by Calculated Risk on 8/28/2018 09:11:00 AM

Tuesday, August 28, 2018

Case-Shiller: National House Price Index increased 6.2% year-over-year in June

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3 month average of April, May and June prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Las Vegas Leads Price Gains in June According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.2% annual gain in June, down from 6.4% in the previous month. The 10-City Composite annual increase came in at 6.0%, down from 6.2% in the previous month. The 20-City Composite posted a 6.3% year-over-year gain, down from 6.5% in the previous month.

Las Vegas, Seattle and San Francisco continued to report the highest year-over-year gains among the 20 cities. In June, Las Vegas led the way with a 13.0% year-over-year price increase, followed by Seattle with a 12.8% increase and San Francisco with a 10.7% increase. Six of the 20 cities reported greater price increases in the year ending June 2018 versus the year ending May 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.8% in June. The 10-City and 20-City Composites reported increases of 0.4% and 0.5%, respectively. After seasonal adjustment, the National Index recorded a 0.3% month-over-month increase in June. The 10-City and 20-City Composites both posted 0.1% month-over-month increases. Nineteen of 20 cities reported increases in June before seasonal adjustment, while 17 of 20 cities reported increases after seasonal adjustment.

“Home prices continue to rise across the U.S.” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “However, even as home prices keep climbing, we are seeing signs that growth is easing in the housing market. Sales of both new and existing homes are roughly flat over the last six months amidst news stories of an increase in the number of homes for sale in some markets. Rising mortgage rates – 30 year fixed rate mortgages rose from 4% to 4.5% since January – and the rise in home prices are affecting housing affordability.

“The west still leads the rise in home prices with Las Vegas displacing Seattle as the market with the fastest price increase. Population and employment growth often drive homes prices. Las Vegas is among the fastest growing U.S. cities based on both employment and population, with its unemployment rate dropping below the national average in the last year. The northeast and mid-west are seeing smaller home price increases. Washington, Chicago and New York City showed the three slowest annual price gains among the 20 cities covered.”

emphasis added

Click on graph for larger image.

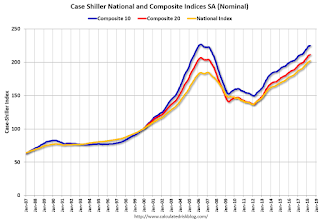

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 0.9% from the bubble peak, and up 0.1% in June (SA).

The Composite 20 index is 2.3% above the bubble peak, and up 0.1% (SA) in June.

The National index is 9.8% above the bubble peak (SA), and up 0.3% (SA) in June. The National index is up 48.5% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.0% compared to June 2017. The Composite 20 SA is up 6.3% year-over-year.

The National index SA is up 6.2% year-over-year.

Note: According to the data, prices increased in 17 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, August 27, 2018

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg

by Calculated Risk on 8/27/2018 07:36:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Higher (or Lower) Depending on Lender

Mortgage rates moved higher for some lenders and lower for others, depending on how that particular lender adjusted their rate sheets on Friday afternoon. … moves are relatively quite small in the bigger picture. On this scale, we're only talking about the upfront costs associated with any given rate as opposed to the actual payment ("note") rate itself. [30YR FIXED - 4.625% - 4.75%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for June. The consensus is for a 6.5% year-over-year increase in the Comp 20 index for June.

• At 10:00 AM ET, Richmond Fed Survey of Manufacturing Activity for August. This is the last of the regional surveys for August.

Vehicle Sales Forecast: Sales Around 16.8 Million SAAR in August

by Calculated Risk on 8/27/2018 04:24:00 PM

The automakers will report August vehicle sales on Tuesday, September 4th.

Note: There were 27 selling days in August 2018, unchanged from 27 in August 2017.

From J.D. Power: Retail Sales Poised for Largest Gain of 2018; Spending Expected to Fall for Second Straight Month

New-vehicle retail sales in August are expected to rise from a year ago according to a forecast developed jointly by J.D. Power and LMC Automotive. Retail sales are projected to reach 1,280,400 units, a 1.3% increase compared with August 2017. [16.8 million SAAR] (Note: August 2018 has the same number of selling days as last year.)It appears August will be another solid month for vehicle sales. Through July, sales were down slightly compared to the same period in 2017.

“With no large disruptions from storms this year, new vehicle sales in August are expected to see the largest gain of the year,” said Thomas King, Senior Vice President of the Data and Analytics Division at J.D. Power. “Last year, Hurricanes Harvey and Irma made landfall during the end of the month, affecting Labor Day sales events. Labor Day remains one of the most heavily shopped periods in the year, accounting for nearly 3% of annual sales, as consumers take advantage of discounts that extend through the first weekend of September.”

emphasis added

Last year, August was the weakest sales month of the year at 16.45 million SAAR, due to the impact of the hurricanes. Following the hurricanes, sales were strong through the end of the year in 2017 as hurricane victims replaced cars damaged during the storms. So, even though sales will be up YoY in August, sales will probably down YoY for the last four months of the year.

