by Calculated Risk on 10/15/2018 11:27:00 AM

Monday, October 15, 2018

House Prices and Inventory

This is an interesting year for housing. With rising mortgage rates (now above 5%), the tax changes, and immigration and trade policies, a key question is: What will be the impact on housing?

The answer is no one knows for sure. It is difficult to measure demand directly, but inventory is fairly easy to track. Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

I don't have a crystal ball, but watching inventory helps understand the housing market. And it appears inventory is increasing nationally, and increasing sharply in some areas (although still somewhat low historically). For example:

• Seattle Real Estate in September: Sales Down 29% YoY, Inventory up 78% YoY

• Las Vegas Real Estate in September: Sales Down 16% YoY, Inventory up 33% YoY

• Houston Real Estate in September: "Market Cools"

• Sacramento Housing in September: Sales Down 15.5% YoY, Active Inventory up 23% YoY

Note: I'm trying to gather data for other areas.

This graph below shows existing home months-of-supply (from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999).

There is a clear relationship, and this is no surprise (but interesting to graph).

If months-of-supply is high, price decline. If months-of-supply is low, prices rise.

For August, the NAR reported months-of-supply at 4.3 months. Based on recent reports, I expect months-of-supply to increase further in September (the NAR is scheduled to release September data this week). Based on the historical relationship, months-of-supply could increase 50% before house prices start declining.

Retail Sales increased 0.1% in September

by Calculated Risk on 10/15/2018 08:42:00 AM

On a monthly basis, retail sales increased 0.1 percent from August to September (seasonally adjusted), and sales were up 6.6 percent from August 2017.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2018, adjusted for seasonal variation and holiday and trading‐day differences, but not for price changes, were $509.0 billion, an increase of 0.1 percent from the previous month, and 4.7 percent above September 2017.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.2% in September.

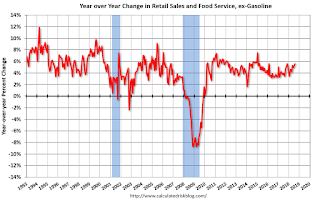

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.1% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.1% on a YoY basis.The increase in September was well below expectations, and sales in July and August were revised down.

Sunday, October 14, 2018

Monday: Retail Sales, NY Fed Mfg Survey

by Calculated Risk on 10/14/2018 09:08:00 PM

Weekend:

• Schedule for Week of October 14, 2018

Monday:

• At 8:30 AM ET: Retail sales for September will be released. The consensus is for a 0.6% increase in retail sales.

• At 8:30 AM ET: The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 19.3, up from 19.0.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 6 and DOW futures are down 53 (fair value).

Oil prices were down over the last week with WTI futures at $72.26 per barrel and Brent at $81.70 per barrel. A year ago, WTI was at $51, and Brent was at $57 - so oil prices are up about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.88 per gallon. A year ago prices were at $2.46 per gallon, so gasoline prices are up 42 cents per gallon year-over-year.

Sacramento Housing in September: Sales Down 15.5% YoY, Active Inventory up 23% YoY

by Calculated Risk on 10/14/2018 11:40:00 AM

From SacRealtor.org: September 2018 Statistics – Sacramento Housing Market – Single Family Homes, September sees sales dip 21%, inventory continues rise

The month ended with 1,318 sales, a 21.4% decrease from the 1,676 sales of August. Compared to September last year (1,560), the current figure is a 15.5% decrease. Of the 1,318 sales this month, 183 (13.9%) used cash financing, 800 (60.7%) used conventional, 225 (17.1%) used FHA, 75 (5.7%) used VA and 35 (2.7%) used Other† types of financing.CR Note: Inventory is still low - months of inventory is at 2.5 months, probably closer to 4 months would be normal - however inventory is up significantly year-over-year in Sacramento.

...

The Active Listing Inventory continued an upwards trend, increasing 2.2% month-to-month, from 3,167 to 3,236 units [Up 23% YoY]. The Months of Inventory followed, increasing from 1.9 to 2.5 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. The chart to the right reflects the Months of Inventory in each price range.

...

The Average DOM (days on market) continued its increase, rising from 24 to 26 from August to September. The Median DOM also increased, rising from 14 to 15. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,318 sales this month, 71.5% (943) were on the market for 30 days or less and 89.2% (1,176) were on the market for 60 days or less.

emphasis added

Saturday, October 13, 2018

Schedule for Week of October 14, 2018

by Calculated Risk on 10/13/2018 08:11:00 AM

The key economic reports this week are September Housing Starts and Existing Home Sales.

For manufacturing, September industrial production, and the October New York and Philly Fed surveys, will be released this week.

8:30 AM ET: Retail sales for September will be released. The consensus is for a 0.6% increase in retail sales.

