by Calculated Risk on 9/21/2018 03:25:00 PM

Friday, September 21, 2018

Q3 GDP Forecasts

From Merrill Lynch:

We are tracking robust 3.7% qoq saar growth for 3Q and 4.4% for 2Q. [Sept 21 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.4 percent on September 19, unchanged from September 14. [Sept 19 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.3% for 2018:Q3 and 2.7% for 2018:Q4. [Sept 21 estimate]CR Note: It looks like GDP will be in the 3s in Q3.

Merrill: "Existing Home Sales have Peaked"

by Calculated Risk on 9/21/2018 02:48:00 PM

A few excerpts from a Merrill Lynch research note:

We are calling it: existing home sales have peaked. We believe that the peak was at 5.72 million, reached in November last year. From here on, sales should trend sideways. If this is indeed the peak, it would be comparable to the rate we last saw in the early 2000s before the bubble set in. Here is the catch — while existing home sales have likely peaked, we do not think we have seen the same for new home sales. New home sales have lagged existing in this recovery and we believe there is room to run for new home sales, leaving builders to add more single family homes to the market.CR Note: As I noted in July (see: Has Housing Market Activity Peaked? and Has the Housing Market Peaked? (Part 2)

The peak in existing home sales can largely be explained by the decline in affordability. With housing prices hovering close to bubble highs and mortgage rates on the rise, affordability has been declining.

emphasis added

First, I think it is likely that existing home sales will move more sideways going forward. However it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc. - but overall the economic impact is small compared to a new home sale.

Also I think the growth in multi-family starts is behind us, and that multi-family starts peaked in June 2015. See: Comments on June Housing Starts

For the economy, what we should be focused on are single family starts and new home sales. As I noted in Investment and Recessions "New Home Sales appears to be an excellent leading indicator, and currently new home sales (and housing starts) are up solidly year-over-year, and this suggests there is no recession in sight."

If new home sales and single family starts have peaked that would be a significant warning sign. Although housing is under pressure from policy (negative impact from tax, immigration and trade policies), I do not think housing has peaked, and I think new home sales and single family starts will increase further over the next couple of years.

BLS: Unemployment Rates in Idaho, Oregon, South Carolina and Washington at New Lows

by Calculated Risk on 9/21/2018 10:25:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in August in 13 states, higher in 3 states, and stable in 34 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Eleven states had jobless rate decreases from a year earlier and 39 states and the District had little or no change. The national unemployment rate was unchanged from July at 3.9 percent but was 0.5 percentage point lower than in August 2017.

...

Hawaii had the lowest unemployment rate in August, 2.1 percent. The rates in Idaho (2.8 percent), Oregon (3.8 percent), South Carolina (3.4 percent), and Washington (4.5 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.7 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue).

Mortgage Equity Withdrawal slightly positive in Q2

by Calculated Risk on 9/21/2018 08:01:00 AM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released yesterday) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q2 2018, the Net Equity Extraction was a positive $9 billion, or a 0.2% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been positive for 8 of the last 11 quarters. With a slower rate of debt cancellation, MEW will likely be mostly positive going forward.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $66 billion in Q2.

The Flow of Funds report also showed that Mortgage debt has declined by $0.546 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Thursday, September 20, 2018

Earlier: Philly Fed Manufacturing Survey Suggested Faster Growth in September

by Calculated Risk on 9/20/2018 06:05:00 PM

Earlier: From the Philly Fed: September 2018 Manufacturing Business Outlook Survey

Regional manufacturing activity continued to grow in September, according to results from this month’s Manufacturing Business Outlook Survey. The survey’s broad indicators for general activity, new orders, shipments, and employment remained positive and increased from their readings in August. The survey’s respondents reported diminished price pressures this month. Expectations for the next six months remained optimistic, but most broad future indicators showed some moderation.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity increased 11 points this month to 22.9, returning the index to near its average reading for 2018. … The firms continued to report overall higher employment. Over 26 percent of the responding firms reported increases in employment this month, up from 18 percent last month, while nearly 9 percent of the firms reported decreases in employment. The current employment index increased 3 points to 17.6.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through September), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

This suggests the ISM manufacturing index will show solid expansion again in September.

CoreLogic: 2.2 million Homes still in negative equity at end of Q2 2018

by Calculated Risk on 9/20/2018 02:01:00 PM

From CoreLogic: Homeowner Equity Q2 2018

CoreLogic analysis shows U.S. homeowners with mortgages (roughly 63 percent of all properties) have seen their equity increase by a total of nearly $981 billion since the second quarter 2017, an increase of 12.3 percent, year over year.CR Note: A year ago, in Q2 2017, there were 2.8 million properties with negative equity - now there are 2.2 million. A significant change.

Homeowners Emerge from the Negative Equity Trap: In the second quarter 2018, the total number of mortgaged residential properties with negative equity decreased 9 percent from the first quarter 2017 to 2.2 million homes, or 4.3 percent of all mortgaged properties. Compared to the second quarter 2017, negative equity decreased 20.1 percent from 2.8 million homes, or 5.4 percent of all mortgaged properties.

