by Calculated Risk on 11/09/2018 08:38:00 AM

Friday, November 09, 2018

Merrill on Trade and Tariffs

A few excerpts from a note by economists Anna Zhou and Ethan Harris at Merrill Lynch: "Here for a long time, not a good time"

In their October 2018 paper, Furceri, Hannan, Ostry and Rose looked into the macroeconomic consequences of tariffs. They analysed data spanning 151 counties (including both EM and DM economies) over the period 1963-2014 to quantify the impact of tariffs on output, productivity, unemployment, real exchange rates and trade balances. The authors find that tariffs have adverse macroeconomic consequences in the short and medium term.

These results are also consistent with economic theory. …

What about the trade balance? According to Furceri, Hannan, Ostry and Rose, the impact is minimal: they find that an increase in tariffs has a small and statistically-insignificant impact on the trade balance-to-GDP ratio. ... developed economies tend to respond more negatively to tariffs than emerging economies.

None of this bodes well for the US. Since the US is an advanced economy that is at or close to the peak of the business cycle, the results of the paper point to the risk of a substantial negative impact from the tariffs.

There is also bad news for the global outlook. As we have argued many times previously, the administration’s primary goal on trade is a significant reduction in the trade balance. We have also contended that this goal will probably not be achieved—and the trade deficit will instead probably widen—because fiscal stimulus will boost consumption and import demand. The paper shows that historical data also do not support an improvement in the trade balance.

Thursday, November 08, 2018

Homebuilder D.R. Horton: Housing Market "Choppy", "momentum is slipping"

by Calculated Risk on 11/08/2018 08:14:00 PM

Friday:

• At 8:30 AM ET, The Producer Price Index for October from the BLS. The consensus is a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for November).

A few comments via Bloomberg from homebuilder D.R.Horton: (HT Brian)

Rising home prices, combined with the jump in interest rates over the past year, are weighing on demand in the U.S., especially for more expensive properties. On a call with analysts, Chief Executive Officer David Auld side the market has been "choppy" in the past four or five weeks. A "little momentum is slipping from the market," he said.

AAR: October Rail Carloads Up 1.0% YoY, Intermodal Up 4.2% YoY

by Calculated Risk on 11/08/2018 04:19:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

U.S. rail traffic in October 2018 was mixed. Total carloads rose 1.0%, or 12,598. On the positive side, carloads of petroleum and petroleum products surged 28.4% (13,746) in October thanks to higher crude oil shipments; carloads of coal rose 1.6% (6,828 carloads, their first increase in five months); and carloads of steel and other primary metal products rose 9.8% (4,188 carloads, their 21st increase in the past 23 months). … Meanwhile, uncertainties in export markets is hurting grain, carloads of which were down 4.8% (5,620) in October. ... Intermodal did very well in October: volumes were up 4.2%, or 58,546 containers and trailers.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Light blue is 2018.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,338,037 carloads in October 2018, up 1.0%, or 12,598 carloads, over October 2017. It’s the eighth straight monthly increase for total carloads, but it’s also the smallest percentage increase in those eight months. In October 2018, 13 of the 20 commodity categories the AAR tracks had carload increases, the fewest since March 2018.

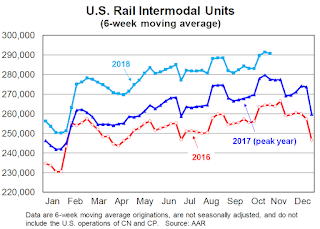

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 1,443,914 containers and trailers in October 2018, up 4.2% (58,546 units) over October 2017. The weekly average in October 2018 was 288,783, the second most (behind June 2018) for any month in history.2018 will be another record year for intermodal traffic.

FOMC Statement: No Change to Policy

by Calculated Risk on 11/08/2018 03:12:00 PM

Merrill on FOMC statement:

"In terms of today's statement, there were only two small changes: 1) "household spending has continued to grow strongly" which shows that the Fed has taken notice of the strength in the consumer spending data; 2) "business fixed investment has moderated from its rapid pace earlier in the year" which is a mark-to-market given the weaker investment data in 3Q. We shouldn't be surprised by either comment as they are simply a summary of the recent data. Interestingly, there was no mention of the softer housing data."FOMC Statement:

Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has declined. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 2 to 2-1/4 percent.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the FOMC monetary policy action were: Jerome H. Powell, Chairman; John C. Williams, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Lael Brainard; Richard H. Clarida; Mary C. Daly; Loretta J. Mester; and Randal K. Quarles.

emphasis added

Leading Index for Commercial Real Estate Declines in October

by Calculated Risk on 11/08/2018 01:01:00 PM

From Dodge Data Analytics: Dodge Momentum Index Declines in October

The Dodge Momentum Index moved 4.2% lower in October to 150.5 (2000=100) from the revised September reading of 157.0. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. October’s shortfall was the third consecutive monthly decline and the result of losses in both components of the Momentum Index. The commercial component fell by 4.9% from September to October, while the institutional component dropped 3.1%. The commercial component has, in fact, been the impetus behind the recent string of declines in the overall index. This is consistent with the view that the commercial building sector is approaching a peak and should begin to gradually ease back over the coming year. The institutional component, meanwhile, has been relatively more stable due to the availability of public funds for projects such as schools and airport terminals.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 150.5 in October, down from 157.0 in September.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year".

