by Calculated Risk on 10/14/2018 11:40:00 AM

Sunday, October 14, 2018

Sacramento Housing in September: Sales Down 15.5% YoY, Active Inventory up 23% YoY

From SacRealtor.org: September 2018 Statistics – Sacramento Housing Market – Single Family Homes, September sees sales dip 21%, inventory continues rise

The month ended with 1,318 sales, a 21.4% decrease from the 1,676 sales of August. Compared to September last year (1,560), the current figure is a 15.5% decrease. Of the 1,318 sales this month, 183 (13.9%) used cash financing, 800 (60.7%) used conventional, 225 (17.1%) used FHA, 75 (5.7%) used VA and 35 (2.7%) used Other† types of financing.CR Note: Inventory is still low - months of inventory is at 2.5 months, probably closer to 4 months would be normal - however inventory is up significantly year-over-year in Sacramento.

...

The Active Listing Inventory continued an upwards trend, increasing 2.2% month-to-month, from 3,167 to 3,236 units [Up 23% YoY]. The Months of Inventory followed, increasing from 1.9 to 2.5 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. The chart to the right reflects the Months of Inventory in each price range.

...

The Average DOM (days on market) continued its increase, rising from 24 to 26 from August to September. The Median DOM also increased, rising from 14 to 15. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,318 sales this month, 71.5% (943) were on the market for 30 days or less and 89.2% (1,176) were on the market for 60 days or less.

emphasis added

Saturday, October 13, 2018

Schedule for Week of October 14, 2018

by Calculated Risk on 10/13/2018 08:11:00 AM

The key economic reports this week are September Housing Starts and Existing Home Sales.

For manufacturing, September industrial production, and the October New York and Philly Fed surveys, will be released this week.

8:30 AM ET: Retail sales for September will be released. The consensus is for a 0.6% increase in retail sales.

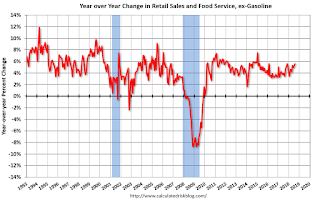

8:30 AM ET: Retail sales for September will be released. The consensus is for a 0.6% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 5.6% on a YoY basis.

8:30 AM ET: The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 19.3, up from 19.0.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 78.2%.

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 67, unchanged from 67. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM ET: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in July to 6.939 million from 6.822 million in June.

The number of job openings (yellow) were up 12% year-over-year, and Quits were up 1% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. This graph shows single and total housing starts since 1968.

The consensus is for 1.216 million SAAR, down from 1.282 million SAAR.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of September 25-26, 2018

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, up from 214 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of 20.3, down from 22.9.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.34 million in August.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.34 million in August.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for September 2018

Friday, October 12, 2018

Oil Rigs Increase Sharply

by Calculated Risk on 10/12/2018 05:36:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on October 12, 2018:

• Oil rigs were up sharply this week, +8 to 869

• Horizontal oil rigs similarly rose, +8 to 772

...

• This report is deceptively bullish, as ‘Other US’ added 8 horizontal oil rigs, of which perhaps 4-6 are likely to roll off next week.

• The Permian added three, and with the Midland spread more favorable, we may see further adds there, as we noted last week.

• The breakeven oil price to add horizontal oil rigs fell to $65 WTI.

• We continue to feel that horizontal oil rig counts will tend to move sideways for the next few weeks.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q3 GDP Forecasts

by Calculated Risk on 10/12/2018 02:52:00 PM

From Merrill Lynch:

3Q GDP tracking remains at 3.7% qoq saar. [Oct 12 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.2 percent on October 10, up from 4.1 percent on October 5. [Oct 10 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.2% for 2018:Q3 and 2.8% for 2018:Q4. [Oct 12 estimate]CR Note: It looks like GDP will be in the 3s in Q3.

Hotels: Occupancy Rate Declined Slightly Year-over-year

by Calculated Risk on 10/12/2018 11:52:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 6 October

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 30 September through 6 October 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 1-7 October 2017, the industry recorded the following:

• Occupancy: -0.9% to 70.9%

• Average daily rate (ADR): +2.4% to US$134.03

• Revenue per available room (RevPAR): +1.5% to US$95.05

…

Houston, Texas, experienced the steepest declines in occupancy (-26.7% to 62.8%) and RevPAR (-31.5% to US$67.08). Houston’s hotel performance was lifted in the weeks and months that followed Hurricane Harvey in 2017 as properties filled with displaced residents, relief workers, insurance adjustors, media members, etc.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is just ahead of the record year in 2017.

