by Calculated Risk on 8/02/2018 01:27:00 PM

Thursday, August 02, 2018

Hotels: Occupancy Rate Increased Year-over-Year

From HotelNewsNow.com: STR: US hotel results for week ending 28 July

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 22-28 July 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 23-29 July 2017, the industry recorded the following:

• Occupancy: +1.3% to 78.5%

• Average daily rate (ADR): +2.9% to US$135.94

• Revenue per available room (RevPAR): +4.2% to US$106.66

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is close to the record year in 2017. Note: 2017 finished strong due to the impact of the hurricanes.

On a seasonal basis, the occupancy rate will be solid through the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

July Employment Preview

by Calculated Risk on 8/02/2018 09:57:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus is for an increase of 190,000 non-farm payroll jobs in July (with a range of estimates between 150,000 to 215,000), and for the unemployment rate to decline to 3.9%.

The BLS reported 213,000 jobs added in June.

Here is a summary of recent data:

• The ADP employment report showed an increase of 219,000 private sector payroll jobs in July. This was well above consensus expectations of 173,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index increased in July to 56.5%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 16,000 in July. The ADP report indicated manufacturing jobs increased 23,000 in July.

The ISM non-manufacturing employment index for July will be released tomorrow.

• Initial weekly unemployment claims averaged 214,500 in July down from 224,500 in June. For the BLS reference week (includes the 12th of the month), initial claims were at 208,000, down from 218,000 during the reference week in June.

The decrease during the reference week suggests a stronger employment report in July than in June.

• The final July University of Michigan consumer sentiment index decreased to 97.9 from the June reading of 98.2. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Merrill Lynch has introduced a new payrolls tracker based on private internal BAC data. The tracker suggests private payrolls increased by 236,000 in July, and this suggests employment growth above expectations.

• Looking back at the three previous years:

In July 2017, the consensus was for 178,000 jobs, and the BLS reported 209,000 jobs added.

In July 2016, the consensus was for 185,000 jobs, and the BLS reported 255,000 jobs added.

In July 2015, the consensus was for 212,000 jobs, and the BLS reported 215,000 jobs added.

In general it looks like the consensus is frequently low for the month of July.

• Conclusion: In general, these reports suggest a solid employment report, and probably above expectations. The ADP report, the reference week for unemployment claims, and the Merrill payrolls tracker all suggest a stronger report in July than in June. So my guess is that the employment report will be above expectations in July.

Weekly Initial Unemployment Claims increased to 218,000

by Calculated Risk on 8/02/2018 08:33:00 AM

The DOL reported:

In the week ending July 28, the advance figure for seasonally adjusted initial claims was 218,000, an increase of 1,000 from the previous week's unrevised level of 217,000. The 4-week moving average was 214,500, a decrease of 3,500 from the previous week's unrevised average of 218,000.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 214,500.

This was at the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, August 01, 2018

Mortgage Rates at 2 Month High

by Calculated Risk on 8/01/2018 07:05:00 PM

Mortgage rates have mostly been moving sideways recently …

From Matthew Graham at Mortgage News Daily: Mortgage Rates Higher, But Not Because Of The Fed

Mortgage rates were slightly higher today, but not because of the Fed. Today brought a Fed policy announcement which can be quite a big deal for rates, depending on the particulars. This time around, those particulars were almost exactly the same as the previous Fed statement. Investors will sometimes read some significance into such an absence of change, but that wasn't a factor today. Of far greater importance to rates was an update from the Treasury department that spelled out near-term borrowing plans.

…

both 10yr yields and mortgage rates hit their highest levels in more than 2 months today. That said, the move was more apparent in Treasuries. Mortgage rates just moved back up to Monday's levels, for the most part (which were 2-month highs at the time). [30YR FIXED - 4.625-4.75%]

emphasis added

U.S. Light Vehicle Sales decrease to 16.7 million annual rate in July

by Calculated Risk on 8/01/2018 04:20:00 PM

Based on a preliminary estimate from AutoData, light vehicle sales were at a 16.7 million SAAR in July.

Note: All other data from the BEA (the BEA will report this month's sales soon).

That is unchanged year-over-year from July 2017, and down 3% from last month.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for July (red, light vehicle sales of 16.7 million SAAR from AutoData).