Housing Inventory Tracking

by Calculated Risk on 8/27/2018 01:34:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was unchanged year-over-year (YoY) in July, this followed 37 consecutive months with a YoY decline.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, Sacramento and also Phoenix (through July) and total existing home inventory as reported by the NAR (through July 2018).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 20% year-over-year in July (inventory was still very low), and has increased YoY for ten consecutive months.

Also note that inventory was up slightly YoY in Las Vegas in July (red), the first YoY increase in Las Vegas since May 2015.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. I expect national inventory will be up YoY at the end of 2018 (but still be low).

This is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble, but it does appear that inventory is bottoming nationally.

Dallas Fed: "Robust Expansion in Texas Manufacturing Continues"

by Calculated Risk on 8/27/2018 11:19:00 AM

From the Dallas Fed: Robust Expansion in Texas Manufacturing Continues

exas factory activity maintained its strong momentum in August, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, held steady at 29.3.The regional surveys for August have mostly indicated somewhat slower growth as compared to July. The last of the regional surveys (Richmond Fed) for August will be released tomorrow.

Other indexes of manufacturing activity also indicated continued solid expansion in August. The new orders index changed little at 23.9, while the growth rate of orders index moved up three points to 19.9. The capacity utilization index was unchanged at 25.2, and the shipments index slipped five points to 26.0.

Perceptions of broader business conditions remained highly positive this month, although uncertainty remained elevated. The general business activity index edged down to 30.9, while the company outlook index rose seven points to 27.3, with more than 30 percent of manufacturers saying their outlook had improved from July. The index measuring uncertainty regarding companies’ outlooks held fairly steady in August at 16.2, well above its readings in the first half of the year.

Labor market measures continued to suggest robust hiring and longer work hours. The employment index remained at a 13-year high of 28.9. Thirty-four percent of firms noted net hiring, compared with 5 percent noting net layoffs. The hours worked index edged down to 19.0.

emphasis added

Chicago Fed "Index points to a moderation in economic growth in July"

by Calculated Risk on 8/27/2018 08:37:00 AM

From the Chicago Fed: Index points to a moderation in economic growth in July

Led by slower growth in production-related indicators, the Chicago Fed National Activity Index (CFNAI) declined to +0.13 in July from +0.48 in June. Three of the four broad categories of indicators that make up the index decreased from June, but three of the four categories made positive contributions to the index in July. The index’s three-month moving average, CFNAI-MA3, moved down to +0.05 in July from +0.20 in June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in July (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, August 26, 2018

Sunday Night Futures

by Calculated Risk on 8/26/2018 07:40:00 PM

Weekend:

• Schedule for Week of Aug 26, 2018

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for July. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for August.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 5 and DOW futures are up 62 (fair value).

Oil prices were up over the last week with WTI futures at $68.66 per barrel and Brent at $75.65 per barrel. A year ago, WTI was at $48, and Brent was at $52 - so oil prices are up about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.83 per gallon. A year ago prices were at $2.36 per gallon - so gasoline prices are up 47 cents per gallon year-over-year.

New Home Prices

by Calculated Risk on 8/26/2018 08:11:00 AM

As part of the new home sales report released last week, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in July 2018 was $328,700. The average sales price was $394,300."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

The average price in July 2018 was $394,300, and the median price was $328,700. Both are well above the bubble high (this is due to both a change in mix and rising prices).

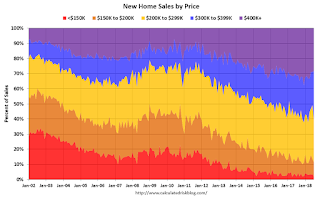

The second graph shows the percent of new homes sold by price.

The $400K+ bracket has increased significantly since the housing recovery started. Still, a majority of new homes (about 60%) in the U.S., are in the $200K to $400K range.

Saturday, August 25, 2018

Schedule for Week of August 26, 2018

by Calculated Risk on 8/25/2018 08:11:00 AM

The key report this week is the second estimate of Q2 GDP.

Other key indicators include Personal Income and Outlays for July and Case-Shiller house prices for June.

For manufacturing, the Dallas and Richmond Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for August.

9:00 AM ET: S&P/Case-Shiller House Price Index for June.

9:00 AM ET: S&P/Case-Shiller House Price Index for June.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 6.5% year-over-year increase in the Comp 20 index for June.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for August. This is the last of the regional surveys for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 2nd quarter 2018 (Second estimate). The consensus is that real GDP increased 4.0% annualized in Q2, down from the advance estimate of 4.1%.

10:00 AM: Pending Home Sales Index for July. The consensus is for no change in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 210 thousand the previous week.

8:30 AM: Personal Income and Outlays for July. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for August. The consensus is for a reading of 63.5, down from 65.5 in July.

10:00 AM: University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 95.3.

Friday, August 24, 2018

Oil Rigs: "Horizontal oil rigs roll off modestly"

by Calculated Risk on 8/24/2018 03:07:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on August 24, 2018:

• Oil rigs let off again this week

• Total oil rigs fell, -9 to 860

• Horizontal oil rigs declined, -2 to 766

...

• Visual inspection suggests that rigs continue to roll off gently from here for the next several weeks.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.