by Calculated Risk on 4/23/2019 02:31:00 PM

Tuesday, April 23, 2019

Earlier Richmond Fed: "Fifth District Manufacturing Activity Moderated in April"

From the Richmond Fed: Fifth District Manufacturing Activity Moderated in April

Fifth District manufacturing activity moderated in April, according to the latest survey from the Richmond Fed. The composite index fell from 10 in March to 3 in April, weighed down by slightly negative readings in the indexes for both shipments and new orders but buoyed by a positive reading for the third component index, employment. Firms were optimistic, expecting conditions to improve in the next six months.

Survey results suggested continued positive growth in both employment and wages, although these indexes dropped slightly in April. However, firms reported a decline in the average workweek as they continued to struggle to find workers with the necessary skills. Firms expected this difficulty to continue in the coming months.

emphasis added

A few Comments on March New Home Sales

by Calculated Risk on 4/23/2019 11:35:00 AM

New home sales for March were reported at 692,000 on a seasonally adjusted annual rate basis (SAAR). This is the second highest sales rate for this cycle (just behind November 2017). This was well above the consensus forecast, however sales for the previous three months were revised down.

With these revisions, sales increased slightly, just 0.7%, in 2018 compared to 2017. And my guess is we haven't seen the peak of this cycle yet.

Earlier: New Home Sales increased to 667,000 Annual Rate in February.

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).

Year-to-date (just through March), sales are up 1.7% compared to the same period in 2018. The comparison will be most difficult in Q1, so this is a solid start for 2019.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through March 2019. This graph starts in 1994, but the relationship had been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through March 2019. This graph starts in 1994, but the relationship had been fairly steady back to the '60s. Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I still expect this gap to slowly close. However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next few years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 692,000 Annual Rate in March

by Calculated Risk on 4/23/2019 10:12:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 692 thousand.

The previous three months were revised down.

"Sales of new single‐family houses in March 2019 were at a seasonally adjusted annual rate of 692,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.5 percent above the revised February rate of 662,000 and is 3.0 percent above the March 2018 estimate of 672,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in March to 6.0 months from 6.3 months in February.

The months of supply decreased in March to 6.0 months from 6.3 months in February. The all time record was 12.1 months of supply in January 2009.

This is at the top of the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of March was 344,000. This represents a supply of 6.0 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is a little low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In March 2019 (red column), 68 thousand new homes were sold (NSA). Last year, 66 thousand homes were sold in March.

The all time high for March was 127 thousand in 2005, and the all time low for March was 28 thousand in 2011.

This was well above expectations of 645 thousand sales SAAR, however, sales in the three previous months were revised. I'll have more later today.

Black Knight: National Mortgage Delinquency Rate Decreased in March

by Calculated Risk on 4/23/2019 08:58:00 AM

From Black Knight: Black Knight’s First Look: Prepayments Surge on Lower Interest Rates; Seasonal Delinquency Rate Improvement Remains Muted

• Prepayment activity increased by 28% month-over-month, the largest single-month increase in more than 2.5 years, in response to declining interest rates and the start of the homebuying seasonAccording to Black Knight's First Look report for March, the percent of loans delinquent decreased 5.3% in March compared to February, and decreased 2.0% year-over-year.

• The national delinquency rate fell by 5.3% for the month, the smallest improvement for any March in six years in what is typically the strongest-performing month of the year

• March 2019 ended on a Sunday, which has historically led to an increase in delinquencies, and came on the heels of February’s atypical increase in delinquencies

• At 40,400 for the month, foreclosure starts were down 19.5 percent from January and edged close to September 2018’s 15-year low

• The month’s 39,700 foreclosure starts marked the lowest single-month volume in more than 18 years, while reduced outflow held active foreclosure inventory steady at 264,000

• Outstanding 90-day delinquencies have now fallen below 500,000 for the first time in more than 12 years

The percent of loans in the foreclosure process decreased 0.2% in March and were down 18.8% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.65% in March, down from 3.89% in February.

The percent of loans in the foreclosure process decreased slightly in March to 0.51% from 0.51% in February.

The number of delinquent properties, but not in foreclosure, is down 9,000 properties year-over-year, and the number of properties in the foreclosure process is down 57,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2019 | Feb 2019 | Mar 2018 | Mar 2017 | |

| Delinquent | 3.65% | 3.89% | 3.73% | 3.62% |

| In Foreclosure | 0.51% | 0.51% | 0.63% | 0.88% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,903,000 | 2,019,000 | 1,912,000 | 1,831,000 |

| Number of properties in foreclosure pre-sale inventory: | 264,000 | 264,000 | 321,000 | 448,000 |

| Total Properties | 2,167,000 | 2,284,000 | 2,232,000 | 2,279,000 |

Monday, April 22, 2019

Tuesday: New Home Sales, Richmond Fed Mfg

by Calculated Risk on 4/22/2019 07:28:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Modestly Higher to Start The Week

Mortgage rates were higher again on Monday, but just barely. The average lender was still in worse shape on Tuesday or Wednesday of last week when rates were the highest they'd been in about a month. [30YR FIXED - 4.25%]Tuesday:

emphasis added

• At 9:00 AM: FHFA House Price Index for February 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM: New Home Sales for March from the Census Bureau. The consensus is for 645 thousand SAAR, down from 667 thousand in February.