Note that the increase in sales at the end of 2017 was due to buying following the hurricanes.

Sales will probably move sideways or decline in 2018 after setting new sales records in both 2015 and 2016.

Note: dashed line is current estimated sales rate.

This was below the consensus forecast for July.

FOMC Statement: No Change to Policy

by Calculated Risk on 8/01/2018 02:02:00 PM

No surprises.

FOMC Statement:

Information received since the Federal Open Market Committee met in June indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has stayed low. Household spending and business fixed investment have grown strongly. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-3/4 to 2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the FOMC monetary policy action were: Jerome H. Powell, Chairman; John C. Williams, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Lael Brainard; Esther L. George; Loretta J. Mester; and Randal K. Quarles.

emphasis added

Construction Spending decreased 1.1% in June

by Calculated Risk on 8/01/2018 10:45:00 AM

Earlier today, the Census Bureau reported that overall construction spending decreased in June:

Construction spending during June 2018 was estimated at a seasonally adjusted annual rate of $1,317.2 billion, 1.1 percent below the revised May estimate of $1,332.2 billion. The June figure is 6.1 percent above the June 2017 estimate of $1,241.3 billion.Both Private and public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $1,019.8 billion, 0.4 percent below the revised May estimate of $1,023.9 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $297.4 billion, 3.5 percent below the revised May estimate of $308.3 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 16% below the bubble peak.

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 9% below the peak in March 2009, and 14% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 9%. Non-residential spending is up 4% year-over-year. Public spending is up 5% year-over-year.

This was well below the consensus forecast of a 0.3% increase for June. However, construction spending for April and May were revised up (most residential construction spending was revised up).

ISM Manufacturing index decreased to 58.1 in July, Concern about Tariffs

by Calculated Risk on 8/01/2018 10:10:00 AM

The ISM manufacturing index indicated expansion in July. The PMI was at 58.1% in July, down from 60.2% in June. The employment index was at 56.5%, up from 56.0% last month, and the new orders index was at 60.2%, down from 63.5%.

From the Institute for Supply Management: July 2018 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in July, and the overall economy grew for the 111th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The July PMI® registered 58.1 percent, a decrease of 2.1 percentage points from the June reading of 60.2 percent. The New Orders Index registered 60.2 percent, a decrease of 3.3 percentage points from the June reading of 63.5 percent. The Production Index registered 58.5 percent, a 3.8 percentage point decrease compared to the June reading of 62.3 percent. The Employment Index registered 56.5 percent, an increase of 0.5 percentage point from the June reading of 56 percent. The Supplier Deliveries Index registered 62.1 percent, a 6.1 percentage point decrease from the June reading of 68.2 percent. The Inventories Index registered 53.3 percent, an increase of 2.5 percentage points from the June reading of 50.8 percent. The Prices Index registered 73.2 percent in July, a 3.6 percentage point decrease from the June reading of 76.8 percent, indicating higher raw materials prices for the 29th consecutive month.

…

"Respondents are again overwhelmingly concerned about how tariff-related activity, including reciprocal tariffs, will continue to affect their business,” says Fiore.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 59.4%, and suggests manufacturing expanded at a slower pace in July than in June.

Still a solid report.

ADP: Private Employment increased 219,000 in July

by Calculated Risk on 8/01/2018 08:17:00 AM

Private sector employment increased by 219,000 jobs from June to July according to the July ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 172,000 private sector jobs added in the ADP report.

...

“The labor market is on a roll with no signs of a slowdown in sight,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Nearly every industry posted strong gains and small business hiring picked up.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market is booming, impacted by the deficit-financed tax cuts and increases in government spending. Tariffs have yet to materially impact jobs, but the multinational companies shed jobs last month, signaling the threat.”

The BLS report for June will be released Friday, and the consensus is for 188,000 non-farm payroll jobs added in July.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 8/01/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 27, 2018.

... The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 1 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to 4.84 percent from 4.77 percent, with points remaining unchanged at 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

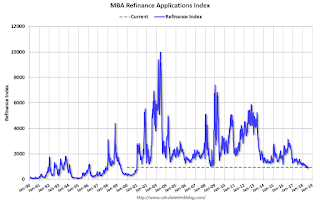

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 1% year-over-year.