...

Negative equity peaked at 26 percent of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis which began in the third quarter of 2009.

emphasis added

Fed's Flow of Funds: Household Net Worth increased in Q2

by Calculated Risk on 9/20/2018 12:26:00 PM

The Federal Reserve released the Q2 2018 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q2 2018 to $106.9 Trillion, for $104.7 Trillion in Q1 2018:

The net worth of households and nonprofits rose to $106.9 trillion during the second quarter of 2018. The value of directly and indirectly held corporate equities increased $0.8 trillion and the value of real estate increased $0.6 trillion.The Fed estimated that the value of household real estate increased to $25.4 trillion in Q2. The value of household real estate is now above the bubble peak in early 2006 - but not adjusted for inflation, and this also includes new construction.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2018, household percent equity (of household real estate) was at 59.9% - up from Q1, and the highest since 2002. This was because of an increase in house prices in Q2 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 59.9% equity - and about 2.2 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $66 billion in Q2.

Mortgage debt has declined by $0.54 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, declined slightly in Q2, and is above the average of the last 30 years (excluding bubble). However, mortgage debt as a percent of GDP, continues to decline.

A Few Comments on August Existing Home Sales

by Calculated Risk on 9/20/2018 11:26:00 AM

Earlier: NAR: Existing-Home Sales Unchanged at 5.34 million in August

Two key points:

1) This is a reasonable level for existing home sales, and doesn't suggest any significant weakness in housing or the economy. The key for the housing - and the overall economy - is new home sales, single family housing starts and overall residential investment.

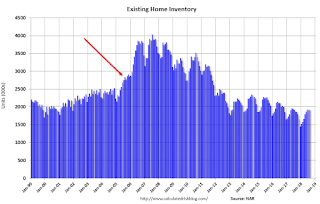

2) Inventory is still very low, but was up 2.7% year-over-year (YoY) in August. This was the first year-over-year increase since May 2015. (Note: Inventory for June was initially reported as up slightly year-over-year, but inventory was revised down).

The current slight YoY increase in inventory is nothing like what happened in 2005 and 2006. In 2005 (see red arrow), inventory kept increasing all year, and that was a sign the bubble was ending.

Although I expect inventory to increase YoY in 2018, I expect inventory to follow the normal seasonal pattern (not keep increasing all year).

Also inventory levels remains low, and could increase significantly and still be at normal levels. No worries.

Sales NSA in August (539,000, red column) were slightly above sales in August 2017 (535,000, NSA).

Sales NSA through August (first eight months) are down about 1.2% from the same period in 2017.

This is a small YoY decline in sales to-date - but it is possible there has been an impact from higher interest rates and / or the changes to the tax law (eliminating property taxes write-off, etc).

NAR: Existing-Home Sales Unchanged at 5.34 million in August

by Calculated Risk on 9/20/2018 10:11:00 AM

From the NAR: Existing-Home Sales Remain Flat Nationally, Mixed Results Regionally

Existing-home sales remained steady in August after four straight months of decline, according to the National Association of Realtors®. Sales gains in the Northeast and Midwest canceled out downturns in the South and West. Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, did not change from July and remained at a seasonally adjusted rate of 5.34 million in August. Sales are now down 1.5 percent from a year ago (5.42 million in August 2017).

...

Total housing inventory at the end of August also remained unchanged from July at 1.92 million existing homes available for sale, and is up from 1.87 million a year ago. Unsold inventory is at a 4.3-month supply at the current sales pace, consistent from last month and up from 4.1 months a year ago. Properties typically stayed on the market for 29 days in August, up from 27 days in July but down from 30 days a year ago. Fifty-two percent of homes sold in August were on the market for less than a month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August (5.34 million SAAR) were unchanged from last month, and were 1.5% below the August 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory was unchanged at 1.92 million in August from 1.92 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory was unchanged at 1.92 million in August from 1.92 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 2.7% year-over-year in August compared to August 2017.

Inventory was up 2.7% year-over-year in August compared to August 2017. Months of supply was at 4.3 months in July.

Sales were at the consensus view. For existing home sales, a key number is inventory - and inventory is still low, but appears to be bottoming. I'll have more later ...

Weekly Initial Unemployment Claims decreased to 201,000, Lowest Since 1969

by Calculated Risk on 9/20/2018 08:34:00 AM

The DOL reported:

In the week ending September 15, the advance figure for seasonally adjusted initial claims was 201,000, a decrease of 3,000 from the previous week's unrevised level of 204,000. This is the lowest level for initial claims since November 15, 1969 when it was 197,000. The 4-week moving average was 205,750, a decrease of 2,250 from the previous week's unrevised average of 208,000. This is the lowest level for this average since December 6, 1969 when it was 204,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 205,750.

This was lower than the the consensus forecast. The low level of claims suggest few layoffs.