Note: 2017 finished strong due to the impact of the hurricanes. There will be some boost to hotel occupancy in the Carolina and Florida regions following hurricanes Florence and Michael, but I expect the overall occupancy to be lower in 2018 than in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

Housing Inventory Tracking

by Calculated Risk on 10/12/2018 10:05:00 AM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 2.7% year-over-year (YoY) in August, this the first YoY increase since early 2015.

The graph below shows the YoY change for non-contingent inventory in Houston and Las Vegas (through September), Sacramento, and Phoenix (through August) and total existing home inventory as reported by the NAR (also through August).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 33% YoY in Las Vegas in September (red), the third consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up 6% year-over-year in Houston in September.

Inventory is a key for the housing market, and I am watching inventory for the impact of the new tax law and higher mortgage rates on housing. I expect national inventory will be up YoY at the end of 2018 (but still be somewhat low).

Note that inventory in Seattle was up 78% year-over-year in September!

Thursday, October 11, 2018

Port of Long Beach: Record Traffic for Fiscal Year

by Calculated Risk on 10/11/2018 06:20:00 PM

From the Port of Long Beach: Port Moves 8 Million TEUs in Fiscal Year

The Port of Long Beach closed out the 2018 fiscal year having handled 8,000,929 twenty-foot equivalent units (TEUs) during the previous 12 months, the most ever, representing a 10.7 percent increase over fiscal year 2017. The Port's fiscal year is Oct. 1 to Sept. 30.Trade traffic remains strong even with the tariffs, at least so far.

“We are poised to break our calendar year record at the end of December,” said Port of Long Beach Executive Director Mario Cordero. “Despite the tariffs imposed by Washington and Beijing, international trade is showing resilience, and at our Port we are providing a conduit for commerce that’s efficient for our customers and getting their cargo to destinations faster, saving them money.”

“The Port of Long Beach moved 701,204 TEUs last month, the second-busiest September in our 107-year history,” said Long Beach Harbor Commission President Tracy Egoscue. “That's a good thing for our economy. Trade flowing through the Port of Long Beach supports 1.4 million jobs across the United States, including more than 300,000 jobs in Southern California.”

House Prices to National Average Wage Index

by Calculated Risk on 10/11/2018 02:29:00 PM

One of the metrics we'd like to follow is a ratio of house prices to incomes. Unfortunately most income data is released with a significantly lag, and there are always questions about which income data to use (the average total income is skewed by the income of a few people).

And for key measures of house prices - like Case-Shiller - we have indexes, not actually prices.

But we can construct a ratio of the house price indexes to some measure of income.

For this graph I decided to look at house prices and the National Average Wage Index released today for 2017 from Social Security.

Note: For a different look at house prices and income, see this post (using median income).

This graph shows the ratio of house price indexes divided by the National Average Wage Index (the Wage index is first divided by 1000).

This uses the annual average National Case-Shiller index since 1976.

As of 2018, house prices were somewhat above the median historical ratio - but far below the bubble peak.

Going forward, I think it would be a positive if wages outpaced, or at least kept pace with house prices increases for a few years.

Note: The national wage index for 2018 is estimated using the median increase over the last several years.

Key Measures Show Inflation Slowed on YoY Basis in September

by Calculated Risk on 10/11/2018 11:14:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in September. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.7% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for September here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (0.7% annualized rate) in September. The CPI less food and energy rose 0.1% (1.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.7%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 2.2%. Core PCE is for August and increased 1.96% year-over-year.

On a monthly basis, median CPI was at 2.3% annualized, trimmed-mean CPI was at 1.7% annualized, and core CPI was at 1.4% annualized.

Using these measures, inflation slowed on a year-over-year basis in September. Overall, these measures are at or above the Fed's 2% target (Core PCE is slightly below 2%)

Cost of Living Adjustment increases 2.8% in 2019, Contribution Base increased to $132,900

by Calculated Risk on 10/11/2018 09:23:00 AM

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2019.

From Social Security: Social Security Announces 2.8 Percent Benefit Increase for 2019

Social Security and Supplemental Security Income (SSI) benefits for more than 67 million Americans will increase 2.8 percent in 2019, the Social Security Administration announced today.Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is a discussion from Social Security on the current calculation (2.8% increase) and a list of previous Cost-of-Living Adjustments.

The 2.8 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 62 million Social Security beneficiaries in January 2019. Increased payments to more than 8 million SSI beneficiaries will begin on December 31, 2018. (Note: some people receive both Social Security and SSI benefits). The Social Security Act ties the annual COLA to the increase in the Consumer Price Index as determined by the Department of Labor’s Bureau of Labor Statistics.

Some other adjustments that take effect in January of each year are based on the increase in average wages. Based on that increase, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $132,900 from $128,400.

The contribution and benefit base will be $132,900 in 2019.

The National Average Wage Index increased to $50,321.89 in 2017, up 3.5% from $48,642.15 in 2016 (used to calculate contribution base).