8:30 AM ET: Retail sales for September will be released. The consensus is for a 0.6% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 5.6% on a YoY basis.

8:30 AM ET: The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 19.3, up from 19.0.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 78.2%.

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 67, unchanged from 67. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM ET: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in July to 6.939 million from 6.822 million in June.

The number of job openings (yellow) were up 12% year-over-year, and Quits were up 1% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. This graph shows single and total housing starts since 1968.

The consensus is for 1.216 million SAAR, down from 1.282 million SAAR.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of September 25-26, 2018

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, up from 214 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of 20.3, down from 22.9.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.34 million in August.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.34 million in August.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for September 2018

Friday, October 12, 2018

Oil Rigs Increase Sharply

by Calculated Risk on 10/12/2018 05:36:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on October 12, 2018:

• Oil rigs were up sharply this week, +8 to 869

• Horizontal oil rigs similarly rose, +8 to 772

...

• This report is deceptively bullish, as ‘Other US’ added 8 horizontal oil rigs, of which perhaps 4-6 are likely to roll off next week.

• The Permian added three, and with the Midland spread more favorable, we may see further adds there, as we noted last week.

• The breakeven oil price to add horizontal oil rigs fell to $65 WTI.

• We continue to feel that horizontal oil rig counts will tend to move sideways for the next few weeks.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q3 GDP Forecasts

by Calculated Risk on 10/12/2018 02:52:00 PM

From Merrill Lynch:

3Q GDP tracking remains at 3.7% qoq saar. [Oct 12 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.2 percent on October 10, up from 4.1 percent on October 5. [Oct 10 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.2% for 2018:Q3 and 2.8% for 2018:Q4. [Oct 12 estimate]CR Note: It looks like GDP will be in the 3s in Q3.

Hotels: Occupancy Rate Declined Slightly Year-over-year

by Calculated Risk on 10/12/2018 11:52:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 6 October

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 30 September through 6 October 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 1-7 October 2017, the industry recorded the following:

• Occupancy: -0.9% to 70.9%

• Average daily rate (ADR): +2.4% to US$134.03

• Revenue per available room (RevPAR): +1.5% to US$95.05

…

Houston, Texas, experienced the steepest declines in occupancy (-26.7% to 62.8%) and RevPAR (-31.5% to US$67.08). Houston’s hotel performance was lifted in the weeks and months that followed Hurricane Harvey in 2017 as properties filled with displaced residents, relief workers, insurance adjustors, media members, etc.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is just ahead of the record year in 2017.

Note: 2017 finished strong due to the impact of the hurricanes. There will be some boost to hotel occupancy in the Carolina and Florida regions following hurricanes Florence and Michael, but I expect the overall occupancy to be lower in 2018 than in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

Housing Inventory Tracking

by Calculated Risk on 10/12/2018 10:05:00 AM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 2.7% year-over-year (YoY) in August, this the first YoY increase since early 2015.

The graph below shows the YoY change for non-contingent inventory in Houston and Las Vegas (through September), Sacramento, and Phoenix (through August) and total existing home inventory as reported by the NAR (also through August).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 33% YoY in Las Vegas in September (red), the third consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up 6% year-over-year in Houston in September.

Inventory is a key for the housing market, and I am watching inventory for the impact of the new tax law and higher mortgage rates on housing. I expect national inventory will be up YoY at the end of 2018 (but still be somewhat low).

Note that inventory in Seattle was up 78% year-over-year in September!

Thursday, October 11, 2018

Port of Long Beach: Record Traffic for Fiscal Year

by Calculated Risk on 10/11/2018 06:20:00 PM

From the Port of Long Beach: Port Moves 8 Million TEUs in Fiscal Year

The Port of Long Beach closed out the 2018 fiscal year having handled 8,000,929 twenty-foot equivalent units (TEUs) during the previous 12 months, the most ever, representing a 10.7 percent increase over fiscal year 2017. The Port's fiscal year is Oct. 1 to Sept. 30.Trade traffic remains strong even with the tariffs, at least so far.

“We are poised to break our calendar year record at the end of December,” said Port of Long Beach Executive Director Mario Cordero. “Despite the tariffs imposed by Washington and Beijing, international trade is showing resilience, and at our Port we are providing a conduit for commerce that’s efficient for our customers and getting their cargo to destinations faster, saving them money.”

“The Port of Long Beach moved 701,204 TEUs last month, the second-busiest September in our 107-year history,” said Long Beach Harbor Commission President Tracy Egoscue. “That's a good thing for our economy. Trade flowing through the Port of Long Beach supports 1.4 million jobs across the United States, including more than 300,000 jobs in Southern California.”