MBA: Mortgage Delinquency Rate Increased Slightly in Q3

by Calculated Risk on 11/08/2018 10:35:00 AM

From the MBA: Mortgage Delinquencies Up Slightly in Third Quarter of 2018

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 4.47 percent of all loans outstanding at the end of the third quarter of 2018, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was up 11 basis points from the previous quarter, but down 41 basis points from one year ago. The percentage of loans on which foreclosure actions were started dropped one basis point from the last quarter to 0.23 percent – its lowest level since the fourth quarter of 1985.

“Despite the small uptick this quarter, the healthy economy is overall supporting low mortgage delinquencies and foreclosure inventories,” said Marina Walsh, Vice President of Industry Analysis at MBA. “Unemployment is at its lowest level since 1969, wages have grown 3.1 percent year-over-year – the biggest jump in almost a decade – and job growth is averaging over 212,000 jobs per month thus far.”

Walsh notes that natural disasters are a major factor in determining whether borrowers make timely mortgage payments. Specifically, there were significant delinquency increases in states adversely impacted by Hurricane Florence and Tropical Storm Gordon, including North Carolina, South Carolina, Mississippi, Arkansas and Alabama. Hurricane Michael, which made landfall after the survey reporting period, will not be reflected until MBA’s fourth quarter survey. Walsh believes it will likely take several quarters for the most recent storms’ effects on the survey results to dissipate.

“The impact of the August and September 2017 hurricanes on several states, particularly Texas and Florida, continues to retreat,” said Walsh. “Primarily because of the declining effects of last fall’s hurricane-related spike, the overall mortgage delinquency rate in the third quarter was down 41 basis points on a year-over-year basis.”

...

In relation to the second quarter of 2018, the 30-day delinquency rate increased 20 basis points to 2.51 percent, the 60-day delinquency rate increased 2 basis points to 0.77 percent, and the 90-day delinquency bucket dropped 11 basis points to 1.18 percent.

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 0.99 percent, down 6 basis points from the second quarter of 2018 and 24 basis points lower than one year ago. This was the lowest foreclosure inventory rate since the second quarter of 2006.

...

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.13 percent – a decrease of 17 basis points from last quarter – and a decrease of 39 basis points from last year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans delinquent increased slightly in Q3, mostly due to the impact of Hurricane Florence.

The percent of loans in the foreclosure process continues to decline, and is close to normal levels.

Note: Delinquencies will probably increase further in Q4 due to Hurricane Michael.

Weekly Initial Unemployment Claims decreased to 214,000

by Calculated Risk on 11/08/2018 08:34:00 AM

The DOL reported:

In the week ending November 3, the advance figure for seasonally adjusted initial claims was 214,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 214,000 to 215,000. The 4-week moving average was 213,750, a decrease of 250 from the previous week's revised average. The previous week's average was revised up by 250 from 213,750 to 214,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 213,750.

This was slightly higher than the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, November 07, 2018

Thursday: FOMC Announcement, Unemployment Claims

by Calculated Risk on 11/07/2018 08:27:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, down from 214 thousand the previous week.

• At 2:00 PM, FOMC Meeting Announcement. No change to policy is expected at this meeting.

CBO: Monthly Budget Review: Summary for Fiscal Year 2018

by Calculated Risk on 11/07/2018 04:46:00 PM

As expected, the deficit is increasing significantly.

From the CBO: Monthly Budget Review: Summary for Fiscal Year 2018

In fiscal year 2018, which ended on September 30, the federal budget deficit totaled $779 billion—$113 billion more than the shortfall recorded in 2017. The deficit increased to 3.8 percent of the nation’s gross domestic product (GDP) in 2018, up from 3.5 percent in 2017 and 3.2 percent in 2016. Outlays in 2018 were reduced by a shift in the timing of certain payments; those payments were instead made in fiscal year 2017 because October 1, 2017 (the first day of fiscal year 2018), fell on a weekend. If not for that shift, the deficit in 2018 would have been $823 billion, or 4.1 percent of GDP.CBO is projecting the deficit next year will probably be close to $1 Trillion (about 4.6% of GDP).

First Look: 2019 Housing Forecasts

by Calculated Risk on 11/07/2018 02:59:00 PM

Towards the end of each year I collect some housing forecasts for the following year. This is just a beginning (I'll gather many more).

The table below shows a few forecasts for 2019:

From Fannie Mae: Housing Forecast: October 2018

From Freddie Mac: Freddie Mac October Forecast: Economic Growth and Home Sales Slow as Mortgage Rates Rise

From NAHB: Economic and Housing Forecasts

From NAR: Economic & Housing Market Outlook November 2018

Note: For comparison, new home sales in 2018 will probably be around 623 thousand, and total housing starts around 1.265 million.

| Housing Forecasts for 2019 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Fannie Mae | 679 | 963 | 1,303 | 4.1%2 |

| Freddie Mac | 1,350 | 4.6%2 | ||

| NAHB | 639 | 885 | 1,268 | |

| NAR | 623 | 3.1%3 | ||

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Prices | ||||