• At 10:00 AM: Richmond Fed Survey of Manufacturing Activity for April.

Housing Inventory Tracking

by Calculated Risk on 4/22/2019 05:48:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 2.4% year-over-year (YoY) in March, this was the eighth consecutive month with a YoY increase, following over three years of YoY declines.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, and Sacramento and Phoenix, and total existing home inventory as reported by the NAR (through March).

The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 92% YoY in Las Vegas in March (red), the eight consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY last year as oil prices increased. Inventory was up 17.5% year-over-year in Houston in March.

Inventory is a key for the housing market. Right now it appears the inventory build that started last year is slowing.

Also note that inventory in Seattle was up 136% year-over-year in March (not graphed)!

Comments on March Existing Home Sales

by Calculated Risk on 4/22/2019 02:17:00 PM

Earlier: NAR: Existing-Home Sales Decreased to 5.21 million in March

A few key points:

1) The key for housing - and the overall economy - is new home sales, single family housing starts and overall residential investment.

Overall, this is still a somewhat reasonable level for existing home sales. No worries.

2) Inventory is still low, and was only up 2.4% year-over-year (YoY) in March. This was the eighth consecutive month with a year-over-year increase in inventory, although the YoY increase was smaller in March than in the five previous months.

3) Year-to-date sales are down about 6.5% compared to the same period in 2018. On an annual basis, that would put sales around 5 million in 2019. Sales slumped at the end of 2018 and in January 2019 due to higher mortgage rates, the stock market selloff, and fears of an economic slowdown (unfounded).

The comparisons will be easier towards the end of the year.

Sales NSA in March (400,000, red column) were below sales in March 2018 (434,000, NSA), and sales were the lowest for March since 2014.

NAR: Existing-Home Sales Decreased to 5.21 million in March

by Calculated Risk on 4/22/2019 10:14:00 AM

From the NAR: Existing-Home Sales Slide 4.9% in March

Existing-home sales retreated in March, following February’s surge of sales, according to the National Association of Realtors®. Each of the four major U.S. regions saw a drop-off in sales, with the Midwest enduring the largest decline last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, fell 4.9% from February to a seasonally adjusted annual rate of 5.21 million in March. Sales as a whole are down 5.4% from a year ago (5.51 million in March 2018).

...

Total housing inventory at the end of March increased to 1.68 million, up from 1.63 million existing homes available for sale in February and a 2.4% increase from 1.64 million a year ago. Unsold inventory is at a 3.9-month supply at the current sales pace, up from 3.6 months in February and up from 3.6 months in March 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February (5.21 million SAAR) were down 4.9% from last month, and were 5.4% below the March 2018 sales rate.

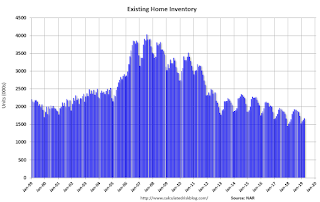

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.68 million in March from 1.63 million in January. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.68 million in March from 1.63 million in January. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 2.4% year-over-year in March compared to March 2018.

Inventory was up 2.4% year-over-year in March compared to March 2018. Months of supply was at 3.9 months in March.

This was below the consensus forecast. For existing home sales, a key number is inventory - and inventory is still low, but appears to have bottomed. I'll have more later ...

Chicago Fed "Index Points to a Pickup in Economic Growth in March"

by Calculated Risk on 4/22/2019 08:37:00 AM

From the Chicago Fed: Index Points to a Pickup in Economic Growth in March

Led by improvements in employment-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to –0.15 in March from –0.31 in February. Three of the four broad categories of indicators that make up the index increased from February, but three of the four categories made negative contributions to the index in March. The index’s three-month moving average, CFNAI-MA3, moved down to –0.24 in March from –0.18 in FebruaryThis graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in March (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, April 21, 2019

Monday: Existing Home Sales

by Calculated Risk on 4/21/2019 09:05:00 PM

Weekend:

• Schedule for Week of April 21, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for March. This is a composite index of other data.

• At 10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.51 million. Housing economist Tom Lawler expects the NAR to report sales of 5.40 million SAAR for March.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 4 and DOW futures are up 40 (fair value).

Oil prices were up over the last week with WTI futures at $64.67 per barrel and Brent at $72.65 per barrel. A year ago, WTI was at $68, and Brent was at $75 - so oil prices are down slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.83 per gallon. A year ago prices were at $2.75 per gallon, so gasoline prices are up 8 cents per gallon year-over-year.