Risk on 5/17/2019 10:24:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in April in 10 states and stable in 40 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today.

...

Vermont had the lowest unemployment rate in April, 2.2 percent. The rates in Pennsylvania (3.8 percent), Vermont (2.2 percent), and Wisconsin (2.8 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.5 percent.

emphasis added

Click on graph for larger image.

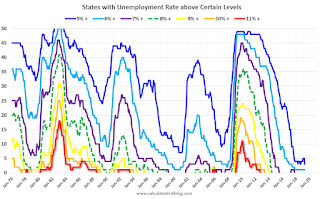

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue). Note that the series low for Alaska is above 6%. Two states and the D.C. have unemployment rates above 5%; Alaska and New Mexico.

A total of nine states are at the series low.

Phoenix Real Estate in April: Sales up 6% YoY, Active Inventory up 7% YoY

by Calculated Risk on 5/17/2019 08:55:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales increased to 9,493 in April, up from 8,990 in April 2018. Sales were up 13.8% from March 2019 (last month), and up 5.6% from April 2018.

2) Active inventory was at 17,804, up from 16,568 in April 2018. That is up 7.5% year-over-year. This is the sixth consecutive month with a YoY increase in active inventory.

The last six months - with a YoY increase - followed twenty-four consecutive months with a YoY decrease in inventory in Phoenix.

Months of supply decreased from 2.78 in March to 2.43 in April. This is still low.